The Hanoi Stock Exchange (HNX) recently published a document from Gia Khang JSC, announcing periodic information about the company’s bond principal and interest payments.

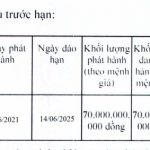

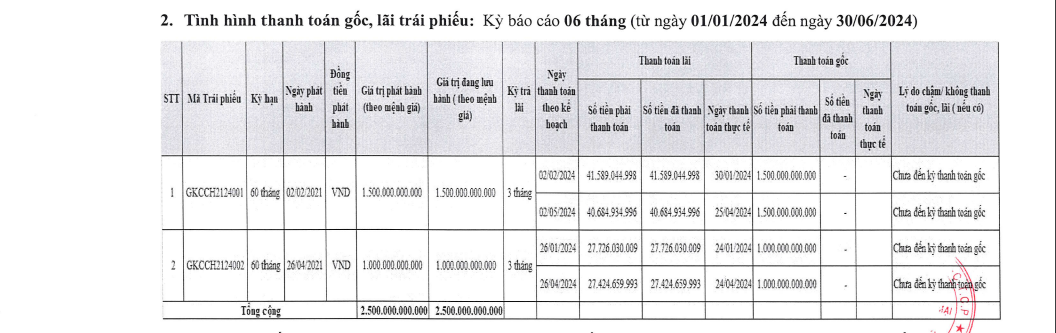

According to the disclosure, in the first six months of 2024, the company paid a total of VND 137.4 billion for four interest payments on two bond lots: GKCCH2124001 and GKCCH2124002.

Source: HNX

Both bond lots were issued in 2021, with a term of 60 months and interest payments made quarterly.

Gia Khang JSC issued VND 1,500 billion worth of GKCCH2124001 bonds and VND 1,000 billion worth of GKCCH2124002 bonds to increase its ownership in An Khang Land JSC.

These bonds are secured by Gia Khang JSC’s shares in An Khang Land JSC, along with related rights, interests, dividends, and/or distributable amounts. Additional collateral includes all rights and interests arising from and related to the Giga City project, as well as land-use rights for the project site owned by An Khang Land JSC.

The underwriter for these bond issues was Tien Phong Securities JSC, according to the issuance announcement.

The Giga City project is a mixed-use complex combining commercial, service, and office space, spanning an area of 40,291 m2 in Linh Tay ward, Thu Duc City, Ho Chi Minh City. An Khang Land JSC has been the project’s investor since December 2016.

Regarding Gia Khang JSC, the company was established on April 14, 2016, with an initial charter capital of VND 100 billion. The shareholders at that time were Mr. Nguyen Khanh Duy, holding 65%, and Mr. Phan Tan Phuc, holding 35%.

In September 2016, the company’s charter capital increased to VND 350 billion, with a change in shareholder structure: Nguyen Khanh Duy (35%), Phan Tan Phuc (35%), and Nguyen Duc Minh Giao (30%).

According to a registration change in November 2017, shareholders Nguyen Khanh Duy and Phan Tan Phuc simultaneously reduced their ownership in Gia Khang JSC to 2.5% and 2.5%, respectively, while Nguyen Duc Minh Giao and Nguyen Truong Giang acquired 55% and 40% stakes.

By the end of October 2018, shareholder Nguyen Khanh Duy had increased his ownership to 12.5%, while Nguyen Truong Giang reduced his stake to 30%. The other two shareholders maintained their ownership percentages.

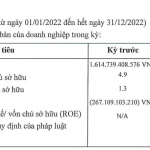

In January 2021, Gia Khang JSC raised its capital to VND 1,000 billion, but the shareholder structure was not disclosed. The current Chairwoman of the Board of Directors and legal representative is Ms. Le Thi Mai Loan (born in 1982).

Just over a year later, in March 2022, the company again increased its charter capital to VND 1,700 billion.

From April 2023 to March 2024, Gia Khang JSC underwent several changes in its Board Chairmanship, first from Ms. Mai Loan to Mr. Bui Thien Phuong Dong (born in 1978) and then to Mr. Pham Dai Nghia (born in 1988).

Mr. Pham Dai Nghia also took on the role of General Director, previously held by Mr. Nguyen Khanh Duy.

There are notable connections between Gia Khang JSC and Bamboo Capital JSC (BCG). Mr. Bui Thien Phuong Dong holds important positions in Tracodi JSC and BCG Land JSC, both of which are subsidiaries of BCG.

Ms. Le Thi Mai Loan also served as Vice Chairwoman of Tracodi JSC for a year, from April 2022 to April 2023. Additionally, she was the legal representative of BCG Land Gateway, a company associated with BCG.

Returning to the two bond lots totaling VND 2,500 billion issued by Gia Khang JSC, the proceeds from these bond issues were intended to increase the company’s ownership in An Khang Land JSC.

An Khang Land JSC, formerly known as A74 Mechanical Company, was established in 2004 through the equitization of a member unit of the Corporation of Machinery and Industrial Equipment. As of November 2015, its charter capital was VND 11.3 billion, with shareholders including Ms. Mac Thi Thinh (10.86%), Mr. Nguyen Duc Minh Giao (15%), Mr. Nguyen Truong Giang (65.29%), and Mr. Nguyen Quoc Anh (8.84%).

In August 2019, A74 changed its name to An Khang Land JSC, and its charter capital reached VND 1,000 billion. However, in March 2020, the company reduced its capital to VND 330 billion, and the shareholder structure and ownership percentages were not disclosed.

According to the latest registration change, the Chairman of the Board of Directors and legal representative of An Khang Land JSC is Mr. Nguyen Khanh Duy, who previously served as General Director of Gia Khang JSC.

Source: BCG Land

The connections between Gia Khang JSC and Bamboo Capital JSC extend further, as Gia Khang JSC is also known as the investor in the King Crown Infinity project, located at 218 Vo Van Ngan, Thu Duc City, Ho Chi Minh City. This project is being developed by BCG Land JSC and constructed by a joint venture between Tracodi and CC1 Corporation.

King Crown Infinity is marketed by BCG Land as a luxury real estate project in Thu Duc City. It is planned to be a 30-story tower with five basement levels and a focus on becoming a landmark in the area. The project boasts a commercial center in the tower’s podium, along with a host of other amenities.

Thai Tuan Group Keeps Piling Up Bond Debts, Owes 9 Months of Social Insurance

In the first month of 2024, Thai Tuan Corporation was able to pay only one month of social insurance amounting to approximately 1.4 billion VND. Consequently, as of January 31, 2024, the company still owes nine months of social insurance, equivalent to a total amount exceeding 12 billion VND.