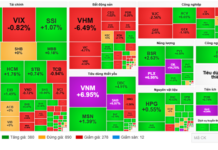

The overnight excitement from international markets failed to sustain its momentum in the domestic market this morning, with the early gains seeming to fizzle out. After peaking at around 9:50 am with a 7.4-point increase, the VN-Index plummeted and ended the session with a modest gain of 1.29 points. Fortunately, the index managed to stay afloat, thanks largely to the real estate sector.

VIC, Vietnam’s largest company by market capitalization, was the star of today’s session, rebounding from a 10-month low and climbing 1.85%. Despite a significant reduction in market cap due to recent price declines, VIC remains one of the top 10 largest stocks in the market. This stock alone contributed 0.71 points to the VN-Index’s 1.29-point gain.

The real estate sector, as a whole, is witnessing a notable surge, with VIC being the most prominent component. While many small and medium-sized stocks in this sector are outperforming VIC, their impact on the broader market is limited. However, the magnitude of the price increases is pleasing investors who have exposure to this sector. The VNREAL index on the HoSE is currently up 1.24%, leading the sectoral indices.

Apart from VIC, there are several dozen other real estate stocks that are up over 1%, with some notable gainers such as CEO (+7.74%), NTL (+3%), PDR (+3.03%), DIG (+2.84%), LHG (+2.69%), KDH (+2.24%), DXG (+2.08%), DTA (+3.15%), and HDC (+3.38%). However, a significant number of real estate stocks have extremely low liquidity, making them unattractive to large investors.

Today’s decline was characterized by the underperformance of blue-chip stocks, once again exerting pressure on the VN-Index near its previous peak. The VN30 index, which tracks the 30 largest stocks by market capitalization, went from a gain of 7.24 points (+0.55%) at its peak to a mere 0.18-point increase (+0.01%) by the end of the session. VIC contributed a substantial 0.9 points to this index, essentially determining its direction. At its strongest, all component stocks were in positive territory, but now, 9 are in the red, while 15 are in the green. This early rally has resulted in a wide range of price movements, with FPT plunging 1.7% from its peak to a 0.67% loss compared to the previous close; TCB tumbling 1.71% to a 0.86% loss; PLX sliding 1.6% to a 0.86% loss; and BID dropping 1.27% to a marginal 0.11% loss. Even the stocks that are still in positive territory, like GVR and VPB, have witnessed declines of over 1% from their intraday highs.

The performance of blue-chip stocks remains a significant concern for the VN-Index in its quest to surpass previous highs. Previous attempts at breaching these levels have also been thwarted by the weakness in this segment. While 6 of the top 10 stocks by market capitalization in the index are still in positive territory, with only BID and FPT in the red, there are no other notable gainers apart from VIC. Expanding our scope to the top 20 stocks by market cap, we find that only HDB has joined the party with a 1.2% gain, but this is offset by 6 other decliners.

The mid- and small-cap segment is faring slightly better, maintaining its upward trajectory despite liquidity being concentrated in a handful of stocks. At the end of the morning session on the HoSE, 61 stocks recorded gains of more than 1% compared to the previous close, accounting for 23.6% of the total matched volume on the exchange. However, only a third of these stocks achieved a trading value of 10 billion VND or more. Furthermore, 76% of the liquidity in this segment was concentrated in just 10 stocks. KDH, DIG, HDB, AAA, and PDR stood out with trading values exceeding 100 billion VND.

On a positive note, today’s prolonged decline hasn’t significantly deteriorated market conditions. At the VN-Index’s peak, we observed a market breadth of 249 gainers versus 107 decliners, and this ratio remained relatively healthy at the end of the session, with 199 gainers versus 188 losers. Only 50 stocks witnessed declines of more than 1%, and none of them witnessed a surge in trading activity. The largest trades were in DCM, which fell 2.83% on a volume of 192.1 billion VND; HSG, which declined 1.38% on a volume of 192 billion VND; and DBC, which dropped 2.08% on a volume of 111.5 billion VND.