The Hanoi Beer Corporation recently shared an environmental impact assessment report for their project to increase the capacity of the Hanoi – Nghe Tinh Brewery from 50 million liters per year to 100 million liters per year.

The Hanoi – Nghe Tinh Provincial Planning and Investment Department issued an adjusted investment registration certificate on September 22, 2023, for the project “Investing in increasing the capacity of the Hanoi – Nghe Tinh Brewery from 50 million liters per year to 100 million liters per year,” with a total expected investment of VND 1,511 billion.

The project is divided into two phases: Phase 1 involves the construction and completion of a brewery with a capacity of 50 million liters per year, operational by December 31, 2022, with a total expected investment of VND 1,230 billion. Phase 2 involves expanding the brewery’s capacity to 100 million liters per year, to be operational by May 30, 2025, with a total expected investment of VND 281 billion.

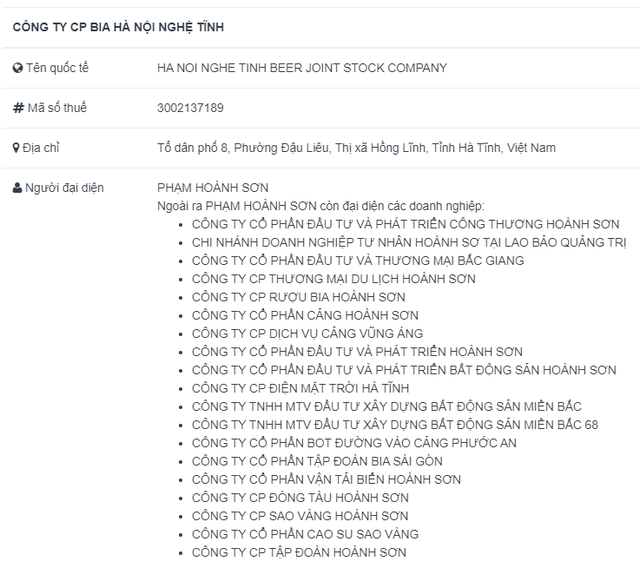

Despite its similar name to many members of Habeco, Hanoi Beer Nghe Tinh is actually part of the multi-sector ecosystem of Mr. Pham Hoanh Son (also known as Son “Xay xat”) – chairman of the Hoanh Son Group.

Established on May 30, 2019, Hanoi Beer – Nghe Tinh JSC’s main business lines include beer and malt production. Its initial chartered capital was VND 100 billion, with Hanoi Beer Corporation holding 51%, Mr. Pham Hoanh Son holding 39%, and Ms. Doan Thi Van Dung and Le Thi Thien Nga each holding 5%.

In July 2022, the company increased its chartered capital from VND 100 billion to VND 420 billion. Mr. Pham Hoanh Son is the Chairman of the Board of Directors and legal representative of the company.

Mr. Pham Hoanh Son

The Hoanh Son Group operates in diverse fields such as cement and ore trading; construction and investment; marine services; sea vessel operation; road cargo transportation from neighboring countries like Laos and Indonesia; mining of stone, sand, gravel, and clay; fertilizer production; and solar power…

According to its website, Hoanh Son Group boasts total assets of $260 million, annual revenue of $180 million, and a workforce of over 2,000 employees.

The group’s current chartered capital is VND 2,000 billion. In October 2018, Hoanh Son’s chartered capital was VND 1,000 billion, with Mr. Pham Hoanh Son owning 95%, Ms. Nguyen Thi Hang Nga owning 4%, and Ms. Luu Thi Duyen owning the remaining 1%.

Companies related to Mr. Pham Hoanh Son

Hoanh Son Group is involved in several large-scale construction projects, such as the Vung Ang Economic Zone Water Supply Project (VND 4,415 billion), the Hoanh Son International Port (nearly VND 1,500 billion), and the Hanoi – Nghe Tinh Brewery (VND 1,200 billion). Recently, the group has also proposed to the Nghe Tinh provincial government to survey and implement a real estate project along Ham Nghi Street in Ha Tinh city and Thach Ha district.

The group has also ventured into renewable energy with the Cam Hoa Solar Power Plant project (Cam Xuyen) with a capacity of 50 MWp and a total investment of VND 1,458 billion. However, according to information from the investor, Hoanh Son Group intended to sell this solar project to a foreign enterprise for $23.9 million in early 2023.

In 2016, Hoanh Son Group made headlines in the financial world when its subsidiary, Hoanh Son Private Enterprise, acquired the Phuoc An Port project by purchasing shares of Phuoc An Port Oil and Gas Investment and Development Joint Stock Company (PAP).

The Phuoc An Port project covers a vast area of 733.4 hectares (including 183 hectares for the port and 550.4 hectares for the port’s logistics services), with a total investment of VND 17,571,36 billion.

As per the plan, Phuoc An Port is designed to serve vessels with a capacity of up to 60,000 DWT, featuring 10 berths (6 container berths and 4 general berths) with a total length of 3,050 meters. The port’s capacity is expected to be 2.5 million TEU/year for container cargo and 6.5 million tons/year for general cargo. Meanwhile, the port’s logistics services area is designed to handle 2.2 million TEU/year for container cargo and 4 million tons/year for general cargo.

In 2016, PAP increased its chartered capital from VND 440 billion to VND 900 billion by offering share sales to Hoanh Son Private Enterprise, chaired by Mr. Pham Hoanh Son (born in 1972). As a result, Hoanh Son Private Enterprise owned 51.11% of PAP’s capital.

The following year, in 2017, PAP further increased its chartered capital to VND 1,100 billion. Hoanh Son Private Enterprise was the sole purchaser of shares worth VND 200 billion, acquiring a 60% stake in the company.

However, in February 2019, Mr. Pham Hoanh Son sold Hoanh Son Private Enterprise to Nhon Trach 6A Industrial Park Investment and Construction Joint Stock Company – a subsidiary of Tuan Loc Investment and Construction Group (Tuan Loc Group). In June 2022, Hoanh Son Private Enterprise sold more than 25.8 million shares.

Around the same time, Hoanh Son Group also gained prominence with its acquisition of a controlling stake of over 50% in Sao Vang Rubber Joint Stock Company and its plans to develop the Sao Vang – Hoanh Son Commercial and Residential Complex project on a “golden land” plot at 231 Nguyen Trai, Hanoi. Mr. Pham Hoanh Son also became the Chairman of Sao Vang Rubber Company.

“Hoanh Son Group’s Chairman Launches ‘Viet Pride’: Doubling Capacity to 100 Million Liters of Beer Annually.”

Hoành Sơn Group is taking a bold step forward with its flagship brand, Bia Sao Vàng. In a strategic move, the company’s chairman has decided to invest in ramping up the brewery’s capacity to 100 million liters per year. This decisive action aims to address the current supply-and-demand challenges and sets a course for Bia Sao Vàng to expand its market share.