Commodity là gì? Ảnh: Reuters

Biểu đồ giá dầu thô. Ảnh: Reuters

Oil Rises on Demand Outlook, Low Inventories

Oil prices edged higher after a surge in US refining activity last week led to larger-than-expected draws in gasoline and crude stockpiles, but gains were capped by less-than-feared supply disruptions from Storm Beryl.

Brent futures rose 42 cents, or 0.5%, to $85.08 a barrel. US West Texas Intermediate (WTI) crude climbed 69 cents, or 0.85%, to $82.10.

WTI rose by as much as $1 during the session, after the US Energy Information Administration reported US crude stocks fell by 3.4 million barrels to 445.1 million barrels in the week to July 5, far surpassing analysts’ expectations for a 1.3 million-barrel drop in a Reuters poll.

Gasoline inventories fell by 2 million barrels to 229.7 million barrels, much more than the 600,000-barrel draw analysts had expected during the week of the US July 4 holiday.

Refineries and offshore facilities suffered little damage from the storm, and most have returned to normal operations, easing concerns about supply disruptions.

Gold Rises on Fed Rate Cut Expectations

Gold prices edged higher after comments from Federal Reserve Chair Jerome Powell raised expectations that the US central bank is on track to lower interest rates soon, while investors awaited US inflation data.

Spot gold was up 0.3% at $2,370.89 per ounce by 18:25 GMT. US gold futures rose 0.5% to $2,379.70.

The market is pricing in a 75% chance of a Fed rate cut in September and December. The appeal of non-yielding bullion tends to increase when interest rates fall.

Focus now shifts to US consumer price index (CPI) data on Thursday and producer price index (PPI) figures on Friday, with recent numbers indicating that inflation has cooled from unexpectedly high levels earlier in the year.

Meanwhile, silver fell about 0.1% to $30.77 per ounce, platinum rose 1% to $994.10, and palladium gained 0.6% to $986.03.

Copper Prices Rise with Weaker Dollar, Supported by CME Backwardation

Copper prices in London rose for the first time in three sessions, buoyed by a weaker dollar and higher copper prices at the CME, with the focus on the large backwardation between the two contracts.

LME three-month copper rose 0.2% to $9,891 per tonne. COMEX September futures climbed 1.0% to $4,622 per pound, equivalent to $10,190 per tonne.

Concerns about demand in China have weighed on copper after China’s June inflation data missed expectations and producer price deflation persisted.

Investors are watching for clues from key party leaders next week on policies to address the prolonged real estate crisis, weak domestic demand, and the sliding yuan.

On the LME, aluminum fell 0.6% to $2,482 per tonne, zinc rose 1.1% to $2,962.50, lead declined 0.6% to $2,179, while nickel lost 1.7% to $16,840. Tin rose 2.3% to $35,080 after touching $35,150, the highest since May 20.

Chinese Steel Prices Hit Three-Month Low on Weak Construction Demand

Steel prices in China fell to their lowest in over three months due to weak demand from the construction sector.

Shanghai Futures Exchange (SHFE) steel rebar dropped 1.1% to 3,471 CNY per tonne, the lowest since April 8. The contract closed down 0.9% at 3,478 CNY.

In Shanghai, hot-rolled coil fell to as low as 3,680 CNY per tonne, the weakest since April 8. Prices declined 0.7% to 3,681 yuan. Wire rod fell 0.8% to 3,660 CNY, and stainless steel dropped 1.4% to 13,930 CNY.

September iron ore on China’s Dalian Commodity Exchange (DCE) fell 1.8% to 813 CNY per tonne, while the August iron ore contract on the Singapore Exchange slid 3.4% to $107.70 per tonne.

Soybeans, Corn Hit Four-Year Lows on Strong US Crop Prospects

Chicago soybean and corn futures plunged to four-year lows as favorable US crop conditions weighed on prices.

Soybean futures fell 13 cents to $10.67 per bushel, touching the lowest since November 4, 2020, while the August and September contracts hit all-time lows.

Corn ended the session down 1-1/4 cents at $4.0725 per bushel. September and March corn futures touched contract lows. CBOT wheat closed down 10-1/2 cents at $5.61-1/2 per bushel.

Soybeans continued their slide as traders remained concerned about weak US export demand, despite the US Department of Agriculture confirming private sales of 132,000 tonnes of soybeans to China for delivery during the 2024/2025 marketing year.

For wheat, the rapid US harvest and improved crop prospects in Russia offset concerns about a sharp drop in France’s crop, analysts said.

