Selling pressure in the last few sessions erased VN-Index’s previous gains, causing the benchmark to end the week slightly lower than the previous week. VN-Index stood at the 1,280-point level, down more than 2 points. The past week was considered a news vacuum as many companies’ financial reports are expected to be released between July 15 and 30.

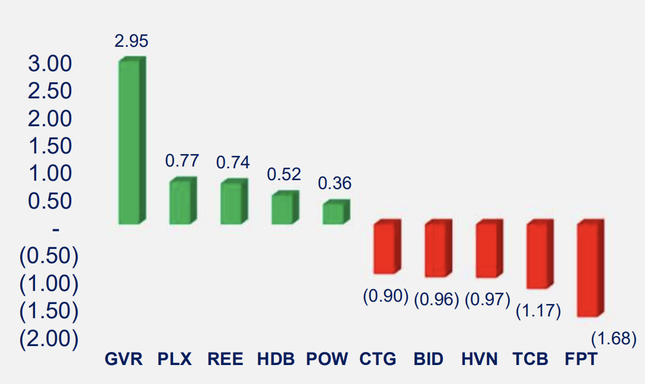

FPT underwent a corrective week with a decline of more than 3.5%, dragging VN-Index down by more than 1.7 points and being the stock with the most negative impact on the index. On the upside, GVR’s attempt to climb nearly 8% was not enough to balance VN-Index. Foreign investors maintained their net selling status with a total value of nearly VND4,500 billion, with FPT being the main focus, accounting for VND1,731 billion. MWG and VHM followed with net selling values of VND644 billion and VND521 billion, respectively.

FPT experienced a corrective week with a decline of more than 3.5%, having the most negative impact on the index.

Expert Pham Binh Phuong from Mirae Asset Securities stated that VN-Index is currently in a sideways trend, with investors’ hesitant psychology. Technically, the psychological level of 1,300 points has become a significant challenge for VN-Index.

“The Q2 earnings results will be a factor in assessing whether investors’ expectations for certain stock groups were reasonable or not. The wait for this information likely influenced investors’ trading decisions,” Mr. Phuong commented.

Analysts from Construction Securities Joint Stock Company (CSI) believed that the sideways trend is likely to persist for a few more sessions, allowing the market to accumulate and prepare for a liquidity surge and a clearer confirmation of the trend.

“We lean towards positive signals and maintain our view that investors should buy, focusing on stocks that have built a solid foundation in the previous two weeks,” CSI recommended.

Regarding the short-term opportunity to surpass the 1,300-point peak, many forecasts support the scenario of VN-Index soon resuming its upward trajectory. Yuanta Securities, for instance, argued that the market is in a volatile phase but with a positive bias. Expectations of an interest rate cut by the US Federal Reserve (Fed) in September, along with positive macro data and listed companies’ Q2 growth, would support the market’s upward momentum in July.

“The low valuation of large-cap stocks and the VN-Index’s forward P/E ratio of 12.x, equivalent to an earnings yield of 8.3%, indicate that the stock market remains more attractive than other investment channels, even as savings interest rates show signs of rebounding,” Yuanta’s expert asserted, adding that VN-Index is likely to surpass the 1,300-point threshold this month.

Analysts from Rong Viet Securities (VDSC) suggested that the Q2 earnings season in July could provide VN-Index with a chance to reclaim the 1,300 level.

According to VDSC’s estimates, the market’s revenue started to recover compared to the previous quarter, although the growth rate might be lower than the same period last year. Meanwhile, after-tax profit growth was expected to reach 13% year-on-year, implying an improvement in the net profit margin of listed companies,” VDSC stated.

On the other hand, exchange rate and interest rate pressures remain burdensome for the market. Considering the mixed impact of these factors, VDSC anticipated that the market would generally maintain the volatility observed in the previous two months. With the Q2 earnings season taking place in July, VN-Index still has the opportunity to reclaim the 1,300-point threshold. However, if the exchange rate situation worsens and the State Bank of Vietnam adjusts its operating interest rates, the index may retreat to the 1,240-point level or even the 1,180-1,220 range in Q3.

In this index range, VDSC expected stock groups to take turns driving the market higher, creating short-term investment opportunities.

Choose stocks for “Tet” festival celebrations

Investors should consider choosing stocks in the banking industry with good profitability, healthy real estate, and abundant clean land reserves. In addition, the group of stocks in infrastructure investment, iron and steel, and construction materials should also be considered.