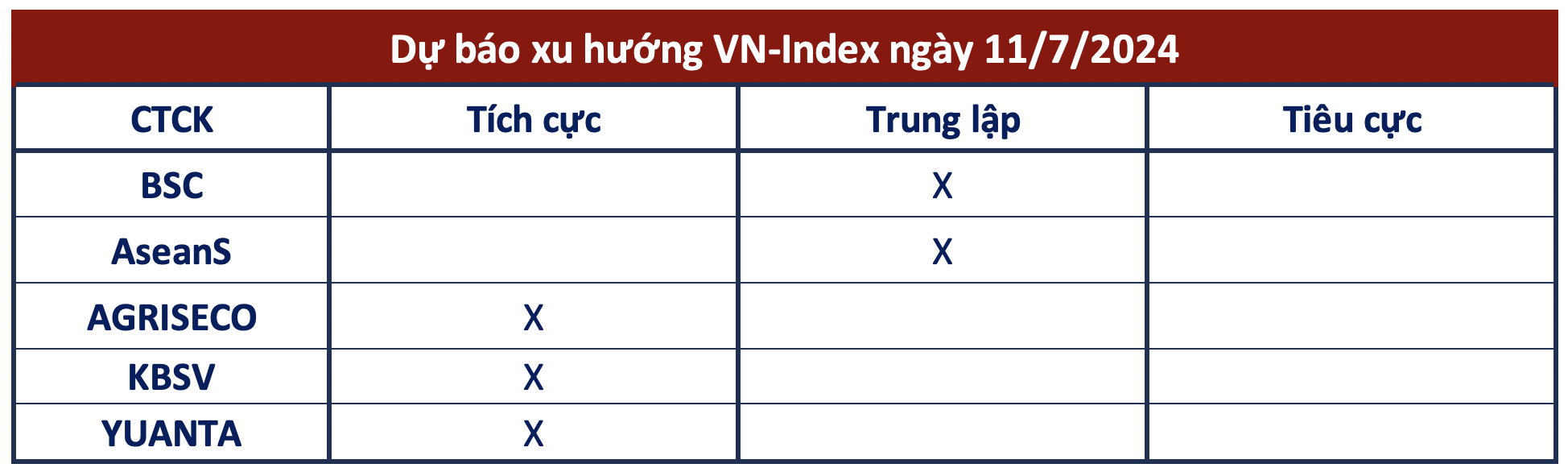

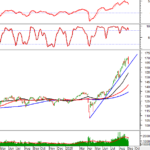

The VN-Index gained momentum and soon approached the 1,300 mark, but increasing selling pressure caused the market to weaken. The index closed at the lowest point of the July 10 session, falling 7.77 points to 1,285. Trading liquidity was maintained, with a turnover of over 21,800 billion VND on the HOSE.

Most securities companies predict that the recent correction was healthy and that investors can consider reinvesting.

Supply pressure is not too strong

BSC Securities

In terms of foreign trading, foreigners net sold over 1,000 billion VND on the HSX today. The tug-of-war around 1,285 is likely to continue in the short term.

Asean Securities

The market corrected for the first time after a consecutive 7-session gaining streak. While the rising liquidity reflected emerging selling pressure, the continued differentiation and upward movement showed that buyers were actively absorbing the selling pressure. This correction is reasonable and in line with the previous scenario.

Therefore, our analysts believe that today’s supply pressure is not too strong, but there is a high probability that the index will continue to fluctuate. We expect the market to find a balance in the 1,260-1,270 range, and investors should consider reinvesting.

Consider reinvesting

Agriseco Securities

Technically, the VN-Index formed a bearish engulfing candle pattern, indicating a potential short-term trend reversal. However, Agriseco Research believes that the market trend and momentum indicators remain positive, and the decline is a healthy correction after seven consecutive gaining sessions. With proactive buying demand gradually returning and improved liquidity, the market is expected to continue towards the mid-term peak of around 1,300 points in the coming period.

Agriseco believes that the 20-day MA, corresponding to the 1,270(+/-5) threshold, will provide reliable support during the index’s fluctuations. Investors should gradually increase their stock proportions at current prices, prioritizing stocks in sectors that are attracting good cash flow, such as retail, steel, fertilizer, and exports (wood and textiles).

KBSV Securities

Although the decline was significant, with a candle engulfing the entire gain of the previous day, the selling pressure from large-cap stocks did not trigger a strong sell-off with high liquidity, indicating that investors remain confident in holding stocks. Investors are advised to place orders to buy a small portion of their trading positions as the index retreats to support levels.

Yuanta Securities

LandX Services reports a loss of 160 billion VND in 2023, cuts over 1,000 staff

In 2023, Dat Xanh Services incurred a net loss of 160 billion VND primarily due to a shortfall in real estate service revenue. Additionally, the company downsized its workforce by over 1,000 employees in the past year.