Illustration

Oil prices drop over 1% as Beryl storm concerns ease

Oil prices dropped by over 1% as Storm Beryl caused less damage to the US oil-producing hub in Texas than initially feared. Brent crude oil stabilized at $84.66 per barrel, down $1.09 or 1.3%. US crude oil stabilized at $81.41, losing 92 cents or 1.1%.

While some US offshore production sites were evacuated, ports closed, and refining processes slowed, major US Gulf Coast refineries appear to have suffered minimal impact after Beryl weakened to a tropical storm.

Major Texas oil shipping ports have reopened, and some facilities are ramping up production. Oil investors also reacted to comments made by Federal Reserve Chair Jerome Powell, who told a Congressional hearing on Tuesday that the economy was “not overheating” and that the job market had eased. While indicating a potential rate cut, oil prices dipped further after these remarks as a weakening economy could hinder crude oil demand.

Gold prices edge higher ahead of US inflation data

Gold prices rose despite a stronger dollar and higher bond yields, as investors awaited US June inflation data due later this week for clarity on the US rate path. Spot gold rose 0.2% to $2,363.64 per ounce by 18:35 GMT, after falling more than 1% in the previous session. US gold futures settled up about 0.2% at $2,367.90.

The dollar strengthened about 0.2% against other currencies, making gold more expensive for holders of other currencies, while the yield on the 10-year Treasury note edged higher. There is an expectation that the Federal Reserve is more likely to begin cutting rates as early as September, which is positively contributing to the current market conditions, according to Bart Melek, head of commodity strategies at TD Securities.

Recent US economic data points to a cooling job market, reinforcing expectations that the US central bank is on track to begin cutting rates soon. The focus now shifts to consumer price index (CPI) data on Thursday, with recent figures showing a cooling from unexpectedly high levels earlier in the year. If evidence of persistent US inflation emerges, it could temper the precious metal’s recent gains, according to Han Tan, chief market analyst at Exinity Group.

Copper prices slide as dollar strengthens

Copper prices slid as the dollar strengthened after Federal Reserve Chair Jerome Powell did not signal a clear timeline for US rate cuts, and concerns about demand in China resurfaced. London Metal Exchange (LME) benchmark copper fell 0.4% to $9,876 a ton.

The industrial metals market is awaiting the long-delayed third plenum of the Communist Party of China, scheduled for July 15-18, which is expected to focus on economic policy and reforms. However, the outlook is that LME copper stocks have risen above 191,000 tons to their highest since October 2022 and nearly double mid-May levels. Most of these deliveries were to warehouses in Asia and originated from China.

On the LME, aluminum prices fell 1.3% to $2,498 a ton, zinc dropped 0.7% to $2,934, lead declined 1.6% to $2,196, and nickel slid 1.9% to $17,140. Meanwhile, tin reached $34,450, the highest since May 21, due to supply concerns, partly due to disrupted shipments from top exporter Indonesia. Exports have fallen to 10,292 tons in the first five months from 23,887 tons a year earlier. Tin rose 0.6% to $34,445.

Dalian iron ore slips on weak China demand concerns

Dalian iron ore futures fell due to concerns about weak demand in China, although investors hoped for additional stimulus from next week’s crucial meeting. The September iron ore contract on the Dalian Commodity Exchange (DCE) in China ended down 0.5% at 834 yuan ($114.70) per ton. The August iron ore contract on the Singapore Exchange rose 1% to $109.40 per ton. On the Shanghai bourse, steel rebar fell 0.5%, hot-rolled coil dropped 0.6%, wire rod declined 0.6%, and stainless steel lost 1.7%.

Robusta coffee prices hit record high due to tight supply

Robusta coffee prices surged to a record high as the global market tightened due to delayed shipments from top producer Vietnam. Robusta coffee prices have risen 63% this year, peaking on Tuesday at $4,667 per ton on the ICE futures market. The market has been rising for about 18 months as global producers like Vietnam struggle to keep up with steadily increasing demand. Prices rose 58% in 2023.

The demand for robusta coffee has increased as roasters switch from arabica to the cheaper variety. Robusta is typically used for soluble coffee but is also increasingly added to the coffee blend dominated by arabica. Vietnam’s coffee exports in June were only 70,202 tons, bringing the cumulative total for the first half of this year to 893,820 tons, down 11.4% from a year earlier, according to customs data on Tuesday.

