Southern Basic Chemicals JSC (code: CSV) has just sent a document to HoSE explaining the reason for the ceiling price increase for 5 consecutive sessions from July 3 to July 9.

The enterprise stated that the trading price of CSV shares was directly influenced and dominated by the general situation of the stock market and investor psychology. The fact that CSV shares increased by 5 consecutive sessions was beyond the company’s control.

Also in the explanation document, the company announced its estimated business results for the first half of 2024. Specifically, consolidated revenue and consolidated pre-tax profit reached VND 832 billion and VND 159 billion, respectively, completing 51% and 61% of the plan proposed at the 2024 AGM.

“Based on the estimated results for the first six months, the company’s management board has grounds to assess that the production and business activities are normal, although facing many difficulties as well as favorable conditions. However, no significant abrupt factors have been observed. Therefore, the trading price of the company’s shares is entirely determined by market factors,” the document stated.

In the stock market, CSV’s impressive streak of ceiling increases actually reached 6 consecutive sessions. At the end of the morning session on July 10, the market price increased to the maximum limit to VND 41,150/share, with a near half-million buying volume at the ceiling price. This is also the highest price ever since CSV was listed on the exchange.

Since the beginning of July, this chemical stock has increased by 55%. If calculated from the beginning of the year until now, this stock has even increased by about 145% in value, with a capitalization of over VND 4,500 billion.

Regarding business performance, in the first quarter of 2024, CSV recorded net revenue of more than VND 351 billion, a 10% decrease compared to the same period last year. However, the cost of goods sold decreased slower, causing net income to decrease by 26% to nearly VND 47 billion.

In 2024, CSV set a business plan with the goal of VND 1,640 billion in revenue, up more than 3% compared to the previous year, but pre-tax profit decreased by 10% compared to the performance in 2023, to VND 261 billion – the lowest profit level in the past 4 years.

The CSV management board assessed that this year has faced many difficulties, such as the selling prices of NaOH and HCI products in the market are decreasing, and H3PO4 or H2SO4 products face fierce competition from cheap imported goods. Consumption and exports are still challenging. However, CSV has favorable conditions as the main raw materials for production are stable, the number of customers is stable, although the competition is higher, promoting consumption for TKV, and inventory levels are suitable for the production process.

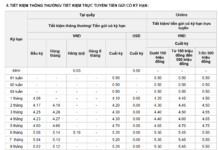

Investing in a volatile market: Should beginners consider putting money into high-yield bonds for 10-30% yearly profit?

Short-term stock market trading has proven to be a risky venture for many investors, leading to substantial losses. However, there are a few select open funds that have managed to achieve impressive returns, reaching up to 30%.