A $1.8 Billion Funded Project

Information from the State Bank of Vietnam reveals that total credit outstanding for the entire economy as of the end of June increased by approximately 6% from the beginning of the year, reaching nearly VND 14.4 quadrillion. Notably, credit growth in June alone reached 3.6%, surpassing the total credit absorbed in the first five months of the year.

This surge in growth can be attributed to a record credit package of $1.8 billion from Vietcombank, BIDV, and VietinBank for the Long Thanh International Airport Construction Investment Project – Phase 1.

This is also the project with the largest funding amount in the history of Vietnam’s banking industry as of now, and it is the first project to be arranged entirely with long-term USD capital from Vietnamese state-owned commercial banks.

Previously, on June 1, the above-mentioned three banks jointly provided funding to the Vietnam Airports Corporation (ACV) for the construction of items to meet the progress of the project invested by ACV, equivalent to approximately 45% of the project’s total investment. Vietcombank acted as the lead bank, contributing $1 billion; VietinBank financed $450 million, and BIDV granted $350 million.

In terms of business performance, in the first quarter of the year, VCB recorded a 1% decrease in net interest income compared to the same period last year, reaching VND 14,078 billion. Pre-tax profit exceeded VND 10,718 billion, a 4% decrease compared to the first quarter of 2023.

Meanwhile, VietinBank’s pre-tax profit exceeded VND 6,210 billion, a slight increase of 4% over the same period last year. BIDV also reported favorable business results, with pre-tax profit reaching VND 7,390 billion, up 6.8% year-on-year. After-tax profit increased by 6.4%, reaching VND 5,916 billion.

What’s in Store for Vietnam’s Banking Credit in Q2?

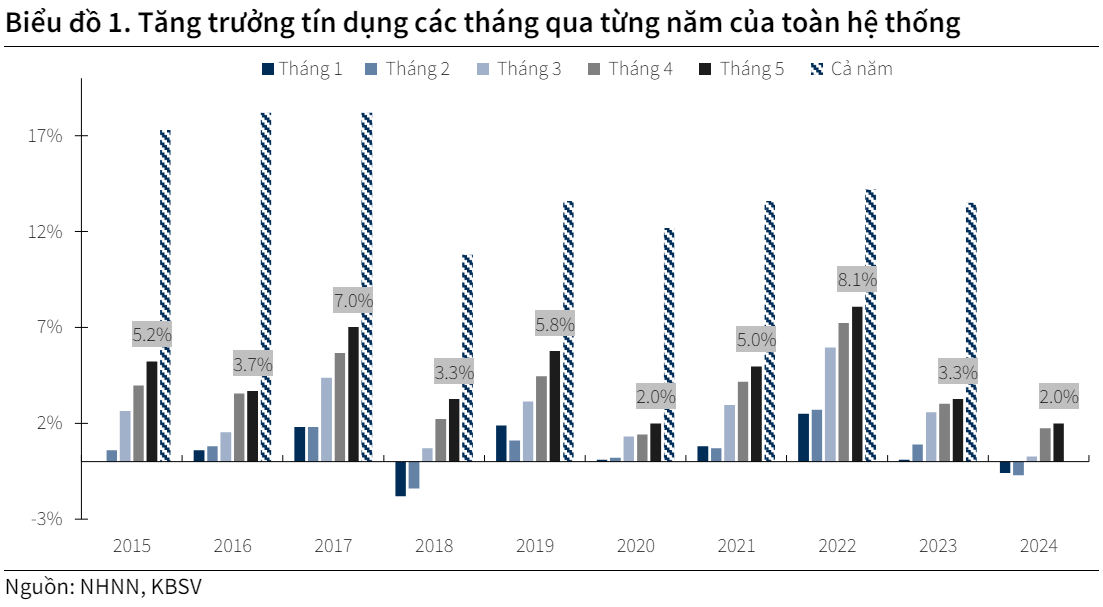

According to a report by KBSV Securities Co., Ltd. on the banking industry, credit growth for the entire system in Q1/2024 was at its lowest in the last 10 years, reaching only 0.26%.

Of this, real estate loans increased by VND 20 trillion in just the first two months of the year (equivalent to a growth of 1.9%). This sector also made a difference in credit growth among banks.

KBSV expects that the growth momentum in Q2/2024 will be driven more by the individual customer segment, as the real estate market continues its recovery following the government’s efforts to resolve legal issues.

“The prevailing story in Q1 included slow credit growth directly impacting net interest income, and non-interest income sources also showed no significant signs of recovery, with a slight deterioration in asset quality. However, we have seen positive signs in the last months of Q2, with better credit growth and improvements in macroeconomic indicators. We expect Q2/2024 to bring improved profit quality for banks, with expected full-year growth of 15%, continued NIM improvement, and positive shifts in non-performing loans,” KBSV stated.

In 2024, with a credit growth target of 15%, an estimated VND 2 quadrillion will be injected into the economy. “Based on the assessment of actual developments and situations, the SBV will adjust the credit growth target for 2024 and proactively adjust the credit growth target of each credit institution to provide sufficient and timely credit capital for the economy,” said the SBV leader.

The Long Thanh International Airport Project, Phase 1, is a nationally important project. In the first phase, it is planned to include one runway and one passenger terminal, along with synchronous auxiliary items. The expected capacity is 25 million passengers and 1.2 million tons of cargo per year.

Upon the completion of all phases, the airport will have a capacity of up to 100 million passengers per year, becoming the largest airport in Vietnam.

It is estimated that this project will contribute about 0.98% to Vietnam’s GDP by 2030 and create 200,000 jobs.

An HR member of the Big4 team with higher salary and bonus than the Chairman and CEO

Vietcombank, the Joint Stock Commercial Bank for Foreign Trade of Vietnam, has recently released its financial report for the fourth quarter of 2023. In this report, the bank has disclosed the figures for the salaries, wages, and bonuses of the executives within the Board of Directors and the Executive Board.