Coffee production in Vietnam has nearly tripled in the first two decades of this century, peaking at 31.58 million 60-kg bags in the 2021/22 crop year, according to data from the US Department of Agriculture. Vietnamese coffee producers have been impacted this year by the worst drought in nearly a decade, dampening prospects for the next harvest, which typically occurs around November.

Global coffee consumption continues to rise despite higher prices. The International Coffee Organization estimated a 2.2% increase in global coffee consumption for the 2023/24 crop year.

Wheat, corn prices rebound; Soybeans hit near 4-year low

Chicago wheat and corn futures rebounded after sharp losses on Monday, while soybean prices closed at their lowest in nearly four years due to expectations of ample supplies from the Northern Hemisphere harvests. Rain from Storm Beryl is expected to provide beneficial moisture across the US Midwest. CBOT corn futures ended up 3/4 cent at $4.08-1/2 per bushel after touching a four-year low on Monday.

While corn prices recovered, soybean futures continued to face challenges from a lack of demand, weak crushing margins, and global oversupply, according to traders. CBOT soybeans fell 19-1/2 cents to $10.80 per bushel, touching their lowest since Nov. 3, 2020. August soybean futures touched their contract low, settling at $11.31-1/4 per bushel. CBOT wheat closed up 1-1/2 cents at $5.72 per bushel.

Wheat futures have benefited from strong export sales, lingering concerns about yields from the European wheat crop, and worries that rain from Storm Beryl could delay the US wheat harvest in the Plains.

Japanese rubber futures rise after four days of losses on higher synthetic rubber prices

Japanese rubber futures rose for the first time in five sessions due to higher synthetic rubber prices, although a stronger yen limited gains. Osaka Exchange (OSE) rubber futures for December delivery rose 2.4 yen, or 0.76%, to 319.5 yen ($1.98) per kg.

September rubber futures on the Shanghai Futures Exchange (SHFE) rose 70 yuan, or 0.48%, to 14,640 yuan ($2,013.20) per ton. Butadiene rubber futures for August delivery on the SHFE, the most active contract, rose 140 yuan, or 0.95%, to 14,940 yuan per ton. Rubber futures for August delivery on the SICOM exchange last traded at 162.4 US cents per kg, up 0.5%.

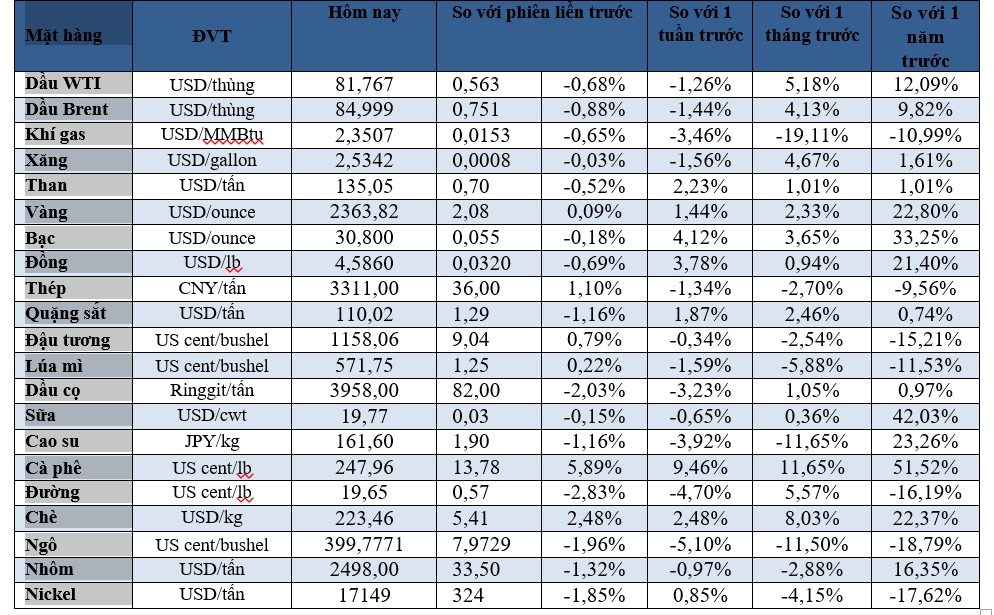

Key commodity prices as of July 10, 2024

Market Update on February 3rd: Crude oil, gold, copper, iron and steel, and rubber all decline together.

At the close of trading on February 2nd, the prices of oil, gold, copper, steel, rubber, and coffee all saw a simultaneous decrease, with iron ore hitting a two-week low.