No Va Real Estate Investment Joint Stock Company (stock code: NVL) announced its business results for the fourth quarter of 2023 with a revenue of 2,027 billion VND, a decrease of 38% compared to the same period last year. Excluding the cost of goods sold, the company’s gross profit was over 554 billion VND, a decrease of 44.2% compared to the fourth quarter of 2023.

In the last quarter of 2023, Novaland recorded a significant financial revenue of 1,825 billion VND, more than twice the amount of the same period last year. Novaland’s financial expenses also decreased by 62.7% to 250.5 billion VND. Selling expenses decreased while business management expenses increased. In addition, the company also recorded a profit of 572 billion VND from other sources. This could be fines collected from partners for contract violations.

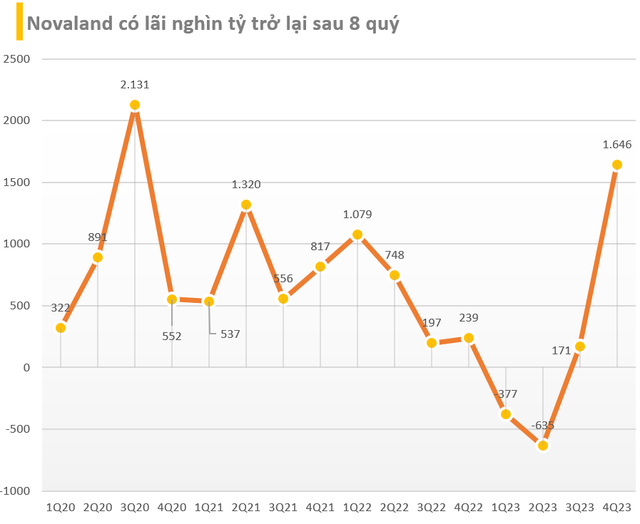

As a result, Novaland reported a post-tax profit attributable to the parent company of 1,646 billion VND, 12 times higher than the fourth quarter of 2023. EPS increased from 70 dong to 844 dong. This is also the first time in 8 quarters that the company has returned to making profits in the billions.

For the cumulative year 2023, Novaland recorded a revenue of nearly 4,760 billion VND and a net profit of 805 billion VND, a decrease of 57% and 63% respectively compared to the same period last year. It should be noted that the company had a loss of over 1,000 billion VND in the first half of the year.

As of December 31, 2023, Novaland’s financial borrowings amounted to 241,376 billion VND, a decrease of 16,000 billion VND compared to the beginning of the year. Among them, the item with the largest decrease was long-term receivables, which decreased from 44,081 billion VND to 33,857 billion VND. The company’s cash and deposits decreased by 5,200 billion VND to 3,412 billion VND. Inventory accounted for more than half of the assets, at 138,760 billion VND.

Novaland’s financial borrowings amounted to 57,704 billion VND, a decrease of nearly 7,000 billion VND compared to the beginning of the year. Among them, bond liabilities amounted to 38,262 billion VND, a decrease of 5,900 billion VND. Bank loans amounted to 9,400 billion VND.