Robusta Coffee Hits Record High, Arabica Slides from 2-1/2 Year Peak

ICE robusta coffee futures fell, a day after hitting a record high, as the supply crisis in top producer Vietnam persisted, while arabica retreated from a 2-1/2-year peak.

September robusta coffee fell 2.7% to $4,509 per tonne, after touching an all-time high of $4,667 on Tuesday.

Traders remained concerned about the overall drought this year in Vietnam, despite the return of rains in the first 10 days of July. Coffee inventories are very low in the Vietnamese domestic market.

Vietnam’s coffee exports in the first half of the year fell 11.4% from a year earlier.

September arabica coffee fell 1.9% to $2,4520 per lb, after touching a near 2-1/2-year high of $2,5235 on Tuesday. London September cocoa futures rose 0.3% to £4,074 per tonne. New York September cocoa gained 0.3% to $2,252 per tonne.

Low prices and delayed payments are pushing farmers in the world’s second-largest cocoa producer, Ghana, to sell to increasingly sophisticated smuggling syndicates, siphoning off production from border regions and raising doubts about next season’s output.

As Ghana’s cocoa sector decline accelerates, Indonesia plans to use revenue from palm oil export taxes to fund the development of its cocoa and coconut industries.

The market is awaiting second-quarter data to be released this Thursday and next week to see if this year’s price hikes are dampening demand.

Sugar Prices Rally

October raw sugar rose 2.2% to 20.04 cents per lb, after falling 2.5% on Tuesday. August white sugar, which expires next week, climbed 1.4% to $561.00 per tonne.

Europe’s largest sugar producer, Suedzucker, said on Wednesday that earnings in the quarter from June to August would be impacted by the extended duty-free imports of agricultural products from Ukraine into the EU.

Japanese Rubber Futures Rise on Weaker Yen

Japanese rubber futures jumped, buoyed by a weaker yen, although soft economic data from China limited further gains. December rubber rose 4.7 yen, or 1.47%, to end at 324.3 yen ($2.01) per kg. September rubber futures on the Shanghai Futures Exchange (SHFE) closed down 20 yuan, or 0.14%, at 14,625 yuan ($2,010.12) per tonne. August butadiene rubber, the most active contract on the Shanghai market, fell 320 yuan, or 2.14%, to 14,640 yuan ($2,012.18) per tonne. August rubber on the SICOM exchange settled at 163.2 US cents per kg, up 0.1%.

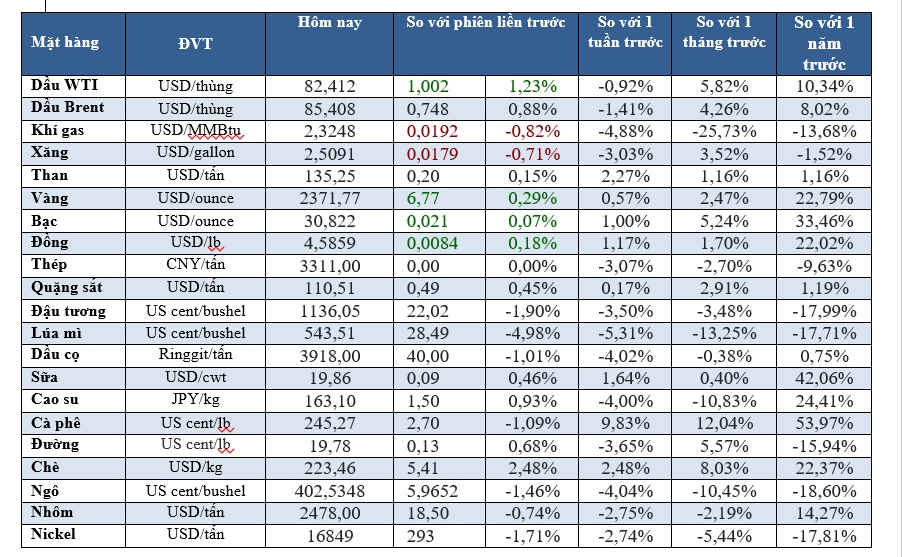

Key Commodity Prices on July 11, 2024

Key commodity prices. Source: Reuters

Top Investment Channels for 2024: Safe and Profitable

2023 is a year full of volatility in the global financial market. Against this backdrop, many investors are interested in gold as a store of assets.

The Golden Fever of Mini Lucky Wealth to Experience Gold Accumulation

Understanding the increasing demand of the younger generation for investment and wealth accumulation, PNJ introduces the Mini Gold Line – Thanh Loc Dai Phat, a meaningful gold gift that inspires young people to experience wealth accumulation.