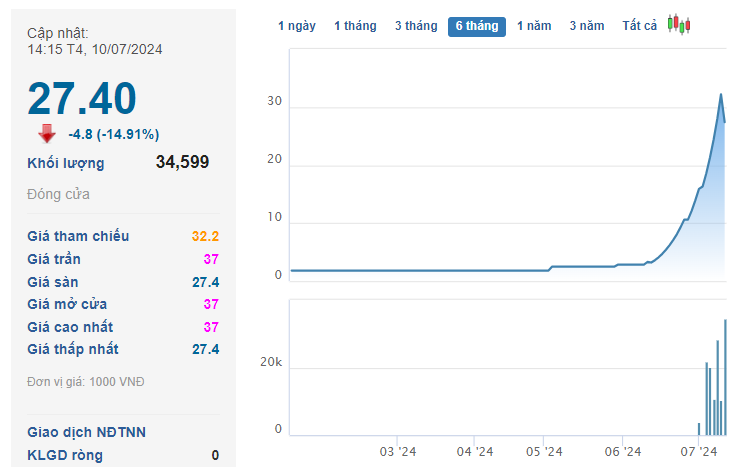

The stock market on July 10 witnessed a surprising turn of events for CDH, a public works and tourism services company in Hai Phong. CDH’s share price continued its upward surge, reaching the daily limit of a 37,000 VND/share peak during the morning session, marking a staggering nearly 1200% increase within just one month. However, an unexpected reversal occurred in the afternoon session, with the share price plunging to the floor, resulting in a 14.9% loss and settling at 27,400 VND/share. This abrupt shift left investors who had purchased at the morning’s peak price facing an immediate loss of nearly 26%.

This dramatic price drop was accompanied by record-high trading volume for CDH, with 34,300 units changing hands, amounting to a value of nearly 1.2 billion VND.

Major shareholder cashes in while leadership aims to buy:

The erratic fluctuations in CDH’s share price over the past month have raised eyebrows among investors, especially considering the absence of notable company news. The most recent development was the finalization of the shareholder list on June 14 to facilitate a 5% cash dividend payout, equivalent to 500 VND per share.

Examining the trading activities of CDH’s major shareholders and insiders, long-term major shareholder, Nguyen Thi Minh Phuong, reported selling 3,500 shares on July 1, followed by additional sales of 21,400 and 20,000 shares on July 3 and 4, respectively. Her remaining stake post-transactions stands at 158,028 shares, representing a 7.9% holding.

Notably, Ms. Phuong has been a long-standing major shareholder of CDH. According to the company’s initial disclosure of major shareholders, as of April 7, 2016, she held 203,428 CDH shares, equivalent to a 10.17% stake. Remarkably, as of December 31, 2023, nearly eight years later, Ms. Phuong maintained her initial shareholding amount.

Thus, from the beginning of 2024 until now, Ms. Phuong has net sold 45,400 CDH shares. Additionally, her husband, Mr. Tran Van Linh, currently holds 1,100 CDH shares.

In contrast to the long-term shareholder’s profit-taking, Mr. Nguyen Van Hien, a member of CDH’s Board of Directors, has registered to purchase 100,000 CDH shares. The expected trading period is from July 1 to July 30, 2024. Mr. Hien currently holds a 7.6% stake, equivalent to 152,367 CDH shares.

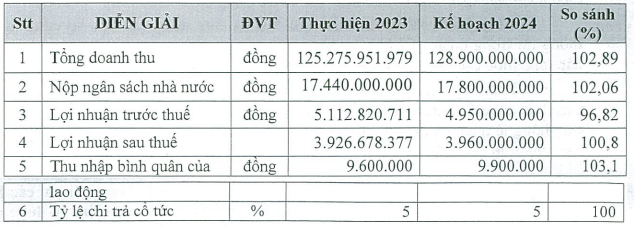

In terms of business performance, CDH reported total revenue of over 125 billion VND for 2023. Consequently, the company’s net profit reached slightly over 5.1 billion VND, an approximate 8% increase compared to the previous year and a 6% surpass of the set plan. For 2024, CDH has set a target of 128.9 billion VND in total revenue and a net profit of 4.95 billion VND. The projected dividend payout remains at 5% in cash.

Tracodi (TCD) earns 163 billion VND profit in 2023

Throughout the year 2023, Tracodi achieved a consolidated net revenue of VND 1,784.5 billion and a post-tax profit of VND 163.3 billion.

Novaland reports over VND 1,600 billion in profit for Q4/2023, bond debt reduced by VND 6,000 billion in one year.

In 2023, Novaland achieved a profit of over 800 billion VND, in contrast to the first half of the year when the company incurred a loss of over 1,000 billion VND.