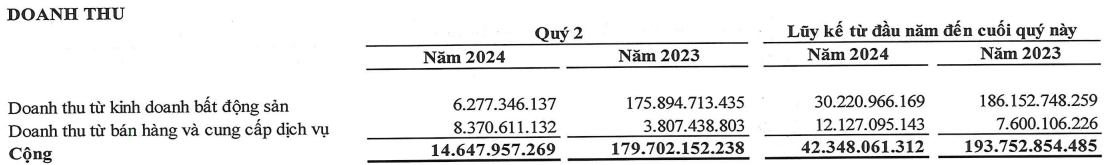

NBB’s real estate business revenue in Q2 reached just over VND 6 billion, a decrease of over 96% compared to the same period last year, while revenue from sales and services surpassed the real estate sector with over VND 8 billion, double that of the previous year.

|

NBB’s revenue structure in Q2 and the first half of 2024

Source: NBB

|

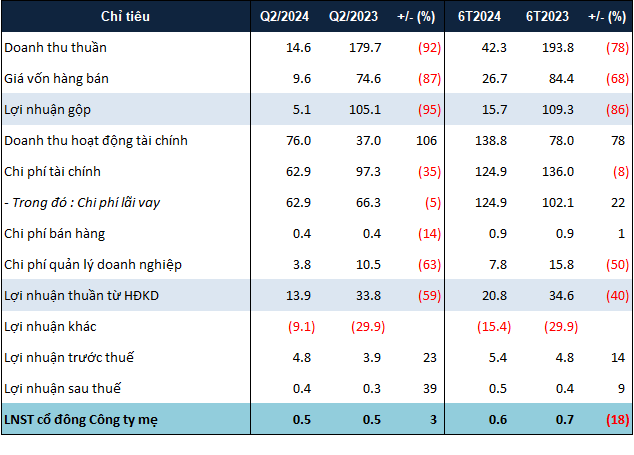

Despite the decline in revenue, NBB’s financial activities shone, bringing in nearly VND 76 billion, double that of the same period last year, mainly from interest on collaborative investments and capital support.

Another positive aspect was the significant reduction in all expenses. Financial expenses decreased by 35% due to banks lowering lending rates, while sales and management expenses also decreased by 14% and 63%, respectively, compared to the previous year.

As a result, NBB’s net profit for Q2/2024 slightly increased by 3% year-on-year, reaching over VND 507 million.

However, for the first half of 2024, NBB’s net profit was nearly VND 607 million, a decrease of 18% year-on-year.

In terms of progress towards its plans, with nearly VND 490 million in post-tax profit in the first half, NBB has only achieved about 3% of its profit plan for 2024.

|

NBB’s business results for the first half of 2024

Source: VietstockFinance

|

On the balance sheet, NBB’s total assets as of June 30, 2024, were over VND 7,700 billion, a 12% increase from the beginning of the year. Cash and inventory increased by 57% and 14%, respectively, to nearly VND 25 billion and VND 1,800 billion.

Notably, long-term receivables increased by 31% to nearly VND 2,700 billion, of which more than VND 2,600 billion was contribution capital receivables from cooperative investments, including collaborations with Ho Chi Minh City Technical Infrastructure Investment Joint Stock Company (HOSE: CII) on two projects: 152 Dien Bien Phu and Ha Noi Highway; and with Thu Thiem North Urban Area One-Member Co. Ltd. on the Thu Thiem New Urban Area projects (over VND 619 billion).

On the other hand, payables increased by 16% to over VND 5,900 billion. Total borrowings decreased by 16% to nearly VND 3,100 billion.

Regarding the Delagi project, NBB’s development investment expenses for this project as of the end of June 2024 exceeded VND 1,000 billion, an increase of over 21% compared to the beginning of the year. Conversely, NBB has received more than VND 1,900 billion in capital contributions from CII for this project, including an investment of over VND 1,400 billion with a term of 12 months and a separate investment of VND 485 billion with a term until December 13, 2030.

Ha Le

Cen Land’s annual profits plummet to 2.5 billion VND, with nearly 60% of assets being accounts receivables.

Although the fourth quarter saw a reversal in profits, declining revenue resulted in Cen Land’s net profit for the entire year of 2023 only reaching 2.5 billion VND. It is worth mentioning that nearly 60% of the company’s assets consist of receivables from partners, with a total value of approximately 4,100 billion VND.