The Hanoi Council for Economic and Budgetary Affairs’ report highlights the city’s rising tax debt from 2021 to 2023.

Soaring Debt Year after Year

Hanoi’s Tax Department collected over 25.4 trillion VND, 37.63 trillion VND, and nearly 43.9 trillion VND in overdue taxes in 2021, 2022, and 2023, respectively. However, the absolute figure for the state budget arrears in the city increased annually, reaching over 21 trillion VND in 2021, over 23.4 trillion VND in 2022, and nearly 28.8 trillion VND in 2023.

Chart: Hong Khanh

Several districts witnessed significant surges in tax debt, including Hoang Mai with an increase of 868 billion VND (up by 58% compared to 2022), Soc Son – Me Linh Tax Branch with an additional 264 billion VND (a 29% hike), and Cau Giay with a rise of 178 billion VND (also up by 29%).

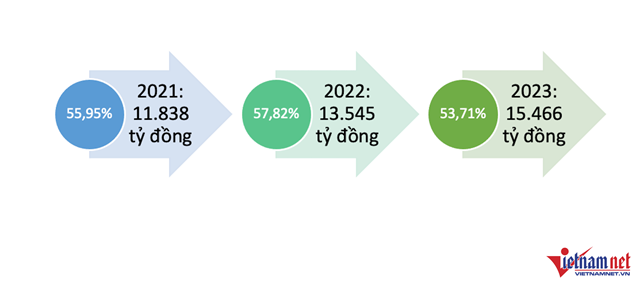

The Economic and Budgetary Affairs Board pointed out that tax debts related to land accounted for over 50% of the annual total. In 2021, land-related tax debts amounted to approximately 11.84 trillion VND, nearly 56% of the total. This figure climbed to 13.545 trillion VND in 2022, constituting nearly 58% of the total, and further increased to nearly 15.47 trillion VND in 2023, making up almost 54% of the total debt.

Hanoi’s Land-Related Tax Debt Situation. Graphic: Hong Khanh

|

These land-related tax debts include financial obligations for land use by several large entities that lack the capacity to pay, such as the National Sports Complex with a debt of 895 billion VND, the Vietnam Shipbuilding Industry Corporation with 173 billion VND, the Vietnam Railways Corporation with 484 billion VND, and the A Chau Company with 617 billion VND.

Additionally, 24 projects that were allocated land with collection of land use fees have outstanding land tax debts totaling approximately 2.8 trillion VND. There is also an additional debt of over 4 trillion VND awaiting processing, associated with financial obligations for land use, accounting for 26% of the total tax debt.

The Economic and Budgetary Affairs Board identified several causes for this situation, including a lack of assertiveness and initiative in determining, managing, and collecting overdue payments.

There has also been a lack of timeliness in addressing and updating the progress of taxpayers’ proposals and concerns, with some cases lingering for years without resolution, especially in determining and reviewing land use fees. Notable examples include Vinaland JSC and VNT Co., Ltd., the investors of the Tay Nam Hanoi Urban Area’s Dreamland Plaza project.

Firm Action Proposed to Address the Issue

Given the situation, the Economic and Budgetary Affairs Board proposed that the Hanoi People’s Committee and the Steering Committee for Tax Debt Collection take decisive action. They recommended coordinating closely with the Hanoi Tax Department to urge taxpayers to fulfill their tax and fee obligations.

Additionally, the city should implement disciplinary measures for cases of intentional land misuse, delayed implementation, or deliberate delay in fulfilling financial obligations. If investors lack the financial capacity to continue, the city should resolutely revoke the projects and reallocate the land through auctions or bidding to select capable investors.

Furthermore, the city has the responsibility to direct relevant agencies to review and address the tax department’s proposals during the supervision of the Economic and Budgetary Affairs Board. This includes addressing significant tax debts, such as those owed by Trung Viet Investment and Construction JSC, Vinaland JSC, and VNT Co., Ltd.

Hong Khanh

Nearly 6,000 fuel retail stores issue electronic invoices

As of January 26th, there are 5,844 retail petrol stations nationwide that have implemented electronic invoice issuance for each sales transaction, in accordance with regulations.