Illustrative Image

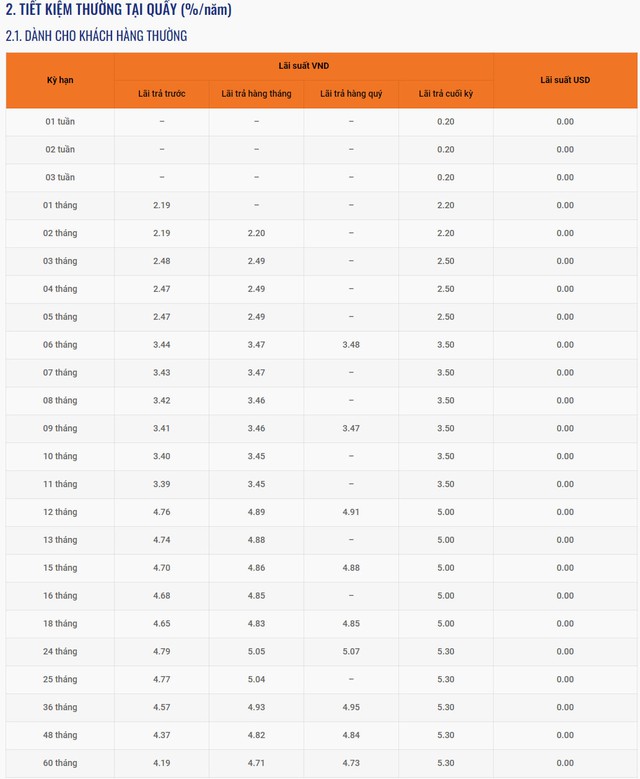

LPBank’s Over-the-Counter Savings Rates for Individual Customers in July 2024

LPBank’s over-the-counter savings rates currently range from 0.2% to 5.3% per annum for end-of-term interest payments.

Specifically, short-term deposit periods of less than 1 month are subject to the same interest rate of 0.2% per annum, unchanged from June; the 1-month and 2-month periods earn an interest rate of 2.2% per annum, an increase of 0.2 percentage points; the 3-5 month period is 2.5% per annum, an increase of 0.2 percentage points; and the 6-11 month period is 3.5% per annum, an increase of 0.3 percentage points.

LPBank maintains its interest rate for the 12-18 month period at 5% per annum. The highest interest rate for regular customers depositing at the counter is also maintained at 5.3% per annum, applicable to the 24-60 month periods.

In addition to end-of-term interest payments, LPBank also offers other flexible interest payment options for customers to consider, such as: interest paid in advance, monthly interest payments, or quarterly interest payments.

Especially for new or renewed deposits with a term of 13 months and a minimum amount of VND 300 billion, customers will be offered a preferential interest rate of 6.5% per annum.

LPBank’s Over-the-Counter Deposit Interest Rates for Regular Individual Customers in July 2024

Source: LPBank

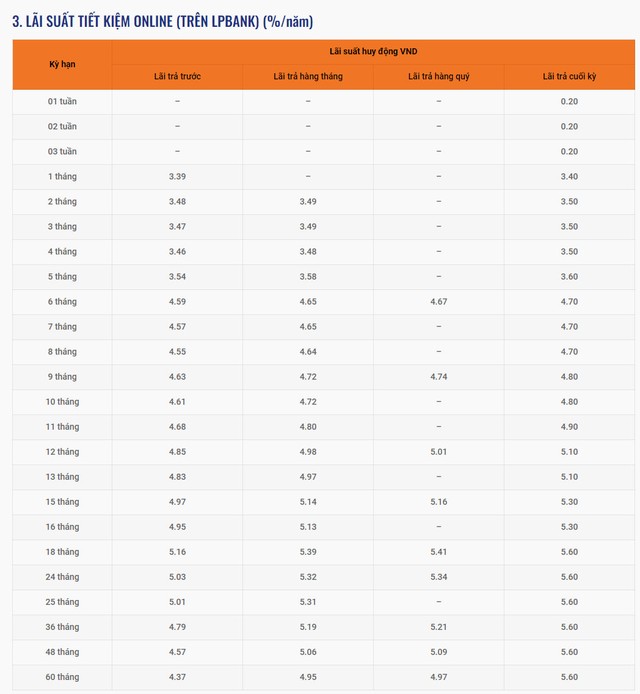

LPBank’s Online Savings Rates for Individual Customers in July 2024

For online deposits via Lienviet24h, LPBank has also increased interest rates by 0.2-0.3 percentage points for many terms compared to the same period in June.

