Mr. Ngo Nguyen Dan has issued an explanation for his failure to disclose information regarding his transaction of POW shares of Vietnam Oil and Gas Power Joint Stock Company (PV Power). Specifically, on July 8, Mr. Dan purchased 5,000 POW shares through matched orders on the exchange without prior registration.

According to the transaction report, Mr. Dan is the husband of Ms. Nguyen Thi Hang, Internal Auditor of PV Power. Regulations stipulate that a relative of an insider of a public company must register the transaction at least five days before the intended trading date.

Mr. Dan attributed his non-compliance to his infrequent engagement in securities trading, typically involving short-term, small-volume transactions. As a result, he was unaware of the regulations pertaining to share trading and information disclosure requirements for individuals related to insiders.

“This is the first time I have made such a mistake, and I would like to express my sincere apologies. I assure you that I will strictly adhere to the regulations in my future transactions”, stated Mr. Dan in his transaction report.

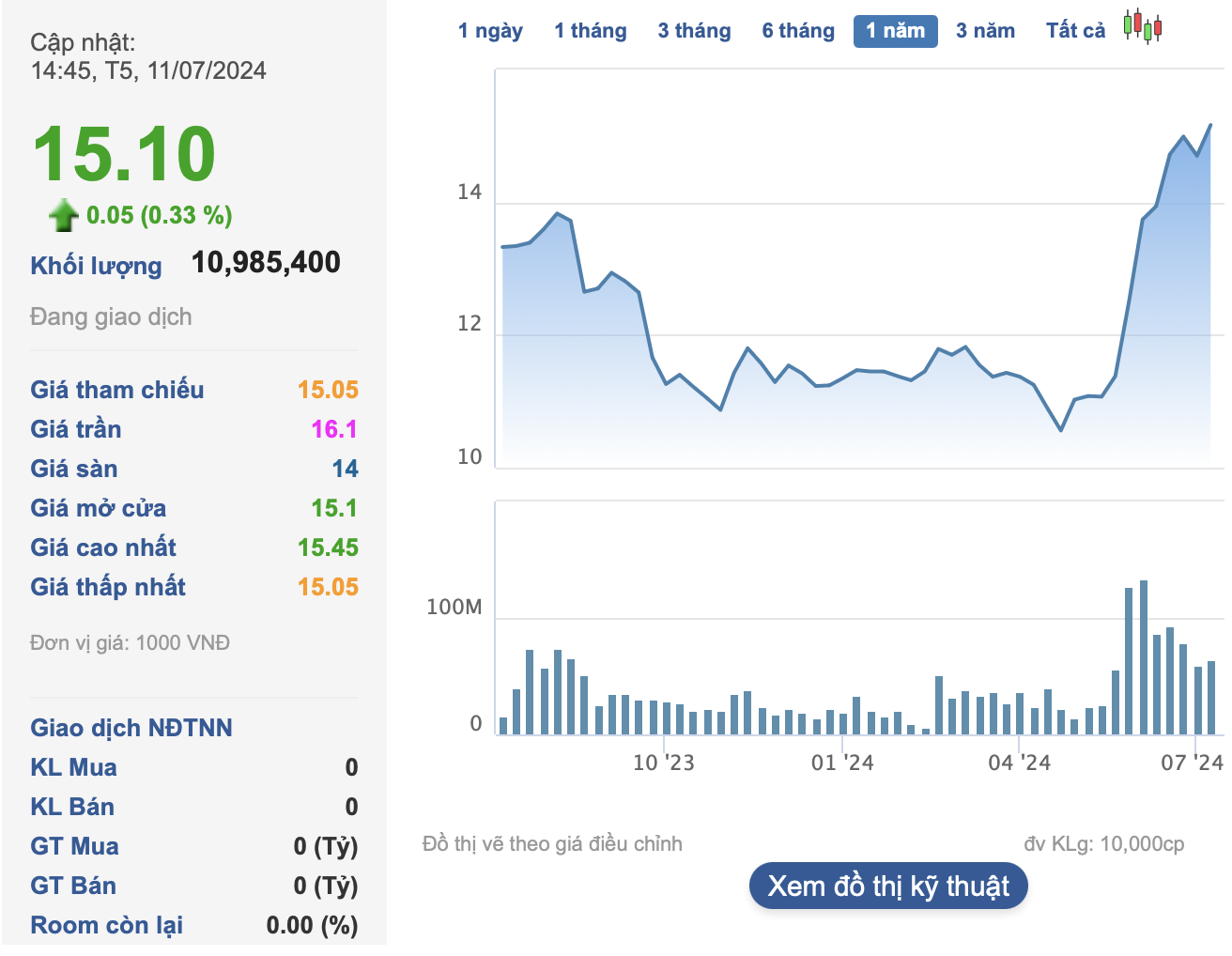

In the market, POW shares are currently trading near their two-year high of VND 15,100 per share, a 34% increase from the beginning of the year. PV Power’s market capitalization has reached VND 35,700 billion, the largest in the power sector on the stock exchange.

At the recent conference on the review of production and business activities for the first half of the year, Mr. Nguyen Dinh Thi, Head of Economics and Planning at PV Power, reported that the total electricity output of the company for the first six months was estimated at 8.574 billion kWh, 3% higher than the same period in 2023 and reaching 98% of the plan.

