Vietnam’s preliminary statistics from the General Department of Customs indicate that in June 2024, the country imported 15,890 completely built-up (CBU) automobiles of all kinds, equivalent to over 310 million USD. This represents a 6.4% increase in volume but a 0.1% decrease in value compared to May.

Cumulatively, in the first two quarters of the year, Vietnam imported a total of 74,585 CBU automobiles, valued at over 1.55 billion USD. This reflects a 5.2% increase in volume but a 6.4% decrease in value compared to the same period last year. The average import price reached 20,788 USD/unit (529 million VND/unit), a 10.7% decrease year-on-year.

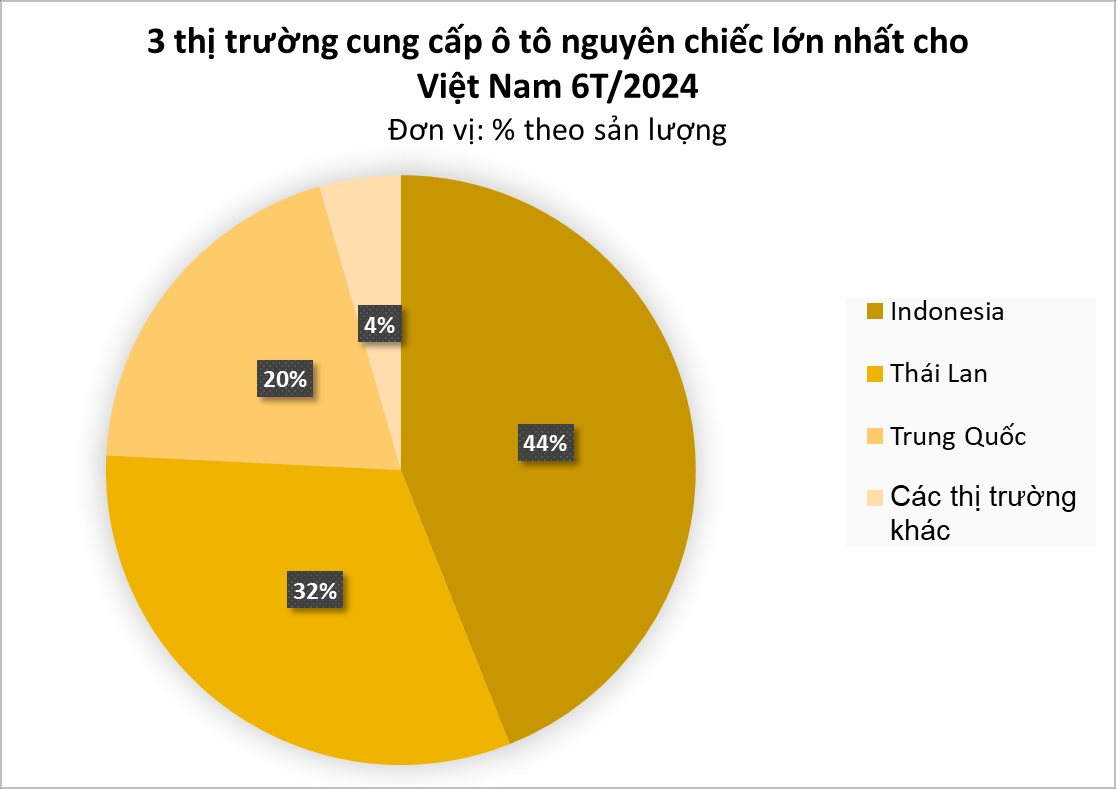

Indonesia emerged as the largest supplier of CBU automobiles to Vietnam in the first half of the year, with 32,797 units valued at 478.4 million USD. The average price per unit was 14,587 USD (approximately 371 million VND), reflecting a 26% increase in volume, a 36% surge in value, and a 7.7% rise in price compared to the previous year.

Specifically, in June, Vietnam imported more than 6,500 automobiles from Indonesia, totaling nearly 98 million USD. This signifies a substantial increase of 65% in volume and 77% in value compared to June 2023.

Thailand secured its position as the second-largest source of CBU automobile imports for Vietnam, with 23,736 units in the first six months of the year, valued at 463 million USD. However, these figures represent a 26% decline in volume and a 31% drop in value compared to the same period last year. The average import price was 19,530 USD/unit (around 497 million VND/unit), a 6.8% decrease year-on-year.

