The Vietnam Road Administration has submitted a draft decree to the Ministry of Transport, outlining regulations for toll fees on expressways.

Addressing Three Conditions, “Encouraging” Tolls for Certain Expressways Before 2025

The decree guides the 2024 Road Law by setting out regulations on toll rates, collection, exemption, management, and usage. It applies to vehicles traveling on expressways that are state-invested, owned, managed, and operated under the purview of the Ministry of Transport.

The draft decree consists of 12 articles across four chapters. Chapter 3 specifies toll rates for expressways and outlines two scenarios for managing and utilizing toll revenues. The first scenario involves the road management agency, which is directly responsible for exploiting the transport infrastructure assets. The second scenario involves the transfer of toll collection rights and the concession of expressway infrastructure assets management.

In the first scenario, the Vietnam Road Administration, as the expressway asset management agency, would organize the toll collection process. Through a bidding process, they would select a contractor to provide toll collection services based on an automatic non-stop toll collection system. One drawback of this approach is that it may not immediately generate a substantial sum to sufficiently fund new expressway projects.

The second scenario involves bidding for expressway management through an operation and maintenance (O&M) contract. The investor would be responsible for toll collection, management, and maintenance of the expressway. The state would sell the toll collection rights for a specified period, receiving a lump sum payment. While this option has its advantages, it may be challenging to attract investors for expressways with low traffic volumes.

According to the Vietnam Road Administration leadership, the policy on toll fees for expressways is a new development compared to the 2008 Law on Traffic and Roads.

“Some expressway projects that are already operational or under construction have not been allocated funds for toll collection items due to the lack of regulations on toll fees,” the Vietnam Road Administration leader clarified.

Therefore, to ensure a solid legal and practical foundation for toll collection implementation, it is necessary to address aspects such as investing in the construction of toll station infrastructure (project approval, adjustments, design, estimation, contractor selection, installation of structures, equipment, and toll collection technology), establishing toll rates, and managing toll fees. The Road Law addresses this in Article 85, Clause 2: “The provisions in Points a and b, Clause 2, Article 42, Article 43, Article 50, Clause 1, Article 84 of this Law shall take effect from October 1, 2024.”

A crucial aspect of the draft is the identification of three conditions related to infrastructure and resources for implementing this toll collection policy.

Firstly, for state-invested expressways to be eligible for toll collection, the project must be designed and constructed according to standards and technical regulations for expressways and other relevant standards and technical regulations.

Secondly, the expressway project must have completed construction and be operational, in compliance with construction laws.

Thirdly, the infrastructure for toll stations, software systems, and equipment to support toll collection operations must be in place, as per regulations.

The Road Law also stipulates that the “Government shall stipulate the conditions and timing for the implementation of toll collection on expressways. This includes expressways falling under the scope of Clause 1, Article 45 and Clause 2, Article 47 of this Law, which have not yet met the requirements specified in these clauses” (Article 50, Clause 3).

The draft decree states, “For expressways that commenced operation before January 1, 2025, and have not yet met the requirements of Clause 1, Article 45, and Clause 2, Article 47 of the Road Law, toll collection will be implemented after fulfilling the second and third conditions.”

It is worth noting that Clause 1, Article 45 of the Road Law states: “Expressways shall be designed according to standards and technical regulations for expressways and other relevant standards and technical regulations.”

Additionally, according to Clause 2, Article 47, expressways must be invested in and constructed in accordance with the planning specified in Clause 2, Article 44 of the Law. They must also be constructed concurrently with the following projects: side roads or adjacent roads; a traffic management center for the expressway; rest stops, parking lots, and service areas; an electronic non-stop toll collection system for roads with road use fees; and a vehicle weight control station.

