The stock market witnessed a positive start to the July 11 session, but this momentum was short-lived as strong corrective pressures during the afternoon session pushed the index below the reference threshold. The VN-Index closed 2.14 points lower at 1,283.80 points. Foreign exchange transactions unexpectedly turned positive, with net purchases of 275 billion VND across the market, ending a 24-session net selling streak.

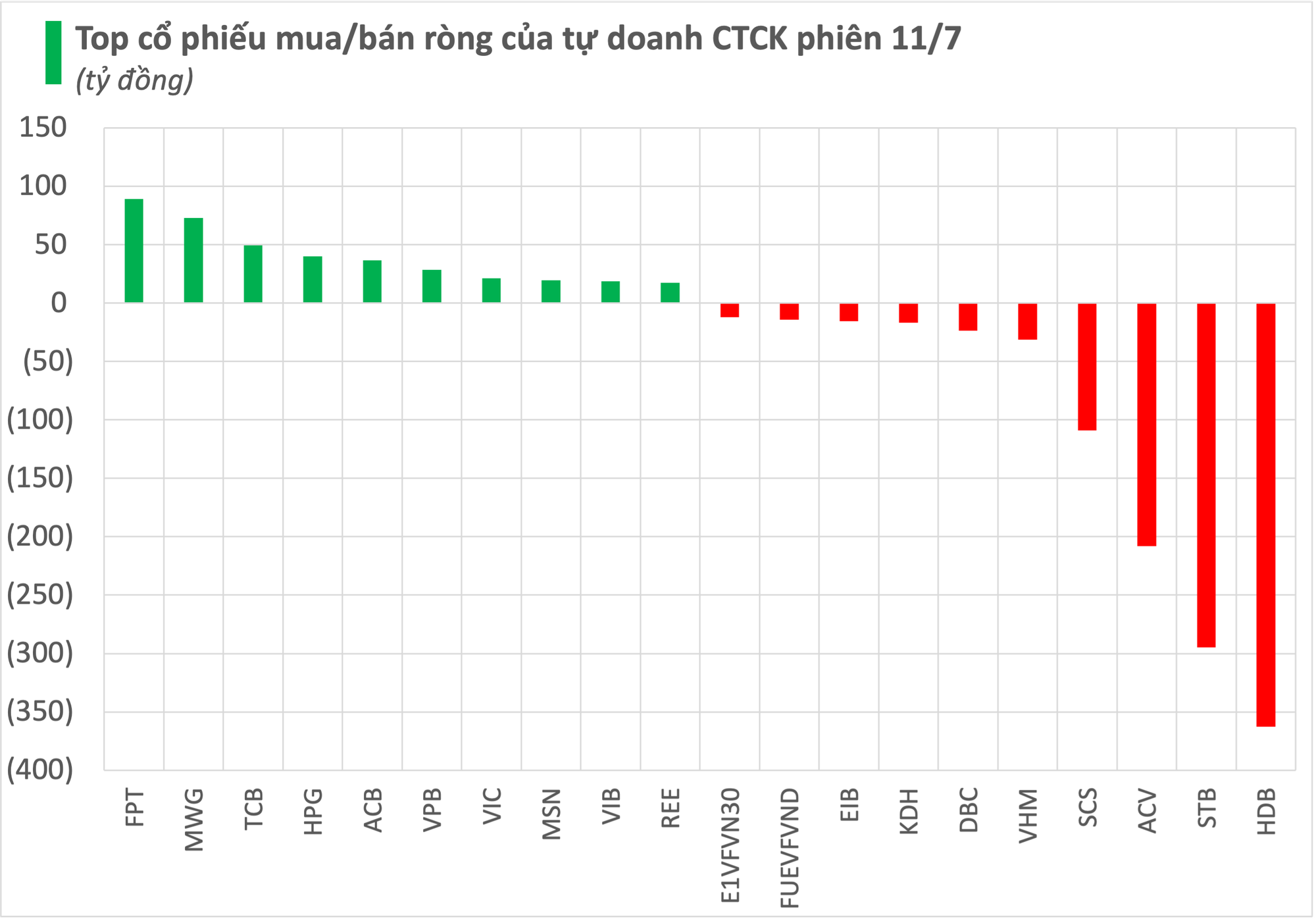

In contrast, after several consecutive net buying sessions, securities companies’ proprietary trading activities turned to net selling, offloading over 568 billion VND worth of shares across the market.

On the HoSE, securities companies’ proprietary trading activities resulted in a net sell-off of 347 billion VND. While they net bought 577 billion VND on the matching order channel, they net sold 924 billion VND on the negotiated trading channel.

HDB and STB experienced the largest net selling by securities companies, with respective values of 363 billion and 295 billion VND, mainly through negotiated trades. SCS and VHM also witnessed net selling, with respective values of 109 billion and 31 billion VND. This was followed by DBC, which faced net selling of around 24 billion VND. KDH, EIB, FUEVFVND, E1VFVN30, DGC, and several other stocks were also among the net sold positions for the day.

Conversely, FPT witnessed the largest net buying by securities companies, with a value of 89 billion VND. MWG and TCB also experienced net buying, with respective values of 73 billion and 49 billion VND. Additionally, stocks such as HPG, ACB, VPB, VIC, and MSN were also net bought during the July 11 session.

On the UPCoM, securities companies’ proprietary trading activities led to a net sell-off of 213 billion VND. ACV experienced a sudden surge in net selling, amounting to 208 billion VND. BSR and BCR also faced net selling, with respective values of nearly 4 billion and 1 billion VND.

Investing in a volatile market: Should beginners consider putting money into high-yield bonds for 10-30% yearly profit?

Short-term stock market trading has proven to be a risky venture for many investors, leading to substantial losses. However, there are a few select open funds that have managed to achieve impressive returns, reaching up to 30%.