Accordingly, LPBank’s online deposit interest rates range from 0.2% to 5.6% per annum, which is 0.3-0.8% per annum higher than over-the-counter savings rates for many terms.

Specifically, short-term deposits of less than 1 month have a common interest rate of 0.2% per annum; the 1-month term earns an interest rate of 3.4% per annum; the 2-4 month term is 3.5% per annum; the 5-month term is 3.6% per annum; the 6-8 month term is 4.7% per annum; the 9-10 month term is 4.8% per annum; 11 months is 4.9% per annum; 12-13 months is 5.1% per annum; and 15-16 months is 5.3% per annum.

The highest interest rate for individual customers’ online deposits is 5.6% per annum, applicable to the 18-60 month terms.

In addition to end-of-term interest payments, LPBank also offers other interest payment options for online deposits, such as: interest paid in advance, monthly interest payments, or quarterly interest payments.

LPBank’s Online Deposit Interest Rates for Individual Customers in July 2024

Source: LPBank

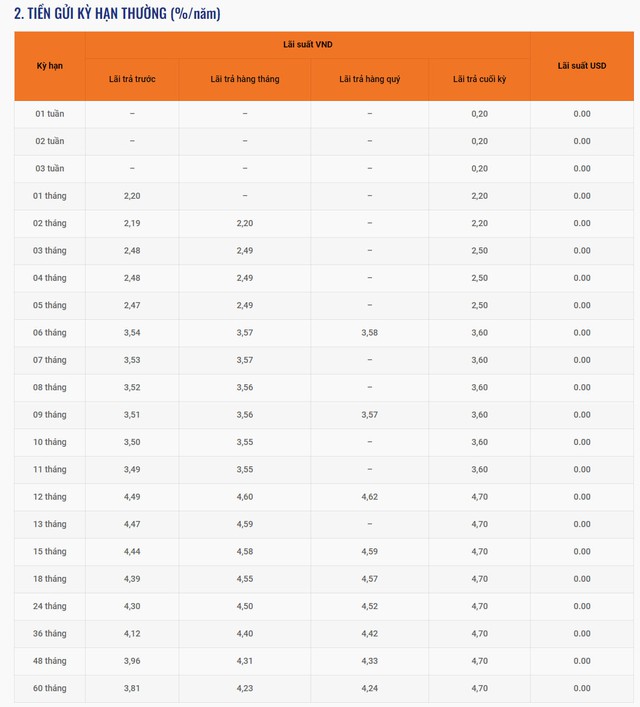

LPBank’s Savings Rates for Business Customers in July 2024

In July, LPBank’s interest rates for business customer deposits range from 0.2% to 4.7% per annum for end-of-term interest payments.

Specifically, deposits with no fixed term and terms of 1 week, 2 weeks, and 3 weeks are subject to an interest rate of 0.2% per annum; the 1-2 month term earns an interest rate of 2.2% per annum; the 3-5 month term is 2.5% per annum; and the 6-11 month term is 3.6% per annum.

Currently, the highest interest rate for business customers at LPBank is 4.7% per annum, applicable to the 12-60 month terms.

In addition to end-of-term interest payments, LPBank also offers other interest payment options for business customers: interest paid in advance, monthly interest payments, or quarterly interest payments.

LPBank’s Over-the-Counter Deposit Interest Rates for Regular Business Customers in July 2024

Source: LPBank

Which bank offers the highest interest rate for online savings in early February 2024?

Beginning February 1st, 2024, several banks have been adjusting their interest rates downwards for savings accounts ranging from 1 to 24 months. Based on a survey conducted across 16 banks, the highest annual interest rate for online savings deposits at a 6-month term is 5%, while for a 12-month term, it is 5.35%.

Banks Sacrificing Profits to Support the Economy

In 2023, the question “which bank has the lowest interest rates?” is being talked about more than ever. With the prevailing difficult economic situation affecting individuals and businesses, in line with the directive of the State Bank of Vietnam (SBV), banks have unanimously sacrificed their profits by reducing lending rates and introducing credit packages with interest rates as low as 0%.