|

iShares ETF Equity Changes from 07/01 to 07/08/2024

|

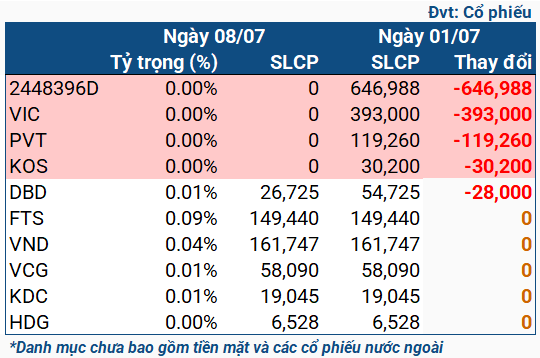

During this period, the iShares ETF fully divested its holdings in VIC, PVT, and KOS. Specifically, 393,000 shares of VIC were sold, over 119,000 shares of PVT, and 30,200 shares of KOS. Additionally, DBD saw a sale of 28,000 shares, a decrease of more than 50% from the beginning of the period.

Furthermore, the number of VND stock options (2448396D) decreased from 646,988 options (approximately 129,000 new shares) to zero, while the number of VND shares held remained unchanged from the previous period. This suggests that the Fund likely sold all of these additional shares.

The iShares ETF has been aggressively selling off Vietnamese stocks since June 11, 2024, following the announcement by asset management giant BlackRock that the ETF will cease trading and no longer accept create or redeem orders after market close on March 31, 2025. The notification also emphasized that the timeline is subject to change.

BlackRock to Shut iShares ETF That’s Heavily Invested in Vietnam Stocks

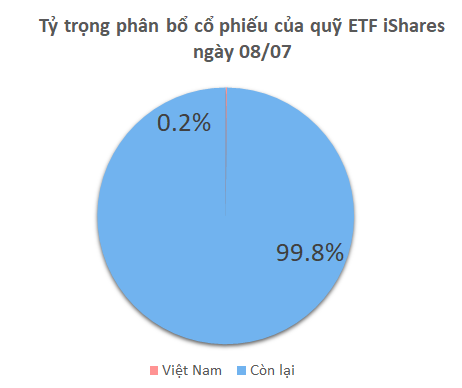

As of July 08, the total assets of iShares ETF stood at approximately $284.6 million, down from nearly $297 million on July 01. Vietnamese stocks in the portfolio are now limited to 6 tickers, making up only 0.2% of the total, including DBD, VND, FTS, VCG, KDC, and HDG. Among these, FTS holds the largest weight, at 0.09%.

BIG: 2023 Profit Soars Over 10x, Expands Nationwide Hotel Chain

Thanks to optimizing real estate business operations and boldly expanding into the service real estate sector (BIG HOTEL), Big Invest Group JSC (UPCoM: BIG) has achieved impressive business results in 2023. BIG has announced its focus on accelerating the plan to open a chain of BIG HOTEL hotels in 2024.

FTS, NKG, SJS included in MSCI Frontier Market Index

The results of the February review, which took place in the early morning of February 13, 2024 (Vietnam time) by MSCI, saw 9 securities being added and 11 securities being removed from the MSCI Frontier Market Index basket. Among the securities added, there are 3 securities from Vietnam.