Shares of REE Corporation, a leading Vietnamese engineering and construction company, have staged an impressive comeback, surging 2.45% on July 10, 2022, to reach a historic high of 71,200 VND per share. This marks a nearly 50% increase in the stock’s value since the beginning of the year, pushing the company’s market capitalization to approximately 33.5 trillion VND (1.3 billion USD).

With a rich history dating back to 1977, REE was the first company to transition from a state-owned enterprise to a public company through privatization in 1993. In 1996, the company introduced its Reetech air conditioning products, marking a significant turning point in its product offerings.

REE ventured into the real estate sector in 2001 with the construction of the e.town 1 building. This was followed by the development of e.town 2, 366 Nguyen Trai in District 5, 9 Doan Van Bo, and REE Tower, most of which function as office buildings for lease.

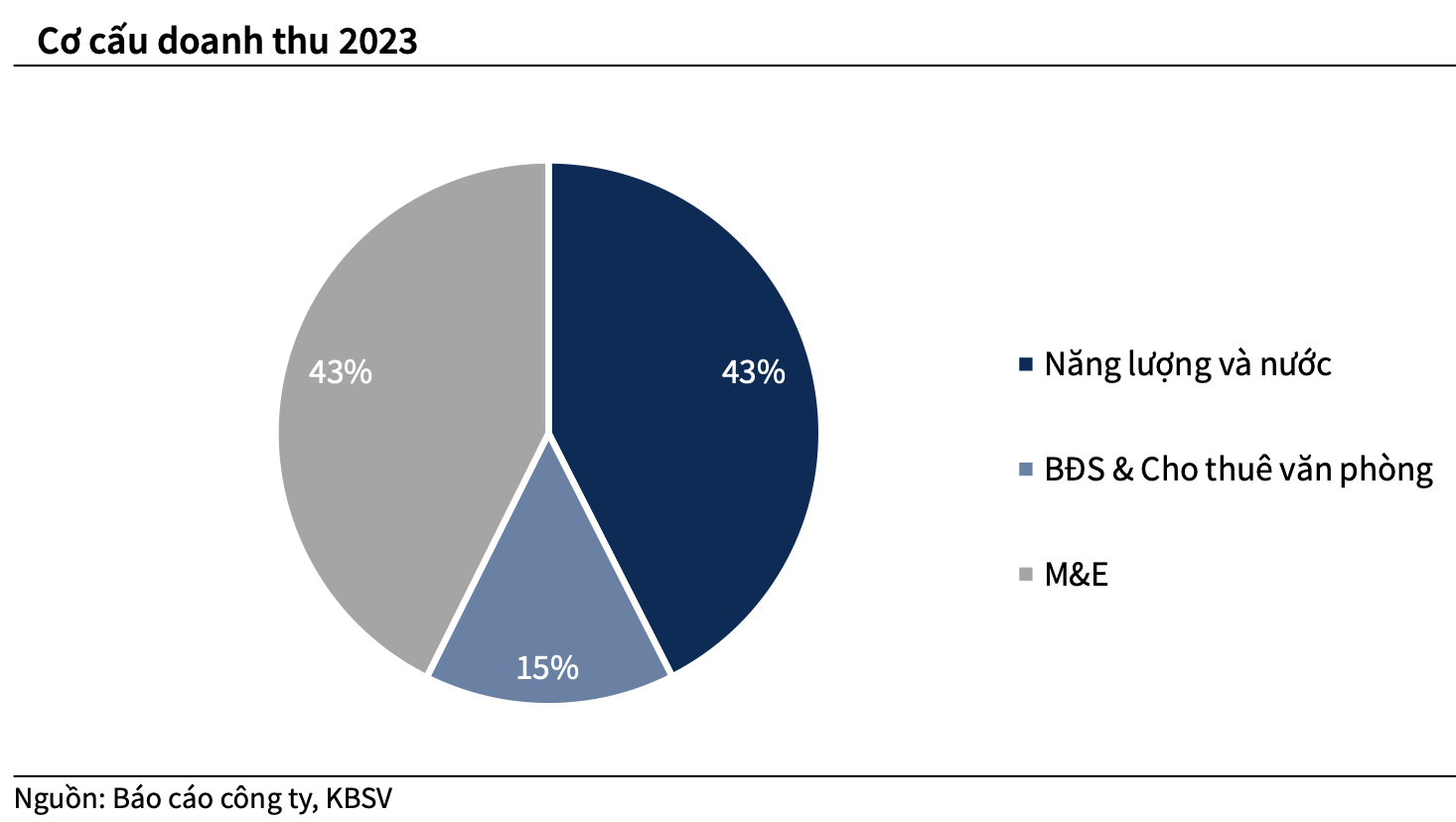

In 2010, the company expanded into the energy sector and now boasts a diverse portfolio that includes hydroelectric, coal-fired, wind, and solar power plants such as Thac Ba Hydropower (TBC), Vinh Son – Song Hinh Hydropower (VSH), Tra Vinh V1-3 wind power plants, Loi Hai 2, and Phu Lac 2. This energy division is currently managed by REE Energy, a wholly-owned subsidiary of REE.

Over nearly half a century, REE has transformed into a diversified conglomerate with business interests in energy, water and environment, real estate, and M&E services. Notably, REE was also one of the pioneering companies to list its shares on the Vietnamese stock exchange when it commenced operations in 2000.

