Vietnam’s statistics office has reported on the contribution of the service sector to economic growth in the first half of the year. Services have become the largest economic sector in Vietnam, accounting for 42.54% of gross domestic product (GDP) in 2023. The sector employs nearly 40% of the total employed labor force in the economy.

This sector continued to be a bright spot in the economy in the first six months of this year, contributing mainly (49.76%) to GDP growth, thanks to increased domestic demand and a strong recovery in international arrivals to Vietnam.

The service sector contributes significantly to GDP growth, driven by increased domestic demand and a rebound in international arrivals to Vietnam.

Revenue from service industries in the first half of the year recorded robust growth compared to the same period last year. Both retail sales of goods, accommodation and catering services, and tourism travel services saw significant increases. Vietnam’s service export turnover is estimated at 11.2 billion USD, up 20% from 2023.

The statistical agency attributes the positive growth in the tourism sector to a record number of international arrivals to Vietnam, which played an important role.

In the first half of the year, international arrivals to Vietnam exceeded 8.8 million, an increase of 58.4% over the same period last year. This figure is even 4.1% higher than in 2019 before the COVID-19 pandemic.

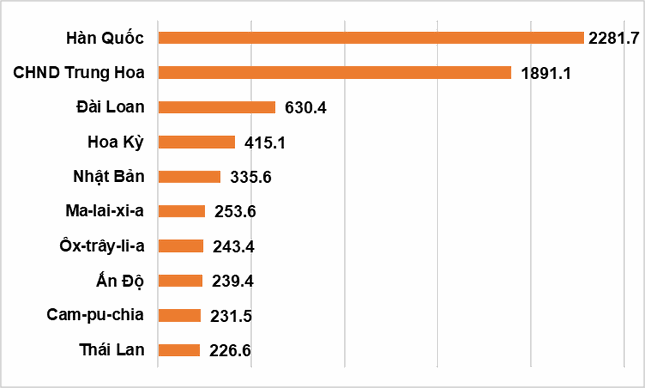

Top 10 markets with the highest number of arrivals in Vietnam in the first six months (in thousands).

Asia remains the dominant market, with 6.9 million arrivals. Vietnam also welcomed 1.1 million visitors from Europe and over half a million from the Americas…

South Korea topped the list with nearly 2.3 million visitors, followed by China with almost 1.9 million. Taiwan, the United States, and Japan are also among the top sources of international arrivals.

“These markets have been the main drivers of the recovery in international arrivals to Vietnam since the COVID-19 pandemic was brought under control,” said the Statistics Office. “European visitors also showed positive growth, especially from the UK, France, Germany, and Italy, thanks to the visa waiver policy for unilateral entry into Vietnam with a temporary stay period of up to 45 days, effective from August 15, 2023.”

Michael Kokalari, Chief Economist at VinaCapital, estimates that the total contribution of the tourism sector to the Vietnamese economy (including direct and indirect contributions) accounts for more than 15% of GDP. VinaCapital expects international arrivals to Vietnam to increase by 40% this year, following a nearly 250% jump in 2023.

The return of Chinese tourists, along with strong tourism demand from Americans, is expected to push total foreign tourist arrivals to Vietnam about 5% higher than pre-COVID-19 levels. However, Kokalari noted that hotel occupancy rates in Vietnam remain about 20% lower than before the pandemic, mainly due to the decline in Chinese tourists.

According to VinaCapital’s statistics, Chinese and Russian tourists accounted for a significant proportion of the mid-range market segment – a market segment that has not fully recovered. In contrast, some luxury resorts have achieved occupancy rates equal to or higher than pre-pandemic levels.

Along with the strong recovery in the international market, domestic tourism also yielded positive results. In the first six months of the year, Vietnam’s accommodation and travel service providers served more than 66.5 million domestic tourists. Total tourism revenue was estimated at about 436.5 trillion VND, 1.3 times higher than in the same period last year.

Looking ahead, the Statistics Office expects the service sector to remain a bright spot in the economy. Some commercial sectors may maintain positive growth momentum due to consumption stimulus policies, including tourism festivals, shopping festivals, domestic market promotion programs, and the promotion of goods distribution through digital platforms and e-commerce to expand domestic consumption.

Positive Signs in Exports and Imports: Early 2024

Vietnam’s total import-export turnover in January 2024 reached nearly $64.22 billion, representing an increase of 37.7% compared to the same period last year. This positive signal in the trade of goods shows a promising start to the year 2024.

EBITDA Continuously Increases for 4 Quarters, WinCommerce Plans to Open 700 More Stores

In 2023, despite the challenges both domestically and internationally, the retail market in Vietnam is gradually becoming a lucrative investment opportunity and a fiercely competitive battleground. Amidst this backdrop, WinCommerce (a subsidiary of Masan Group) emerges as the solution for an optimized store model, expanding networks, and sustaining market share for Vietnamese businesses…

Prime Minister: State-owned enterprises holding substantial resources need to be profitable

On the morning of February 5th, Prime Minister Pham Minh Chinh emphasized the importance of profitable operations and increased contributions to GDP growth and the state budget by working with 19 conglomerates and state-owned enterprises. These businesses possess significant resources and must strive to generate more profits.