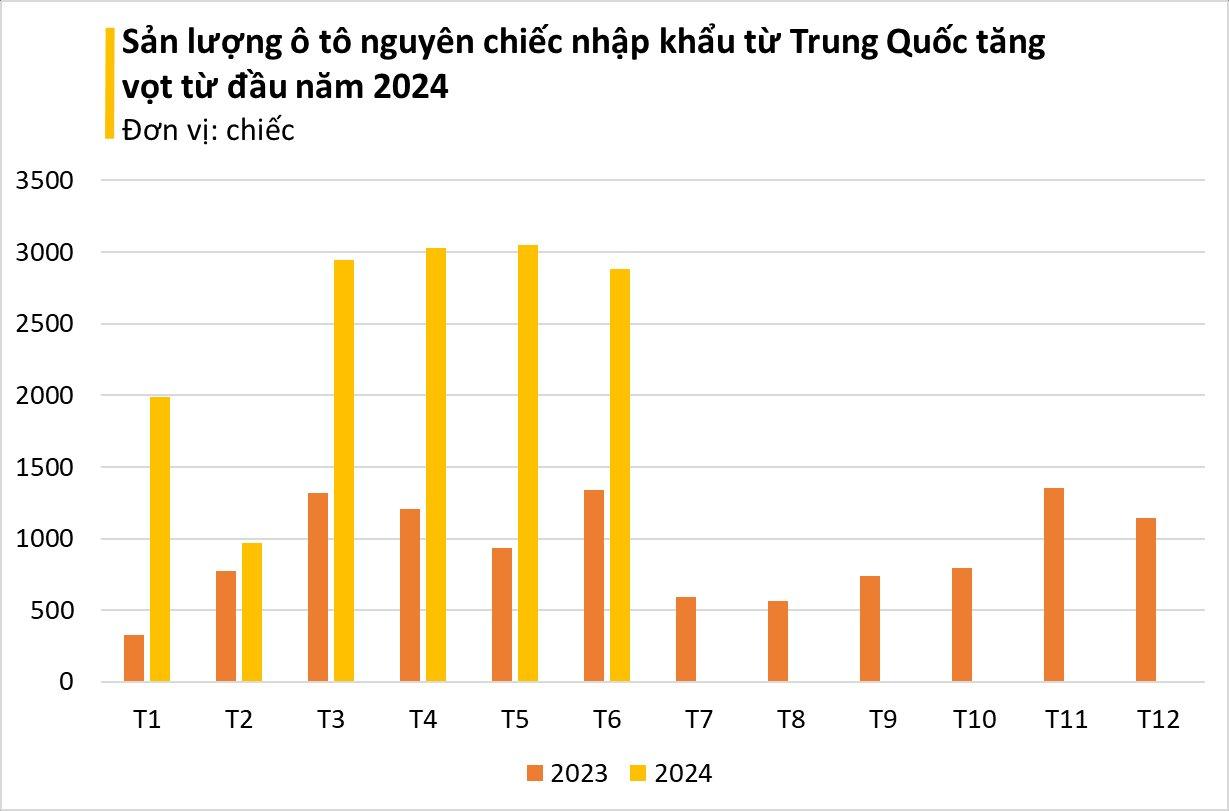

Notably, China has been actively ramping up its automobile exports to Vietnam since the beginning of the year. Vietnam imported 14,729 units from China in the first half of 2024, valued at 455.8 million USD, with an average price of 30,950 USD/unit (approximately 787 million VND/unit). This remarkable performance translates to a 152% surge in volume and a 103% jump in value compared to the same period last year, despite a 19.4% decrease in price.

In June alone, Vietnam imported 2,882 automobiles from China, valued at nearly 83 million USD. This represents an impressive 115% increase in volume and a 56% jump in value compared to June 2023.

According to experts, the rise in automobile imports can be attributed, in part, to the gradual reduction in tax rates. Vietnam has actively engaged in and signed 16 free trade agreements (FTAs), many of which include commitments related to CBU automobiles and roadmaps for reducing import taxes to 0%. For instance, the ASEAN Trade in Goods Agreement (ATIGA) has already reduced automobile import taxes to 0% since 2018. Similarly, the UK/EVFTA (Vietnam-UK and Vietnam-Europe FTAs) will bring taxes down to 0% by 2028, while the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) aims for a 0% rate by 2027.

As per the EVFTA commitments, import taxes on CBU automobiles from the EU will decrease by approximately 6.4% annually for ten consecutive years. In 2024, the applicable import tax stands at 38.1%, and it is projected that by 2030, import taxes on CBU automobiles from the EU will be eliminated.

Additionally, according to a draft decree being finalized by the Ministry of Finance for submission to the Government for issuance, the registration fee for CKD automobiles will be reduced by 50%. This decree is expected to be applied from August 1, 2024, to January 31, 2025. As a result, the significant increase in imported vehicles in recent months can be attributed to consumers’ anticipation of the official reduction in registration fees, allowing them to purchase automobiles at more affordable prices.

The surge in imported automobiles contributes to product diversification and offers Vietnamese consumers a wider range of options. However, this also poses challenges for locally produced automobiles, which often carry a higher price tag.