The ranking is compiled after the world’s strongest banks publish their annual financial reports. The combined pre-tax profits of these banks reached a staggering $1.53 trillion in 2023, marking a 14% average increase from the previous ranking and a significant 41% surge for Europe, with markets such as Switzerland and Italy witnessing respective jumps of 155% and 72%.

In the US, JPMorgan reported a record-high pre-tax profit of $61.6 billion, the highest ever achieved by an American bank, reflecting a 33% increase from the previous year.

While higher interest rates boosted the banks’ net interest income, they also made borrowing more expensive and challenging for the banks’ customers. There are also early signs of ‘stress’ in loan portfolios, particularly in the so-called ‘stage two’ loans, which exhibit significantly increased credit risk.

“After a record-breaking year, the normalization of interest rates will impact profits in many of the world’s banking markets. But banks will also look to fee-generating businesses, cost rationalization, and, especially in Europe, M&A to increase scale and compete with larger rivals,” said The Banker‘s editor, Silvia Pavoni.

Under the International Financial Reporting Standard (IFRS), ‘stage two’ loans indicate a significant increase in credit risk since the previous reporting date. There has been a notable rise in some major banking markets regarding these types of loans, which now make up a significant proportion of total loans. This phenomenon is observed in Australia and Germany, with respective ratios of 17% and 10%, due to real estate loans becoming a concern for banks in both countries in recent years.

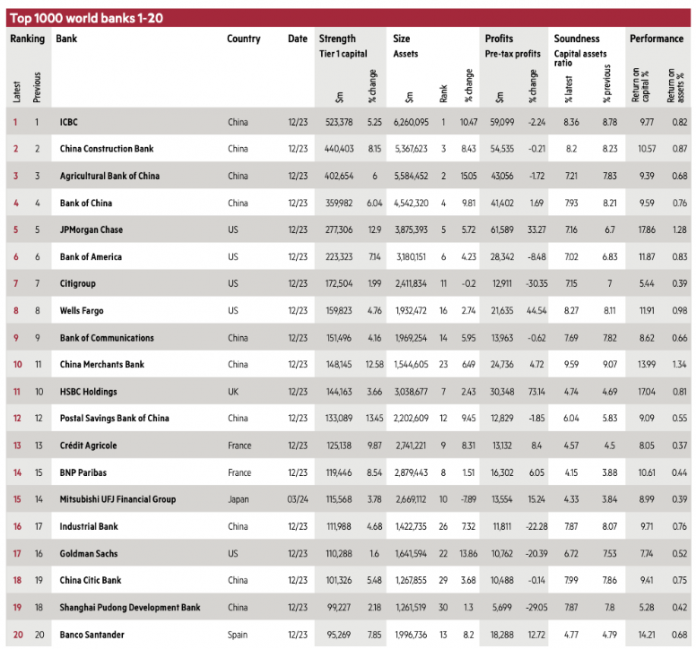

Chinese banks continue to dominate the Top 1000 ranking, with ICBC, China Construction Bank, Agricultural Bank of China, and Bank of China maintaining their positions as the four largest global banks by Tier 1 capital, a core measure of financial strength under the international Basel regulatory framework.

Two more Chinese banks, Bank of Communications and China Merchants Bank, also feature in the Top 10 of the ranking, claiming the ninth and tenth spots, respectively.

ICBC’s Tier 1 capital now stands at $524 billion, nearly double that of its closest non-Chinese competitor, JPMorgan.

With a 12.58% increase in Tier 1 capital, China Merchants Bank surpassed the only previously remaining European bank in the Top 10, HSBC. The top 10 positions in the ranking now exclusively feature Chinese and American banking giants.

However, in terms of asset size, HSBC remains the seventh-largest bank globally, accounting for over 40% of UK banks’ pre-tax profits. Two other European heavyweights, the French banks BNP Paribas and Crédit Agricole, are also among the top 10 lenders by assets.

Elsewhere in Europe, banks in Italy and Switzerland reported their highest-ever pre-tax profits in three decades’ worth of data, while lenders in countries like the UK and Spain achieved their highest pre-tax profits since the global financial crisis.

Top 20 banks in The Banker‘s Top 1000 World Banks ranking for 2024

In The Banker‘s ranking of the Top 20 largest banks globally, Chinese banks account for half of the list (including ICBC, Agricultural Bank of China, Bank of China, Bank of Communications, China Merchants Bank, Postal Savings Bank of China, Industrial and Commercial Bank of China, China Citic Bank, and Shanghai Pudong Development Bank), alongside five American banks (JPMorgan Chase, Bank of America, Citigroup, Wells Fargo, and Goldman Sachs), two French banks (Crédit Agricole and BNP Paribas), one British bank (HSBC), one Japanese bank (Mitsubishi UFJ Financial Group), and one Spanish bank (Banco Santander).

Outdated Billion-Dollar Profit Milestone: 5 Banks with over 1 Billion USD in Profits, Total Banking Profits on the Exchange Surpass 255 Trillion Dong

After 6 years since its establishment, the “Billion-Dollar Profit Club” has seen its membership grow tenfold, surpassing the milestone of 10,000 billion in profits.

Legal Loopholes in Bad Debt Processing

Bad debts and the speed of bad debt processing can be hindered when the right to collateral enforcement for borrowing customers is no longer inherited in Resolution 42/2017 amended by the Law on Amending Credit Institutions. This will force banks to carefully consider before lending, avoiding the risk of debt recovery in the future.