There has been a 12% increase in the supply of ready-built warehouses in Southern Vietnam, according to JLL. This follows the introduction of the Cainiao Dong Nai Logistics Park project and the launch of SLP’s second phase of the SLP Park Long Hau project in Long An, adding over 27,000 sqm of new leasable area in Q2 2024.

In a subdued demand environment, some projects have converted their asset functionality. Notably, a large-scale ready-built warehouse project in Binh Duong has converted over 60% of its ready-built warehouse space into built-to-suit factories, effective Q2. As a result, the total market supply stands at 1.9 million sqm, a near 4% decrease from the previous quarter but a substantial 12% increase year-on-year.

The market for modern ready-built warehouses in Southern Vietnam has shown early signs of recovery with new leasing inquiries. An optimistic outlook is expected, with successful transactions anticipated in the latter part of the year.

Additionally, while external trade activities are showing signs of recovery, improvements remain modest. The domestic market continues to be the primary driver of warehousing demand. In Q2, net absorption of ready-built warehouses in the south tripled from the previous quarter to approximately 16,000 sqm.

In Northern Vietnam (including Hanoi, Hung Yen, Hai Phong, Bac Ninh, and Hai Duong), two new projects totaling 46,000 sqm were welcomed in Q2 in Bac Ninh: Horizon Park in Yen Phong Industrial Park and Frasers Yen Phong 2C – Phase 1.

The market is witnessing a growing interest in sustainability and diverse property types. As a result, Northern Vietnam is expected to introduce a new type of modern, two-story ready-built warehouse in 2025 to optimize leasable area, reduce construction costs, and save land rental expenses.

Demand for modern ready-built warehouses in Northern Vietnam remained stable in Q2 2024, driven primarily by manufacturing tenants amidst the context of the “China +1” shift. The “China +1” strategy encourages investors to diversify their supply chains and reduce dependence on a single country.

|

Modern ready-built warehouses in Northern Vietnam saw positive net absorption of 27,000 sqm in Q2, led by Bac Ninh and Hai Phong. While new leasing activity was relatively modest compared to previous quarters, it remained optimistic given the market’s challenges. |

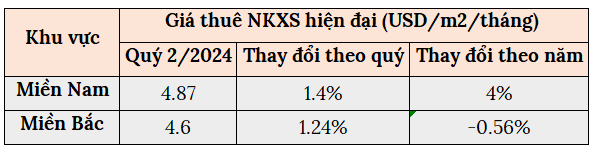

Rental rates for warehouses ranged from USD 4.6 to USD 4.9 per sqm per month.

In Southern Vietnam, the average asking rent in the market during Q2 was USD 4.87 per sqm per month, a slight increase of 1% from the previous quarter and a 4% year-on-year rise. This increase is attributed to the introduction of new, higher-rent projects in the modern segment.

Meanwhile, in Northern Vietnam, the average asking rent for modern ready-built warehouses was USD 4.6 per sqm per month, a modest 1% increase from the previous quarter but a near 1% year-on-year decrease due to the impact of new project rates, while existing projects maintained stable rents without significant fluctuations.

What to Expect in the Last Six Months of 2024

In the last six months of 2024, the market for modern ready-built warehouses in Northern Vietnam is expected to see a significant addition of new supply, with approximately 131,000 sqm of space becoming available for lease in Bac Ninh and Hung Yen. Notable projects include Frasers Hung Yen, Thuan Thanh 3B Industrial Park, and SLP Park Thuan Thanh II, bringing the total market supply to over 1.3 million sqm by the end of the year.

In the first half of 2025, the market is expected to continue its rapid expansion, with prominent investors such as BWID, Frasers, KCN Vietnam, LOGOS, and MEA – a Japanese developer entering the ready-built warehouse development market for the first time in both the North and South – delivering new projects.

Overall, with continuous supply growth, the market will remain competitive, presenting challenges in leasing activities as demand struggles to keep up with supply growth.

In Southern Vietnam, the conversion of development plans to built-to-suit factories to cope with abundant supply and subdued demand has significantly reduced new supply. Only about 100,000 sqm of new space is expected to be completed in the latter half of 2024. Existing developers like BWID and KCN Vietnam continue to expand their market share with new projects.

In addition to the asset functionality conversion strategy, another notable trend is the emergence of multi-functional projects. These facilities offer spaces suitable for both warehousing and manufacturing purposes, attracting a diverse range of tenants and accelerating occupancy rates.

1 Shark Appears to Buy Vietnamese Rice at Over $1,000/ton: Ousts China as the Second Largest Customer, Imports Surge by over 16,000%

This European country unexpectedly bought Vietnamese rice at a price of $1,040 per tonne, with production increasing by over 16,000% in the first month of the year.