The market witnessed a turnaround and headed south in the afternoon session after hovering around the previous peak. The index closed at the session’s lowest level on July 10, losing 7.77 points to reach 1,285. Liquidity was maintained, with trading volume on HOSE exceeding 21.8 trillion VND.

Foreign investors’ net selling was a downside, with a net sell value of 1,051 billion VND in the entire market. This marked the 24th consecutive session of foreign investors’ net selling in the Vietnamese market.

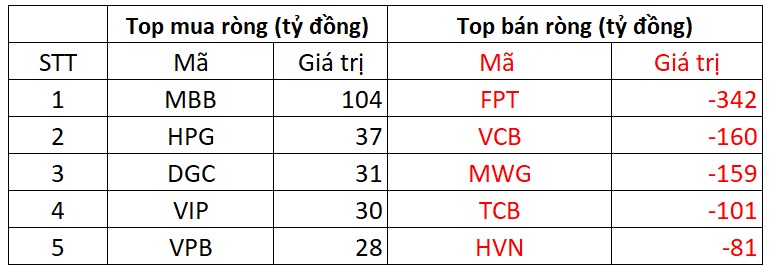

On the HOSE, foreign investors net sold 1,037 billion VND.

In the buying column, MBB attracted the most net buying from foreign investors, with a net buy value of 104 billion VND. HPG and DGC were the next two most bought stocks, with net purchases of 37 billion VND and 31 billion VND, respectively. VIP and VPB were also net bought, with values of 30 billion VND and 28 billion VND.

On the other hand, FPT faced the strongest net selling pressure from foreign investors, with a net sell value of 342 billion VND. VCB and MWG also witnessed net selling of 160 billion VND and 159 billion VND, respectively.

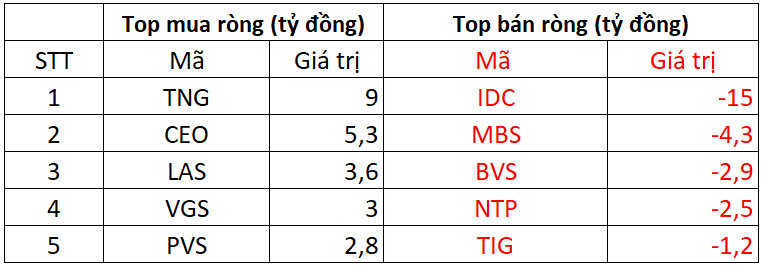

On the HNX, foreign investors net sold 3 billion VND

In terms of net buying on the HNX, TNG witnessed the strongest net buying, with a value of 9 billion VND. CEO was the next stock in the foreign investors’ net buying book on HNX, with a net buy value of 5 billion VND. Additionally, they net bought a few billion VND worth of LAS, VGS, and PVS.

On the opposite side, IDC faced net selling pressure from foreign investors, with a net sell value of nearly 15 billion VND. MBS, BVS, and NTP also witnessed net selling of a few billion VND.

On the UPCOM, foreign investors net sold 11 billion VND

Conversely, QNS faced net selling pressure from foreign investors, with a net sell value of nearly 7 billion VND. Additionally, they net sold positions in PHP, ACV, and others.

Dragon Capital Chairman: “Long-term vision is needed, accepting necessary adjustments for a safer, more efficient, and higher quality market”

According to Mr. Dominic Scriven, Chairman of Dragon Capital, the role of the finance industry in the stock market will be significant in 2023 and possibly in 2024. The roles of other industries, such as real estate or consumer goods, will depend on their respective challenges.