The VN30-Index lost over 10 points as the large caps’ decline extended into the afternoon session. FPT, the most negatively traded stock, dragged the VN-Index down by more than 1 point as it remained the focus of foreign net selling, with a value of over VND 236 billion.

Just from the beginning of July until now, this technology stock has been sold a net of VND 1,761 billion, the highest on the exchange. FPT is currently “exposed” with a 2.81% foreign ownership limit, equivalent to 41 million shares.

GVR, MWG, and bank stocks BID, LPB, CTG, and VPB followed suit. Weaker buying power in the afternoon session led to slower growth in liquidity and sharper declines in stock prices. Only 6 stocks in the VN30 basket rose, while 23 stocks fell.

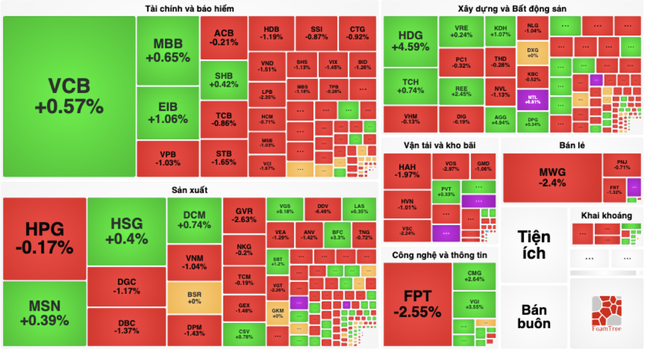

Red dominated in many sectors, although the decline was not deep.

The market also saw a sea of red on the HoSE exchange. A series of sectors adjusted simultaneously, including banking, real estate, industry, construction, chemicals, oil and gas, and retail.

Although the decline was not steep, the simultaneous weakening of many stocks made it difficult for the VN-Index to break through the old peak. For stocks that have performed well in the past, such as chemicals and retail, profit-taking at high prices is not surprising.

Despite the market correction, the sea shipping group continued to attract money, with VTO and VIP hitting the ceiling price. Some mid-cap stocks also recorded more positive transactions than the overall market, with HAX, CKG, NTL, HHP, and NVT hitting the ceiling price. In the context of blue chips losing their leading role, midcaps continue to emerge as “hot” speculative money.

Today’s notable trades also took place at ITA. Tan Tao Joint Stock Company closed down 4.7% after HoSE’s decision to restrict trading in the stock. The reason is that, up to now, the company has delayed submitting its 2023 audited financial statements for more than 45 days from the prescribed deadline. Accordingly, from July 16, ITA will only be traded in the afternoon session.

At the end of the trading session, the VN-Index decreased by 7.77 points (0.6%) to 1,285.94 points. The HNX-Index decreased by 1.12 points (0.46%) to 244.54 points. The UPCoM-Index decreased by 0.5 points (0.5%) to 98.75 points. Liquidity fell with the HoSE matching value at nearly VND 18,000 billion.