The company’s revenue for the first half of the year was estimated at VND 16,169 billion, 97% of the plan and equal to the same period last year. In the second quarter alone, PV Power is estimated to have generated nearly VND 10,000 billion in revenue, equivalent to approximately VND 109 billion per day.

In a recent report, MBS assessed PV Power as a standout performer in the energy sector, with a projected profit growth of 210%. This impressive performance is attributed to significant improvements in gas-fired, hydroelectric, and coal-fired power generation in the second quarter compared to the previous year.

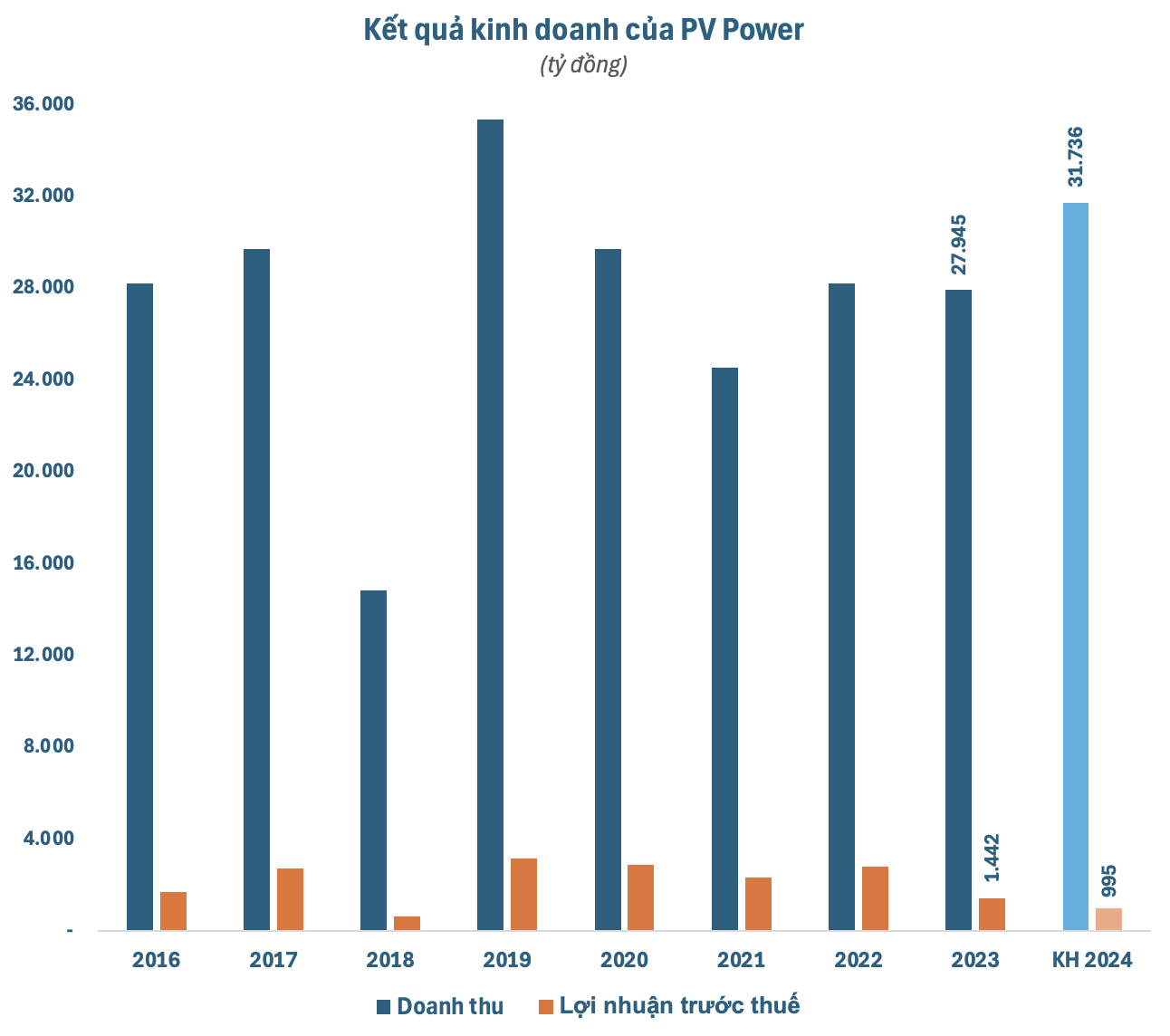

For this year, PV Power has set ambitious targets, aiming for a 16% increase in electricity output and a 9% rise in revenue compared to last year, reaching 16.7 billion kWh and VND 31,700 billion, respectively. However, their projected pre-tax profit is expected to decrease by nearly 31% from last year’s performance, amounting to VND 995 billion. Interestingly, during the 2019-2023 period, the company consistently exceeded its profit plans.

Free Lifetime Trading, MBS App also Provides Free Professional Consultation by Experts and AI

To bring good luck and prosperity at the beginning of a new year, MBS has introduced a lifetime free trading policy along with prominent technological features, especially in terms of analysis and advisory services on trading platforms; helping investors to gain more value on their investment journey in 2024.

Facing potential loss of VND 1,000 billion, PV Power urgently recommends to the Government and Ministry of Industry and Trade

PV Power has recently issued an urgent recommendation to the Government and the Ministry of Industry and Trade regarding the challenges faced in the construction of Nhon Trach 3 and 4 Power Plant.