Balancing the Benefits for the People

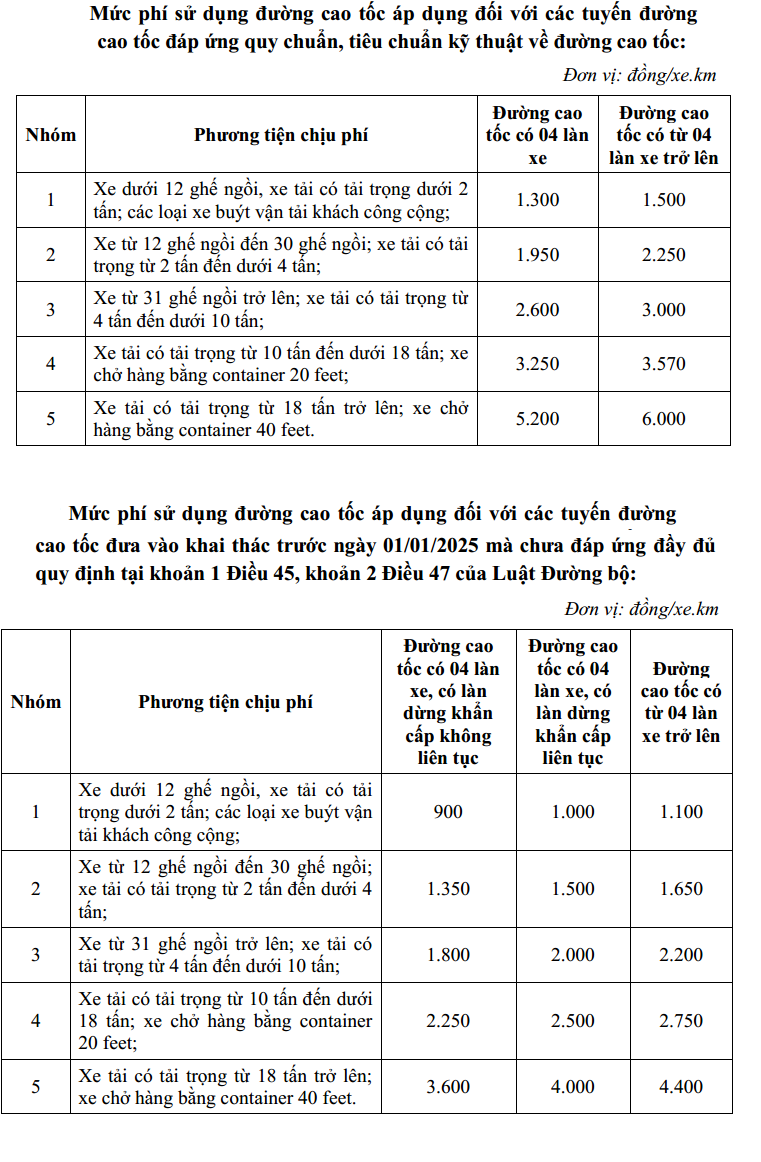

Regarding toll rates, the Vietnam Road Administration leader stated that the rates were carefully studied and formulated based on an analysis of the benefits accrued by vehicle owners when using these expressways. International practices were also referenced.

“Users of expressways are typically willing to pay a fee equivalent to 50-70% of the benefits they derive from using the expressway,” the Vietnam Road Administration leader remarked.

To determine the toll rates, the drafting agency suggested considering the following factors that contribute to user benefits.

Firstly, the calculation should be based on a comparison of the costs incurred when using a toll road versus an alternative route or mode of transportation.

Secondly, relevant taxes and fees should be taken into account.

Thirdly, the service rates for using expressways and expressways invested through the PPP model should be considered.

According to calculations by the Institute for Transport Strategy and Development, the quantification of vehicle operating costs and time savings revealed that, compared to traveling on parallel national highways, vehicles using expressways would save an average of VND 4,824/vehicle/km. Of this, 25% is attributed to reduced vehicle operating costs, while 75% is attributed to reduced time for goods and passengers in transit.

In light of the above conditions, the Vietnam Road Administration announced that there are currently 12 expressway projects/sections that are state-invested and owned, completed, and operational, which are eligible for toll collection. These include the Lao Cai – Kim Thanh, Hanoi – Thai Nguyen, Ho Chi Minh City – Trung Luong, Cao Bo – Mai Son, Mai Son – National Highway 45, National Highway 45 – Nghi Son, Nghi Son – Dien Chau, Cam Lo – La Son, La Son – Hoa Lien, Vinh Hao – Phan Thiet, Phan Thiet – Dau Giay, and My Thuan – Can Tho expressways. Among these, eight projects belong to the North-South Expressway in the East, which has recently been put into operation.

With the proposed toll rates, it is expected that after the implementation of toll collection on the operational expressways, the annual toll revenue could reach VND 3,210 billion, with VND 2,850 billion being contributed to the state budget. This will provide the government with additional resources for the maintenance of existing expressways and the investment in new expressway projects.

The most extensive bribery case ever in Thanh Hoa: Numerous suspects prosecuted for “Giving and Receiving Bribes”

The Provincial Security Investigation Agency (PSIA) of Thanh Hoa province announced on January 31st that it has made the decision to initiate a prosecution against 23 individuals in connection with the offenses of “Accepting bribes” and “Giving bribes” as stipulated in Article 354(3) and Article 364(2) of the Criminal Code.

Mobile World achieves revenue of VND118,000 trillion: TVs, tablets, and phones all decrease by 10% – 50%, while one product grows in both quantity and revenue.

Mobile World Investment Corporation (MWG) has recently announced its 2023 business results. According to the report, the company’s consolidated revenue reached over 118 trillion Vietnamese dong, equivalent to 89% of the revenue in 2022.