In a surprising turn of events, several key executives of DHG have recently resigned from their positions, despite the company’s robust performance and record profits in 2023. This comes as a surprise as the company has been thriving, with generous salaries and bonuses for its leaders.

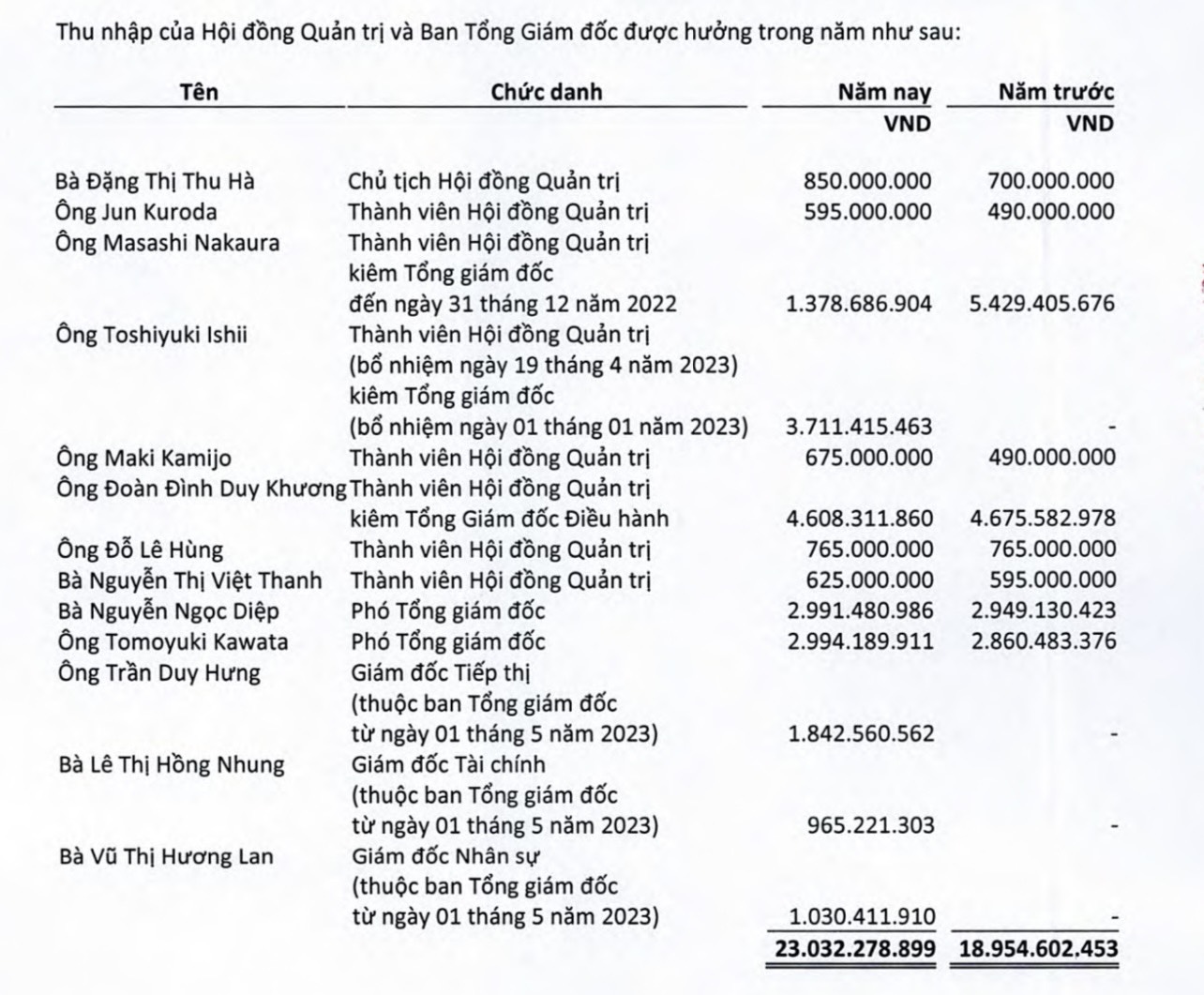

The departing executives include Mr. Doan Dinh Duy Khuong, CEO of DHG, who stepped down on July 10th, followed by Ms. Vu Thi Huong Lan, HR Director, and Ms. Le Thi Hong Nhung, CFO, who both left on July 15th. In 2023, these individuals earned attractive compensation packages, with Mr. Khuong receiving over VND 4.6 billion annually, Ms. Lan over VND 1 billion, and Ms. Nhung earning more than VND 965 million.

DHG, Vietnam’s largest pharmaceutical manufacturer, has consistently maintained its leading position in the industry for 27 consecutive years and is among the top 5 domestic pharmaceutical companies in terms of market share.

In 2019, the company came under the control of Japanese conglomerate Taisho, which acquired a 51.01% stake. Currently, Taisho holds a controlling stake of 51.01%, while the remaining 43.31% is owned by SCIC. Mr. Khuong, the former CEO, represented the interests of SCIC, holding over 22.6 million DHG shares, equivalent to a 17.31% stake.

