On August 2, International Food Joint Stock Company – Interfood (code: IFS) will finalize the list of registered shareholders to receive a 24% cash dividend for 2023 (01 share will receive VND 2,400). The payment is expected to be made on September 9.

With more than 87 million shares currently in circulation, Interfood is expected to spend nearly VND 210 billion on this dividend. The majority of the dividend will go to foreign shareholder Kirin Holdings Singapore Pte. Ltd., which currently holds nearly 96% of Interfood’s shares.

Kirin became a major shareholder of Interfood in 2011 after acquiring shares from a Malaysian shareholder. The Japanese food production group has since worked to improve IFS’s debt structure and develop new products and markets for the company.

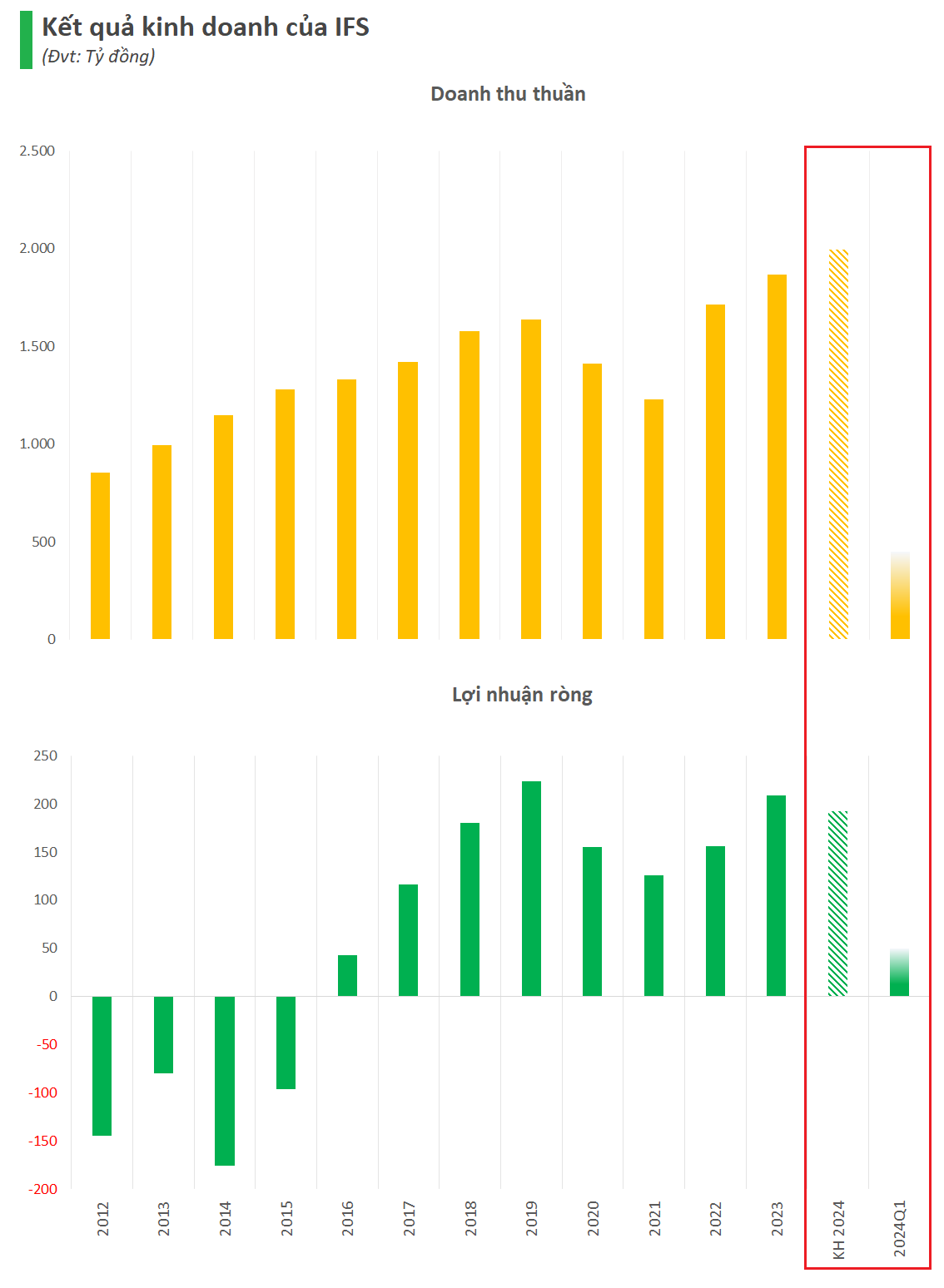

After consistently making profits from 2016, Interfood eliminated its accumulated losses in 2021. Since then, the owner of the well-known Wonderfarm herbal tea brand has continuously paid cash dividends to shareholders. The dividend payout ratio was 1.9% in 2021, 19.8% in 2022, and 24% in 2023.

In 2024, Interfood aims for a record high net revenue of VND 1,993 billion, up nearly 7% compared to the previous year. However, the company is cautious about its profit target, planning for a net profit of only about VND 192 billion, an 8% decrease compared to 2023.

Interfood stated that the company aims to achieve higher growth than the market and increase sales for its priority brands – Wonderfarm herbal tea, Ice+, and Latte – by making clear value propositions and maximizing customer touchpoints through effective marketing strategies. In addition, Interfood continues to expand its iMUSE business, contributing to the health of Vietnamese people.

In the first quarter of 2024, Interfood recorded net revenue of VND 447 billion, a 13% increase compared to the same period last year, mainly due to increased sales at the beginning of the year, focusing on key and strategic product lines.

After deducting the cost of goods sold and expenses, Interfood’s net profit was over VND 50 billion, a significant 69% increase compared to the first quarter of 2023. With these results, Interfood has completed 22% of its net revenue plan and over 26% of its annual profit target.

In the market, IFS shares are currently trading at VND 32,700 per share, slightly up from the beginning of the year. The corresponding market capitalization is nearly VND 2,900 billion.