Energy Segment Drives Growth

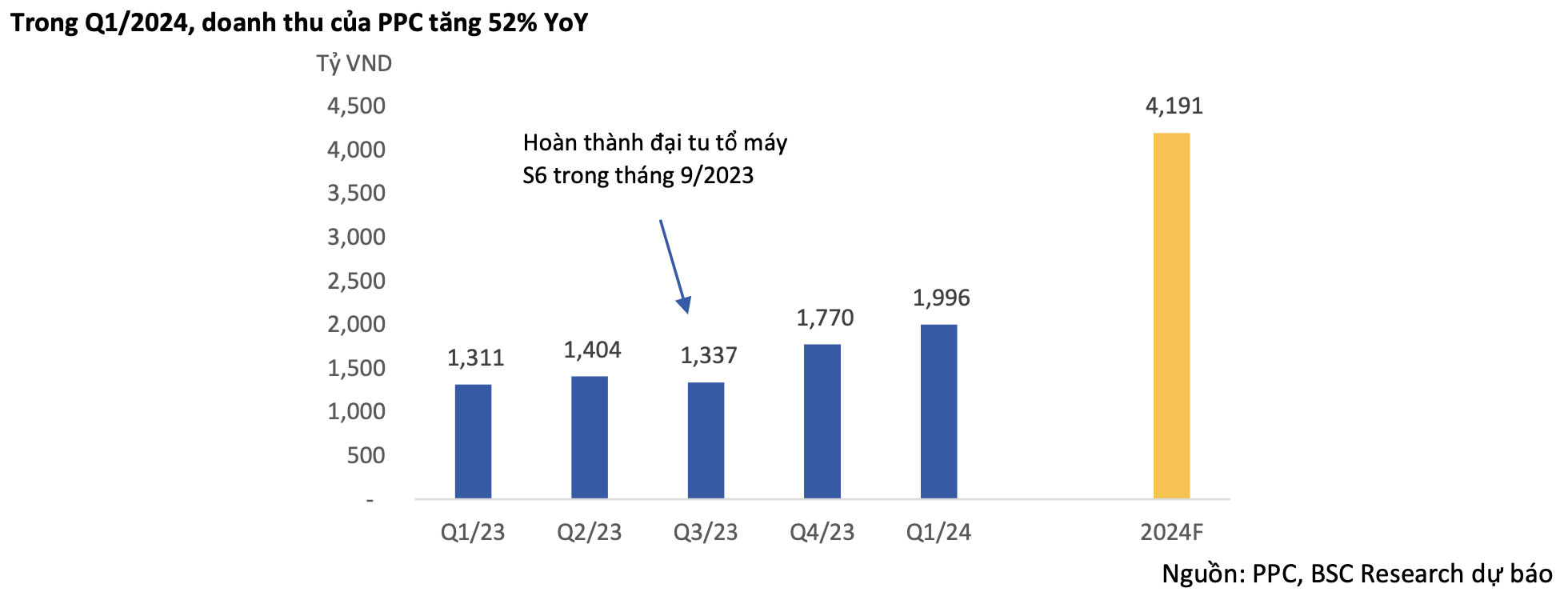

According to a recent report by BIDV Securities (BSC), the second half of 2024 is expected to see an increase in electricity production from hydroelectric plants compared to the same period last year due to the weakening of El Niño weather conditions since June 2024 and the transition to La Niña. The most challenging period for hydropower is typically during the peak dry season months of June and July.

However, in 2024, the direct electricity sales ratio (Qc) in the sales structure of hydropower plants is expected to reach 95-98% (usually 85-90%), resulting in a 20% year-on-year decrease in the average selling price of these plants. Participating in the competitive electricity market could lead to better selling prices.

In 2025, the Qc ratio for power plants is projected to decrease to 85-90% due to 1) improved financial health of EVN with electricity price increases, and 2) the development orientation of the retail electricity market, which will gradually reduce the direct electricity purchase and sale ratio of EVN.

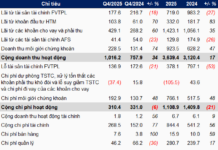

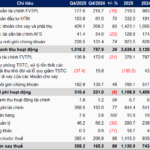

For the thermal power group, in 2024, the thermal power units are expected to operate normally and reduce abnormal costs (related to overhauls), helping PPC’s NPATMI reach 678 billion VND, (+56% year-on-year), contributing 161 billion VND to REE’s NPATMI.

Regarding the progress of divestment from PPC, in April and May 2024, REE announced the transfer of approximately 5 million PPC shares and continued to register for the sale of 5 million PPC shares. Thus, REE is on track with its plan to divest from PPC, and assuming the completion of the transfer of 10 million PPC shares, REE will receive about 150 billion VND, reducing its ownership from 23% to 20.5%.

