With the prospect of recovering consumption, falling raw material prices, and expanded market share, businesses in the coated steel industry are forecast to see strong profit growth throughout 2024, with some companies expected to increase their profits by up to 12 times.

STEEL PRICES RECOVER BY 8%

According to MBS, the potential for growth in domestic construction steel production and prices stems from the expected improvement in apartment supply, which will positively impact steel demand. Infrastructure investment is predicted to increase by 12% year-over-year.

The apartment supply is expected to improve in 2024. Hanoi will see an increase of over 33% in 2024, reaching 20,000 apartments, while Ho Chi Minh City will have approximately 1,000 units, a 31% increase year-over-year. Therefore, the favorable real estate supply situation could positively affect construction-related activities, boosting steel consumption. Moreover, the disbursement of public investment is estimated at VND 26 billion, a 12% increase year-over-year, positively impacting steel demand.

Thanks to the recovery in the construction industry and the growth in public investment, MBS forecasts that steel bar prices will reach an average of VND 15 million per ton, an 8% increase year-over-year, while production is expected to reach 10.5 million tons, a 9% increase year-over-year.

The Ministry of Industry and Trade has decided to investigate galvanized steel imports from China and South Korea from Q3 2024. Domestic products like HSG and NKG will avoid competition with cheap imports. The market share of domestic enterprises may increase as the price gap is expected to narrow.

Additionally, regarding anti-dumping duties on HRC products, corporations are expected to submit dossiers to the Ministry of Industry and Trade for investigation. In the context of cheap Chinese steel putting pressure on domestic prices (imported HRC from China accounts for 55% market share in Q1), these duties may be applied from Q4/2025. The taxes will benefit some companies with expansion plans, such as HPG and NKG.

Global steel price fluctuations with uncertain trends have led businesses to cautiously manage their inventories. Inventory levels at enterprises have decreased by over 25% (raw material values have decreased by about 20%) due to low consumer demand and volatile raw material prices. The rebound in steel prices has reduced the pressure on provision adjustments by about 35%.

For coated steel businesses like HSG and NKG, gross profit margins vary with the cooling steel prices in the EU and the US and depend on the timing of contract signings and each company’s export markets. According to MBS forecasts, an 8% recovery in steel prices and a 6% decrease in raw material prices will be the basis for a gross profit margin recovery to 13% in 2024.

Steel companies’ profits are expected to grow by 40% in 2024 due to several factors: The steel industry’s potential recovery is signaled by positive developments in the real estate sector. Increased housing and infrastructure supply will contribute to both prices and volumes. Revenue is expected to recover by 25% due to a 9% increase in production and an 8% rise in selling prices.

The gross profit margin is expected to recover to 13% in 2024, up from 8% in 2023, due to an 8% increase in output prices and a 4% decrease in raw material costs (ore and coal) due to stable supply. In addition, the appreciation of the Vietnamese dong against the US dollar and lower interest rates will ease financial pressures. Provision adjustments will also cool down as output prices rise.

ENTERPRISE PROFITS TO INCREASE BY TURNS, EVEN UP TO 12 TIMES

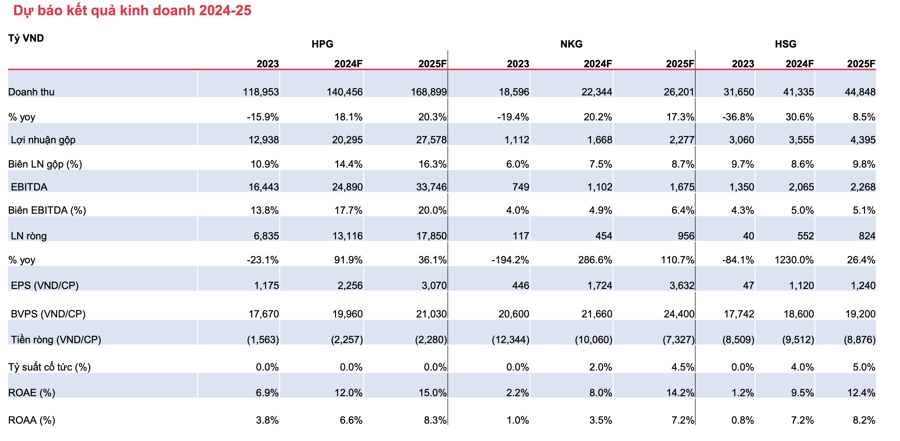

Based on the above forecasts, MBS provides detailed estimates of financial results for each enterprise.

For HPG, both steel bar and HRC demands show positive recovery signals due to the growth in domestic housing and production supply. Selling prices and production are predicted to increase by 8% and 7%, respectively. Additionally, export partners in ASEAN, such as Indonesia and Malaysia, have strong demands. Export volume is expected to reach 2.1 million tons, a 5% increase, thanks to robust demand from ASEAN partners.

MBS forecasts that HPG’s after-tax profit for 2024 and 2025 will reach VND 13,116 billion and VND 17,850 billion, increases of 92% and 36% year-over-year, respectively. The main drivers include expected consumption volume growth of 8% and 13%, respectively, with the expectation of a recovery in housing supply and strong export markets such as the EU and ASEAN.

The gross profit margin is expected to continue recovering to 14%/16% in 2024/2025 due to rising steel prices and decreasing coal and ore prices. The Dung Quat Complex Phase 2, which is expected to commence operations in Q2 2025, presents a long-term growth prospect for the enterprise. The P/B ratio is below the average of the previous two growth cycles.

For NKG, both the export and domestic steel industries are expected to enter a recovery cycle in 2024 as demand improves. With positive outlooks for the EU and US markets, NKG will benefit from being a leading company in the industry.

NKG’s net profit will enter a recovery cycle, with a remarkable growth rate of 287%/111% in 2024-2025. Revenue is expected to increase by 20%/17% due to the recovery in production volume and selling prices, along with improved export demand. The gross profit margin is expected to increase by 7.5% and 8.7%, respectively, due to the more significant increase in selling prices compared to HRC raw material prices. The P/B ratio is below the average of the previous two growth cycles.

Notably, HSG is forecast to see a breakthrough increase in profits. Domestic demand for coated steel is expected to grow due to active construction activities. Selling prices and production are expected to increase by 6% and 5%, respectively, due to the recovery in both the domestic and export markets. Moreover, HSG’s gross profit may expand due to its low-priced inventory.

HSG’s net profit is expected to reach VND 552 billion in 2024, a remarkable increase of 1,230% year-over-year, due to a 30% revenue increase. This is attributed to expected production and price growth of 10% and 14%, respectively. Gross profit will increase quarterly as the company benefits from its low-priced inventory. Transportation costs are expected to decrease by 30% year-over-year as global shipping rates cool down. Anti-dumping duties may provide an opportunity to gain market share in the domestic galvanized market.

Vinamilk: Impressive nearly 20% growth in Q4/2023 export revenue

Vinamilk has announced its financial report for Q4 2023, recording a consolidated total revenue and after-tax profit of VND 15,630 billion and VND 2,351 billion, respectively. This represents an increase of 3.6% and 25.8% compared to the same period last year. For the full year, the consolidated total revenue and after-tax profit reached VND 60,479 billion and VND 9,019 billion, completing 95% of the revenue target and 105% of the profit target.