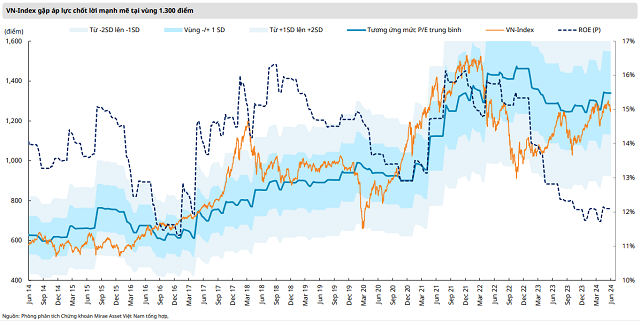

Mirae Asset maintains a bullish outlook on the VN-Index, targeting the 1,320-1,340 range, which corresponds to a 10-year average P/E ratio. This comes despite expecting a less robust growth trajectory, with price action likely to fluctuate within a wide range, leading to a period of consolidation.

This trend is predicted to persist until mid-July, as the market enters a quiet period in terms of news flow, and trading sentiment is expected to be cautious ahead of the Q2 earnings season.

According to Mirae Asset, the lack of strong upward momentum in the market is largely influenced by the weak trading activity of large-cap stocks in the banking and real estate sectors.

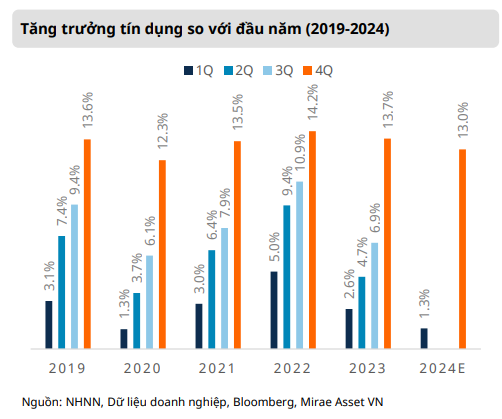

While the banking sector has seen an acceleration in credit growth in the first half of June, reaching 3.79% from the end of 2023 (an improvement from 2.41% at the end of May), this may not be reflected in Q2 profits.

The real estate industry is yet to see a significant improvement as it awaits clearer information on the early application of three important laws. Therefore, the Q2 earnings picture presents a considerable challenge for the VN-Index in the coming months.

Key factors to watch in the second half of 2024 include credit growth. Lending rates are not the main barrier to credit growth in the first half of 2024.

Instead, the more challenging issue is credit demand. However, Mirae Asset expects credit growth to accelerate in the latter half of the year, driven by a recovery in the manufacturing sector and continued monetary and credit policy easing.

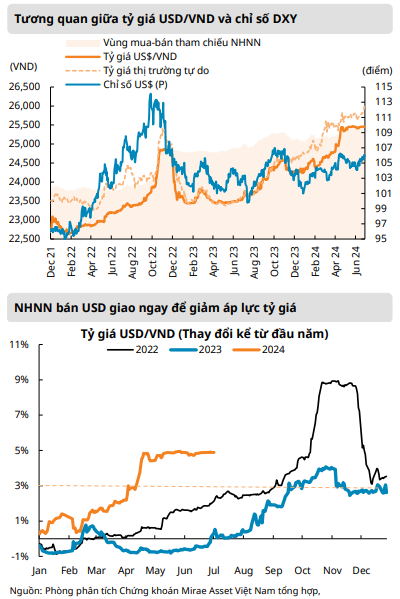

Regarding exchange rates, with the Fed expected to deliver only one or two rate cuts in the second half of 2024, this is unlikely to significantly impact the already tense exchange rate situation due to the significant interest rate differential between the USD and VND.

Mirae Asset anticipates continued pressure on exchange rates, albeit with slightly reduced tension compared to the beginning of the year.

The State Bank of Vietnam is likely to continue its strategy of selling USD from foreign exchange reserves, gradually adjusting the base interest rate through the issuance of bills and reverse repurchase agreements while awaiting foreign capital inflows into Vietnam and expecting a slowdown in outflows as the Fed loosens monetary policy.