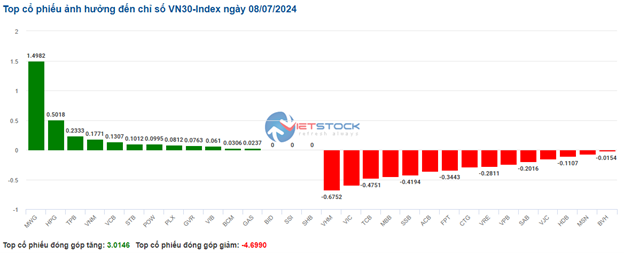

Stocks within the VN30 basket are witnessing a slightly more dominant green trend. Specifically, HPG, MBB, MSN, and VCB respectively contributed 1.19 points, 1.06 points, 0.53 points, and 0.39 points to the overall index. Conversely, FPT, MWG, TCB, and VNM are experiencing heavy selling pressure, dragging more than 2 points from the VN30-Index.

Source: VietstockFinance

|

The construction materials sector leads the recovery with a 1.33% increase, despite somewhat mixed performances within the industry. The green trend primarily stems from steel companies, with the three giants, HPG, up 1.55%, HSG, up 2.98%, and NKG, up 2.17%. Additionally, other codes like VGC, up 0.56%, HT1, up 0.37%, and VGS, reaching the ceiling price, contribute to the positive momentum.

Regarding HPG, from a technical perspective, the stock price surged in the morning session, accompanied by rising trading volume. It is expected to surpass the 20-day average by the end of the session, indicating investors’ optimistic sentiment. Currently, HPG‘s price has rebounded after successfully retesting the previous peak breached in March 2024. This upward movement is further reinforced by the buy signals from the MACD and Stochastic Oscillator, bolstering the long-term uptrend.

Source: https://stockchart.vietstock.vn/

|

Following closely, the wholesale sector also displayed resilience, starting the session with a 1.29% gain. The buying force was largely concentrated in PLX, up 1.74%, along with other codes like SMC, up 2.5%, VPG, up 2.03%, and TLH, up 3.37%. Conversely, DGW, down 0.31%, HHS, down 0.87%, and VFG, down 1.08%, painted the screen red, but the selling pressure wasn’t significant.

Meanwhile, the consulting and support services sector continued its lackluster performance, exerting downward pressure on the overall index with a substantial 2.07% decline. This drop was mainly driven by TV2, down 2.9%, as the stock witnessed three consecutive floor sessions. Currently, it is finding balance at the previous May 2024 low (equivalent to the 34,000-36,200 range). Additionally, VNC, down 0.26%, and KPF, down 0.61%, also dipped into the red, but their impact was negligible.

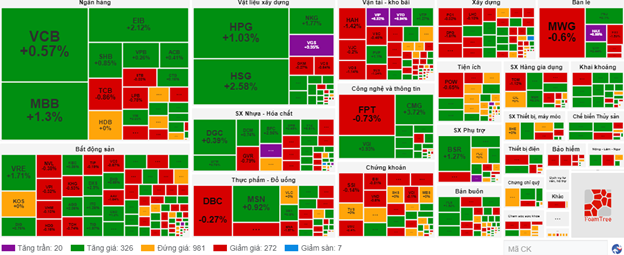

Compared to the opening, buyers and sellers were engaged in a fierce tug-of-war, with over 980 codes unchanged and a slight edge for the buyers. There were 326 rising codes (including 20 ceiling prices) versus 272 falling ones (with 7 floor prices).

Source: VietstockFinance

|

Opening: VN-Index Fluctuates

As of 9:40 a.m. on July 10th, the VN-Index hovered around the reference level, gaining nearly 2 points to reach 1,295.32 points. Meanwhile, the HNX-Index slightly dipped to 245.57 points.

On July 8th, Jerome Powell, Chairman of the Federal Reserve (Fed), expressed concern that maintaining high-interest rates for an extended period could pose risks to economic growth. Currently, the Fed’s overnight lending rate stands at 5.25%-5.50%, the highest level in 23 years. This outcome is a result of 11 consecutive hikes as inflation soared to its highest level since the early 1980s.

The market anticipates that the Fed will initiate a rate cut in September, with a potential additional reduction of 0.25 percentage points by year-end. However, FOMC members at their June meeting indicated only a single cut for this year.

As of 9:40 a.m., large-cap stocks like VCB, BID, and MBB propelled the market upward, contributing to a nearly 1.5-point gain. On the flip side, FPT, MWG, and BCM led the group of stocks negatively impacting the market, resulting in a nearly 1-point decline.

The rubber products sector maintained stable growth from the beginning of the session, with stocks like DRC, up 0.41%, and CSM, up 3.08%, while the remaining stocks remained unchanged.