Illustrative Image

7 banks report profits over 20,000 trillion in 2023

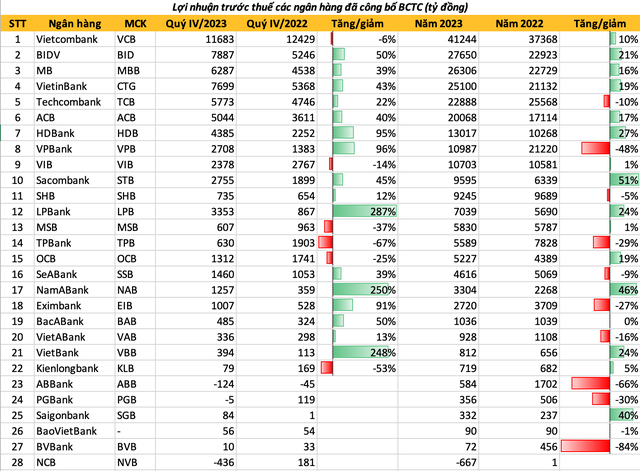

Despite facing many difficulties, there are still 10 banks that have achieved pre-tax profits of over 10,000 trillion dong in 2023, including Vietcombank, BIDV, MB, Agribank, VietinBank, Techcombank, ACB, HDBank, VPBank, and VIB.

Remember in 2017, Vietcombank was the first bank to record profits exceeding 10,000 trillion dong. Up to now, after 6 years, the number of members in the “Trillion Profit Club” has multiplied tenfold. It is noteworthy that there are 7 banks with profits over 20,000 trillion dong, including 5 banks with profits over 1 billion USD, which are Vietcombank, BIDV, MB, Agribank, and VietinBank.

At the end of 2023, the total consolidated pre-tax profit of 27 listed and UPCoM traded banks reached nearly 255,300 trillion dong, equivalent to 10.3 billion USD. If including Agribank, the profits generated by these banks in the past year amounted to 280,700 trillion dong, equivalent to 11.3 billion USD. Among them, the top 10 banks accounted for nearly 223,500 trillion dong, occupying 80%.

Last year, state-owned banks dominated the rankings of profit, thanks to the cautious provision of credit provisions in previous years.

Among them, Vietcombank is still the industry-leading bank and far ahead of other banks in the system. The financial report shows that Vietcombank’s pre-tax profit in 2023 reached 41,244 trillion dong, an increase of 10% and establishing a new profit record in the banking industry.

The next 4 banks behind Vietcombank reported similar profits. Among them, BIDV reported pre-tax profit of 27,650 trillion dong, MB achieved 26,306 trillion dong, VietinBank achieved 25,100 trillion dong, and Agribank is estimated to reach 25,400 trillion dong.

This is the first year MB has entered the Top 3 in overall profit in the industry, not only surpassing VietinBank and Agribank but also distancing itself from large joint stock banks such as Techcombank (22,888 trillion dong), ACB (20,068 trillion dong), VPBank (10,987 trillion dong),…

In 2023, there were 15 out of 28 banks (including 27 listed banks and Agribank) recording positive profit growth. Among them, Sacombank had the highest profit growth rate, reaching 51% compared to 2022. The banks with the next highest profit growth rates are Nam A Bank (+46%), Saigonbank (+40%), HDBank (+27%), VietBank (+24%), BIDV (+21%).

On the contrary, there were up to 13 banks experiencing profit decline and reporting losses. Among them, Bản Việt Bank saw the most significant decrease (-84%), followed by ABBank (-66%) and VPBank (-48%). The only bank on the stock exchange that reported losses in 2023 was NCB.

Banking sector’s profits expected to grow better in 2024

According to the survey results of the State Bank of Vietnam, the business situation and pre-tax profits of the banking system in Q4/2023 improved slightly compared to the previous quarter but were much lower than the expectations recorded in the previous survey. Assessing the overall situation in 2023, credit institutions believe that the business situation has not met expectations and have significantly adjusted down their expectations for the pre-tax profit growth rate compared to the forecasted level in the previous survey.

With the business situation and pre-tax profits in 2023 growing at a low rate and not meeting expectations, credit institutions expect the business situation to be more optimistic from Q1/2024 and throughout 2024, but pre-tax profits may recover slower than the business situation.

In its new report, SSI Securities believes that 2024 will continue to be a challenging year for the banking sector in terms of asset quality. However, the overall situation will improve compared to 2023, mostly due to the reduced cost of capital, which is much lower than in 2023, and improved pre-provision operating profit (PPOP), helping banks have more room to create a better provision buffer.

In SSI’s base scenario, GDP growth is expected to recover between 6.0% – 6.5%, the average interest rate for the year maintained at the lowest level in the past decade, and the State Bank of Vietnam would have flexible responses in the mechanism of recognition and provisioning for bad debts. According to SSI’s estimate, the pre-tax profit growth rate of the banks within the research scope in 2024 is forecasted to reach 15.4%, which is a better growth rate than the 4.6% in 2023.

In a more positive view, BIDV Securities (BSC) expects the overall profit growth of the banking industry to recover (forecasting after-tax profits of the growth watchlist to increase by 20% in 2024 compared to 4% in 2023) with the main impetus coming from the expansion of the net interest margin (NIM), however, the speed will depend on the credit demand and asset quality.

In the base scenario with low maintained deposit interest rates and gradually improving credit growth, BSC forecasts that the average NIM for the watchlist will increase by about 0.07 percentage points in 2024, thereby helping the expected net interest income to grow by 19% compared to 2023 and being the main driver for the expected 20% increase in after-tax profits.

According to BSC, the surprise factor for the above forecast will come from the pace of credit demand recovery, especially positive developments in the real estate market, thereby helping banks improve output interest rates. An early indicator for credit demand to return may be when banks simultaneously increase deposit interest rates, showing increased mobilization pressure to support capital disbursement.