In the renewable energy segment, according to the Power Plan 8, REE is set to develop two wind power projects with a total capacity of 128 MW in the period of 2023 – 2025, increasing the wind power capacity from 126 MW to 254 MW (+100%) and estimated to contribute 700 billion VND to REE’s overall valuation.

Currently, there is no new pricing mechanism for onshore and near-shore wind power, and BSC assumes that these projects will use the transitional electricity price. Although the transitional price is 30% lower than the FIT price, the investment rate is also expected to decrease by about 20-25% (referring to REE’s plan) so that the net profit margin/revenue of new projects can still reach about 35% (the old wind power projects of REE reached 45%). BSC expects that by the end of 2025 or early 2026, the plants may officially come into operation.

In the ME segment, BSC assesses that the fourth quarter of 2025 will be the peak of profit after two difficult years, driven by projects such as the Long Thanh Airport and the recovery of the real estate market. In addition, BSC forecasts that the real estate market supply may come in early first quarter of 2025 after the new Land Law is passed and the guiding circulars are issued.

In the clean water segment, in 2024, REE will account for 40 km of new pipeline but has not yet generated revenue, leading to an increase in depreciation expenses and an estimated after-tax loss of about 31 billion VND. BSC expects the project to be completed and fully operational from the second quarter of 2025, doubling the capacity from 300,000 m3/day to 600,000 m3/day. Moreover, the Son Da Water Plant has been operating at full capacity since 2022, and the demand for clean water in Hanoi remains high, so BSC believes that the new plant will only need four years to reach full capacity.

Who is the richest stock market leader in Vietnam?

Do you think Pham Nhat Vuong is the richest person in Vietnam? This may be true, but if we only consider the scale of the Vietnamese stock market and based on the percentage of individual stock ownership, Mr. Vuong still loses to another figure.