The Electronic Transactions Law 2023 has officially come into force since July 1st. This is a piece of legislation that has a far-reaching impact on various sectors and entities in society. Some of its provisions are novel in the system of legal norms and require detailed guidance to ensure uniform implementation.

To provide a legal basis for enforcing the provisions of the Electronic Transactions Law in real life, the Ministry of Information and Communications has drafted a decree on electronic signatures and trusted services. The draft is currently undergoing consultation with relevant stakeholders.

However, in recent days, public opinion has been particularly concerned about the information that if the electronic signature regulations in the draft are applied, people may have to bear additional trillions of dong in fees when transacting with banks.

If the draft’s electronic signature regulations are applied, people may bear additional fees when transacting with banks. Illustration

In an interview with the Industry and Trade Newspaper, Mr. Nguyen Quoc Hung, Vice Chairman and General Secretary of the Vietnam Banks Association, expressed his agreement and support for the orientation of a civilized society, where every citizen should have a digital signature or electronic signature for public service and business transactions.

However, he pointed out that some contents of the draft decree on electronic signatures and trusted services, developed by the Ministry of Information and Communications, are inconsistent with the provisions of the 2023 Electronic Transactions Law (the law does not prohibit). This could significantly impact the operations of credit institutions and increase costs for citizens and enterprises when conducting electronic transactions with credit institutions.

“I fully agree and support the idea of every citizen having a digital or electronic signature. However, we need to consider its application in the context of infrastructure, technology, and the gradual adaptation of the people, without disrupting production and business activities or causing a sudden increase in costs for citizens and enterprises… The ultimate goal is to facilitate citizens. The Banking Association has submitted a proposal on the draft decree, regulations on electronic signatures, and electronic services to the Ministry of Information and Communications,” Mr. Hung said.

In reality, credit institutions also believe that banks currently apply two-factor authentication to ensure that the person performing the transaction is the account holder. Since July 1st, banks have also implemented biometric authentication per the State Bank’s Decision 2345/NHNN to ensure the highest security for customers. Adding digital signatures will significantly impact banks, customers’ experiences, and increase costs for both parties.

Therefore, credit institutions proposed that people should be allowed to choose whether to use digital signatures based on their needs. If implemented, it should be done systematically, using the same digital signature for all activities, from banking transactions to public services and administration…

“Implementing digital signatures on a unified platform can enhance customer experience. If the service experience is not good, it will affect customers in the long run. Each credit institution needs to ensure both security and convenience for citizens,” a Vietcombank representative suggested.

Meanwhile, a VietinBank representative suggested that each bank needs to prepare solutions for the coming time. If the use of electronic signatures becomes mandatory, banks must ensure the benefits of the people and can consider a single-window solution to reduce costs while ensuring privacy and system-wide usage.

In addition, credit institutions also proposed using specialized electronic signatures to ensure the safety of internal activities and represent the organization in transactions with other organizations and individuals. They also suggested creating and providing electronic signatures for organizations and individuals to use in transactions with the institution, in line with its functions and tasks as prescribed by law.

“The Electronic Transactions Law has opened up the direction of allowing people to choose various forms, including specialized electronic signatures to ensure safety. When people have higher incomes and realize the necessity of having their own digital signature, they will make that choice themselves. Sub-law regulations should not impose additional costs on citizens and businesses,” said Mr. Nguyen Quoc Hung.

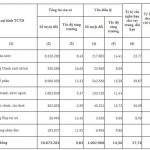

According to a report from one of the four state-owned commercial banks, as of now, the number of customers transacting through digital channels at this bank is estimated at 12 million, with 6.5 – 7 million transactions/day (approximately 2.3 billion transactions per year, averaging 500 transactions/second). Thus, when the draft decree takes effect, with the cost of CA (Certificate Authority) services in the market ranging from VND 550,000 to VND 1,800,000/year, the bank’s customers will have to pay up to VND 6,600 – 21,600 billion per year for CA Provider services.

State bank urges banks to boost lending from early 2024

The State Bank of Vietnam (SBV) has announced that credit growth at the beginning of 2024 is relatively low compared to recent years. As a result, the SBV is urging credit institutions to actively implement measures to boost credit growth right from the early months of 2024.