Image: CafeF

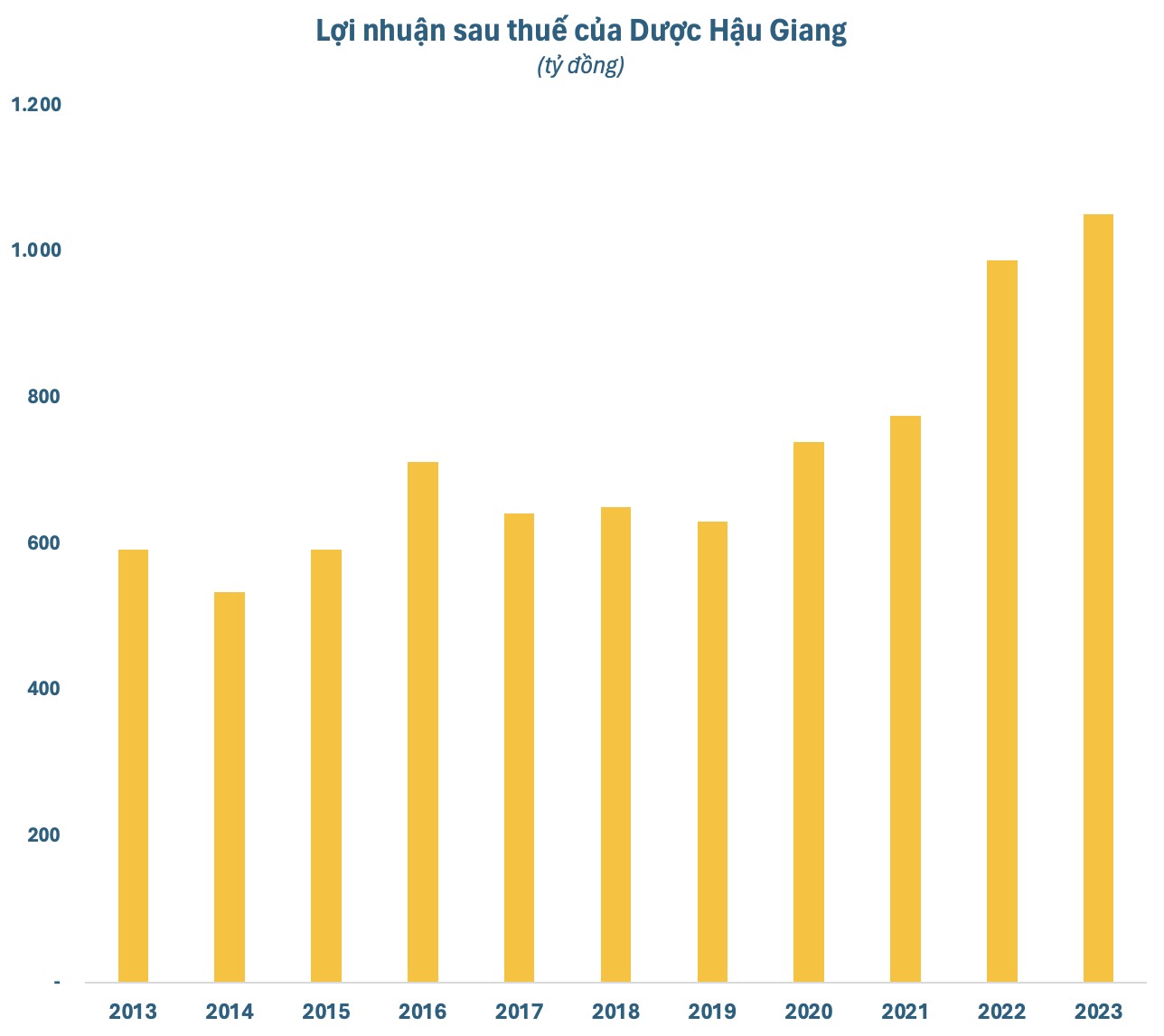

Since the involvement of the Japanese investor, DHG has continuously enhanced its business operations, resulting in significant financial growth. From 2019 to 2023, the company’s profits increased at an average rate of nearly 14% annually.

In 2023, DHG achieved a remarkable milestone, recording a post-tax profit of VND 1,051 billion. This was the first time in the company’s history that it surpassed the VND 1,000 billion profit mark in a single year.

Image: CafeF

Not only has DHG demonstrated strong internal growth, but the Vietnamese pharmaceutical industry as a whole has also been presented with new opportunities in the post-Covid-19 era. According to a report by Mirae Asset Securities, Vietnam’s pharmaceutical market is estimated to have reached a revenue of USD 7.24 billion in 2023, with the OTC channel and hospitals contributing USD 1.8 billion and USD 5.448 billion, respectively.

Mirae Asset Securities predicts that the post-Covid-19 era will bring a resurgence in demand for antibiotics, a key strength of DHG in the OTC channel. The company’s main antibiotic brands, Klamentin and Haginat, are expected to be the primary growth drivers in 2024.

However, DHG’s financial performance in the first months of 2024 has shown a slight decline. This year, the company aims for VND 5,200 billion in revenue and a pre-tax profit of VND 1,080 billion.

Following a period of rapid growth, DHG’s stock price is currently undergoing a correction, trading around VND 110,000 per share.

Image: CafeF