Fixed interest rate for 2 years at only 7.5%/year, with a competitive interest rate margin of 2.9% after the promotional period

By transferring their loans to VIB, customers can enjoy attractive and highly competitive interest rates in the market today, at only 5.5%, 6.5%, and 7.5%/year fixed for 6, 12, or 24 months, respectively. After the promotional period, an interest rate margin of only 2.9% will be applied.

When transferring their loans to VIB, customers can choose to not make any principal payments for up to the first 24 months of the loan term. This is a unique benefit offered by VIB to customers repaying loans from other banks, helping to reduce financial pressure and providing more time to balance their cash flow and increase future income.

Most home purchase loans are eligible for refinancing with VIB, including loans for purchasing townhouses, apartments, and home renovation.

Support for advance disbursement to quickly settle the old loan

Unlike the market practice of having to settle the loan at the previous bank and withdraw the collateral asset file or provide additional collateral before disbursement, VIB offers advance disbursement to all customers for loan settlement. With this benefit, customers transferring their loans to VIB have complete financial autonomy and don’t have to worry about borrowing money to settle their loans, minimizing risks and additional costs.

Additionally, for loans to repay debts to other banks, VIB offers a loan term of up to 30 years and a loan limit of up to 80% for collateralized assets such as townhouses, villas, apartments, and adjacent houses that have been granted ownership certificates. The asset appraisal fee is currently waived for customers transferring their loans to VIB until 30.09.2024. VIB also offers flexible income verification options for customers.

Leading retail bank for car loan, home loan, and consumer loan products

As a pioneer in offering specialized loan products that bring superior benefits to customers before, during, and after the loan term, VIB has established itself as a leading choice for customers seeking home loans in Vietnam.

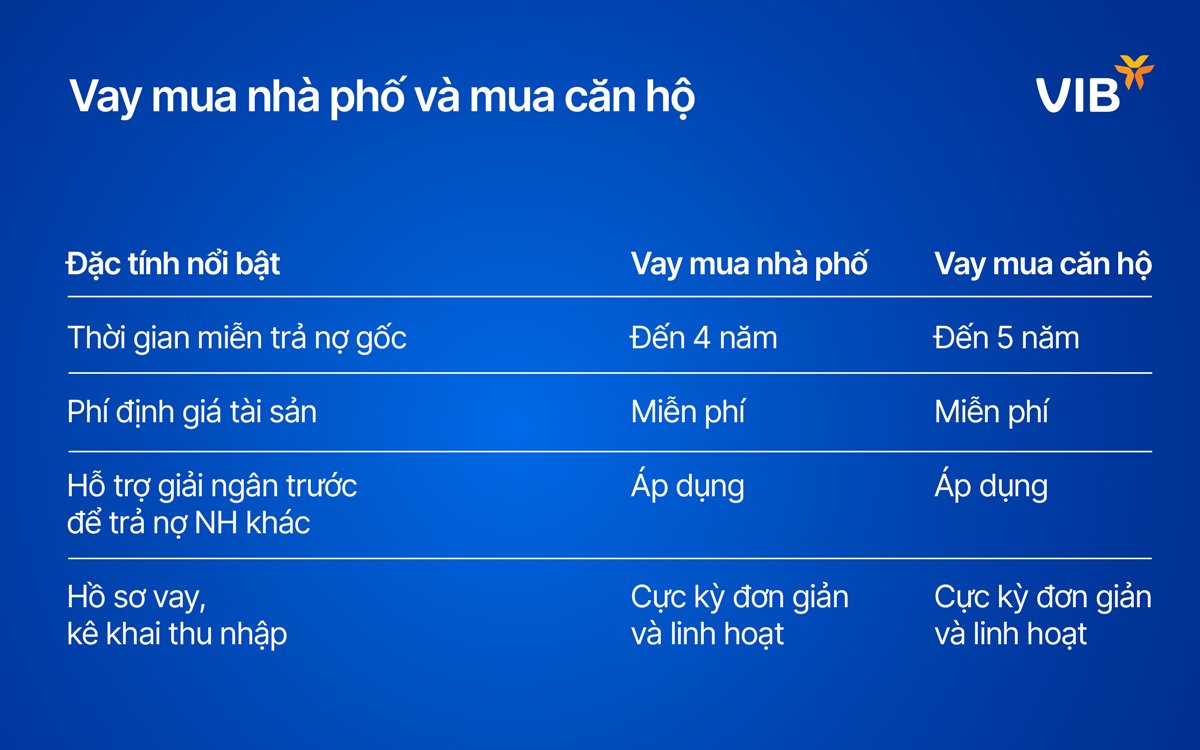

Anticipating the recovering demand for home purchases in Q3 2024, VIB has launched a townhouse purchase loan package with a total limit of up to VND 30,000 billion, with fixed interest rates of only 5.9%, 6.9%, and 7.9%/year for fixed-rate terms of 6, 12, and 24 months, respectively, and no principal payments for up to 48 months. This is VIB’s largest loan package to date, making it easier for individual customers to access long-term capital with attractive fixed-rate packages, a simple, fast, and efficient loan approval process.

Earlier, from the end of March 2024, VIB made a big splash in the market with its apartment purchase loan product, offering interest rates from 5.9%/year and no principal payments for up to 5 years. The loan balance for this product has increased sevenfold since the beginning of the year, contributing to VIB’s 5% credit growth in the first 6 months.

With these two loan packages, customers can enjoy an additional 0.4% interest rate discount and advance disbursement if they are repaying loans from other banks, as mentioned above. For apartment purchases, thanks to optimized approval processes and a vast database, VIB commits to approving loans within 8 hours from the time of complete file collection and asset appraisal. VIB also offers flexible payment policies, tailored to the financial situation and conditions of each customer.

With interest rates at their lowest level in 20 years and asset appraisal values on the rise due to the recovering real estate market, now is the ideal time to own a townhouse or apartment or to transfer your loan at an optimal cost. Customers can contact VIB via hotline: 1800 8180 or visit the VIB website for more information.

Easier mortgage interest rates

Starting from the beginning of the year, banks have been implementing various low-interest credit packages, offering loans to pay off debts from other banks… with the aim of stimulating the demand for home loans.

Reflecting on a year of free-falling interest rates

Savings interest rates in 2023 witnessed a race to the lowest levels in 20 years, dropping from a peak of 12% per year for the 12-month term in early 2023 to below 5% per year by the end of the year. Let’s take a closer look at the unprecedented interest rate developments of the past year with Tiền Phong.