The Vietnamese stock market experienced fluctuations in the first half of the year and can be divided into two phases. The first phase lasted until the end of the first quarter, with the VN-Index continuing its recovery trend from 2023, driven by low-interest rates and economic recovery.

In the second phase, pressure from exchange rates, the upward trend in deposit interest rates, and foreign investors’ net selling caused the market to fluctuate and adjust in the latter part of the quarter. For the first half of 2024, the VN-Index increased by 10% in terms of index points, and the trading value in the first six months of 2024 rose by 83% compared to the same period last year.

Looking at the market outlook for the second half of 2024, KBSV Securities believes that several key factors will shape the trend of the Vietnamese stock market.

KBSV lowered its forecast for the growth of average EPS of listed companies on the Ho Chi Minh Stock Exchange to 14% (down from 19% in the previous report) after the first-quarter data release was less optimistic than expected. This downward revision also reflects a more cautious view of the two large-cap sectors, banking, and real estate, amid the rising interest rate environment and the slow recovery of the real estate market. However, this 14% growth rate is still considered high, supporting the overall trend of the stock market.

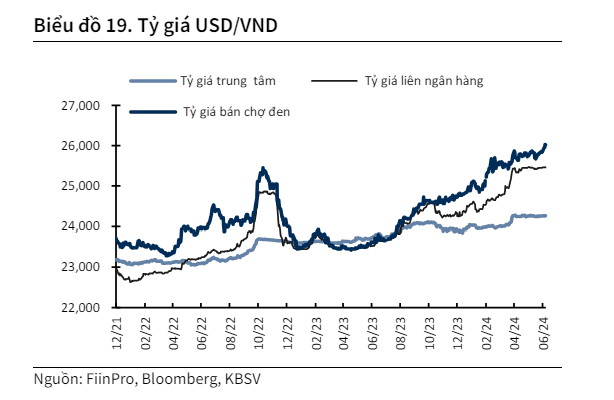

Additionally, the upward trend in interest rates due to exchange rate pressure is another factor influencing the market. The analyst team predicts that deposit interest rates will continue to rise by 0.7%-1% in the second half of 2024, creating pressure on the stock market. This is a consequence of the State Bank’s policies to stabilize exchange rates, such as net withdrawals through bill channels, sales of foreign exchange reserves (estimated at $6 billion in the first half of the year), and increases in OMO and bill interest rates. The exchange rate pressure is expected to remain intense in the third quarter before easing in the fourth quarter as the Fed cuts interest rates, and foreign currency inflows increase from remittances and exports entering the peak season.

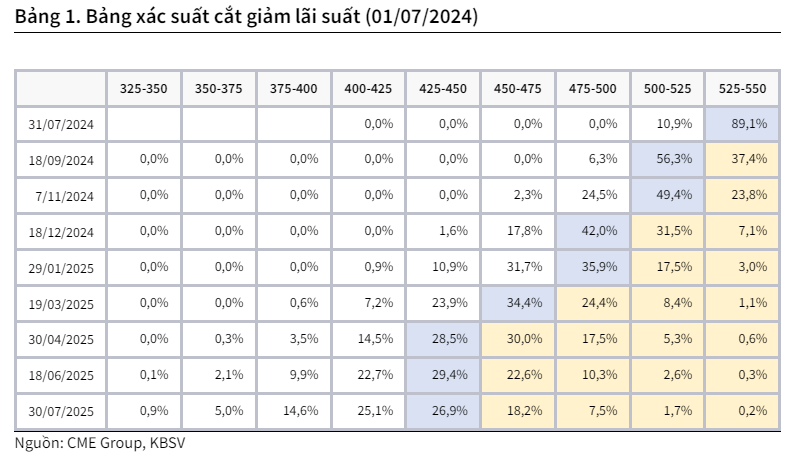

Regarding the Fed’s monetary policy, KBSV has lowered its forecast for the number of rate cuts by the Fed this year to one, down from three in the previous report. This means that exchange rate pressure will remain intense for at least the first half of the third quarter before easing in the fourth quarter, after the Fed cuts interest rates in September, and foreign currency supply is boosted by remittances and the peak export season towards the end of the year.

With the current economic data from the US economy, the Fed could delay rate cuts until after September this year. Additionally, the expectation of the first cut by 25 basis points (not too large) means that interest rates will still be relatively high. As a result, the strength of the US dollar, combined with the interest rate differential between USD and VND, will continue to put pressure on the exchange rate.

“Low-interest rates will likely have to increase to ease the pressure. This will relatively negatively impact the domestic stock market. In addition, investors’ expectations of an early rate cut by the Fed this year may be affected if it falls short of expectations, potentially leading to short-term selling pressure,” said KBSV in its report.

For the market outlook in 2024, KBSV lowered its VN-Index target to 1,320 points at the end of the year (down from 1,360 points in the previous report). This revision is a result of lowering the target P/E ratio of the index to 15 times (from 15.3 in the previous report, reflecting the expectation of a higher base interest rate) and reducing the projected earnings growth of listed companies on the Ho Chi Minh Stock Exchange to 14% (from 19% in the previous report).