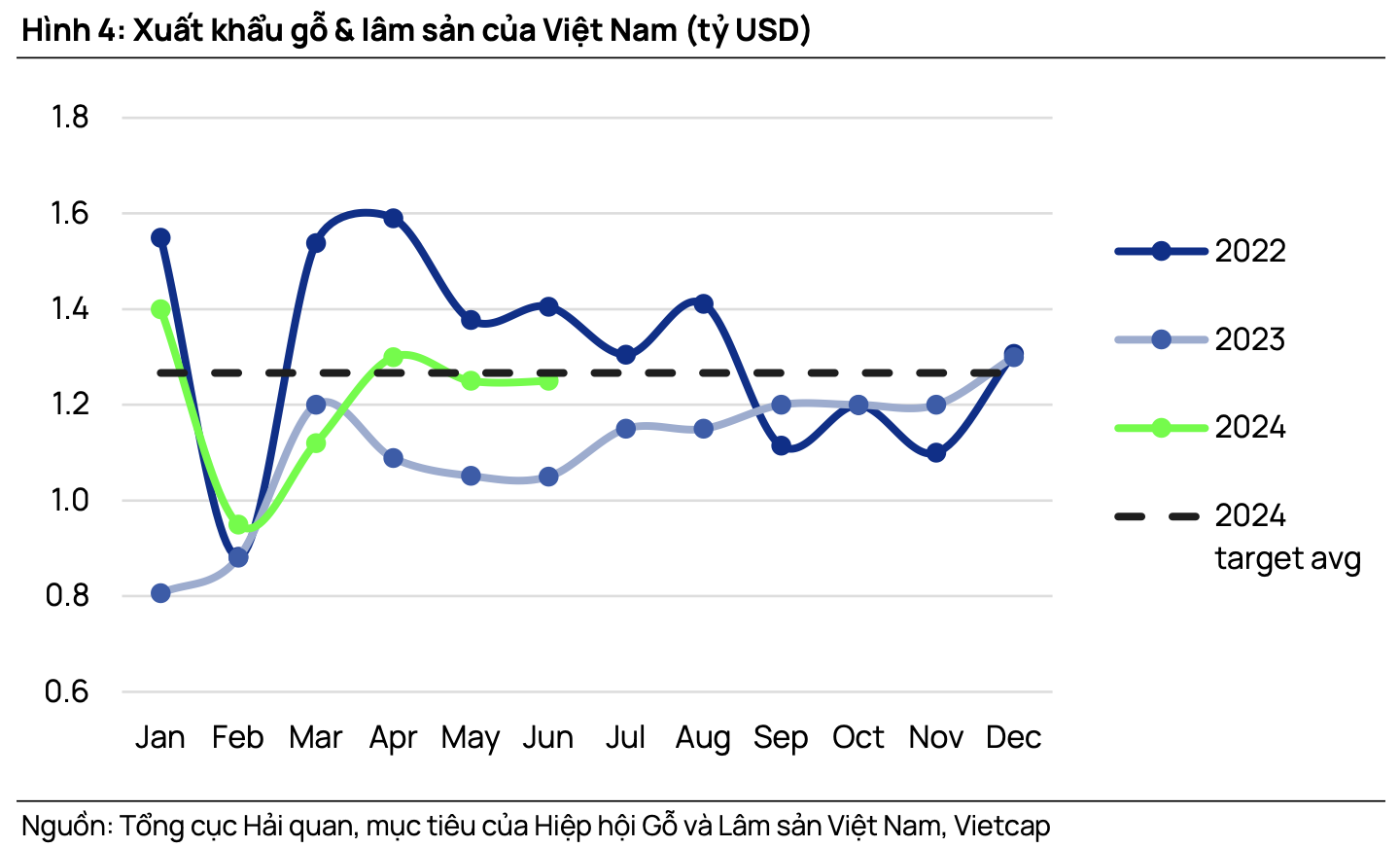

Wood products are one of Vietnam’s key export commodities, bringing in billions of USD annually. According to statistics from the Forestry Department under the Ministry of Agriculture and Rural Development, in the first six months of 2024, Vietnam’s exports of wood and forest products reached USD 7.95 billion, up approximately 21.2% over the same period in 2023 and accounting for 52.3% of the plan for the whole year.

Of this, the export turnover of wood and wood products to the US market reached USD 4.38 billion, up 27.6% over the same period in 2023 and accounting for up to 55% of the industry’s total export turnover. The US’s increased imports of Vietnamese wood and wood products reflect a rapid recovery in demand in this market, especially for wooden furniture.

On the Vietnamese stock exchange, there are quite a few companies operating in the field of wood processing and export, among which Phu Tai (code PTB) is a notable name with many attractive stories both inside and outside this main field.

In a recent report, Vietcap argued that wood exports increased sharply thanks to inventory replenishment activities. Revenue from Phu Tai’s wood segment increased by 22% over the same period in the first quarter of 2024. Phu Tai’s management maintains an optimistic outlook and forecasts that this segment will lead the company’s growth in 2024.

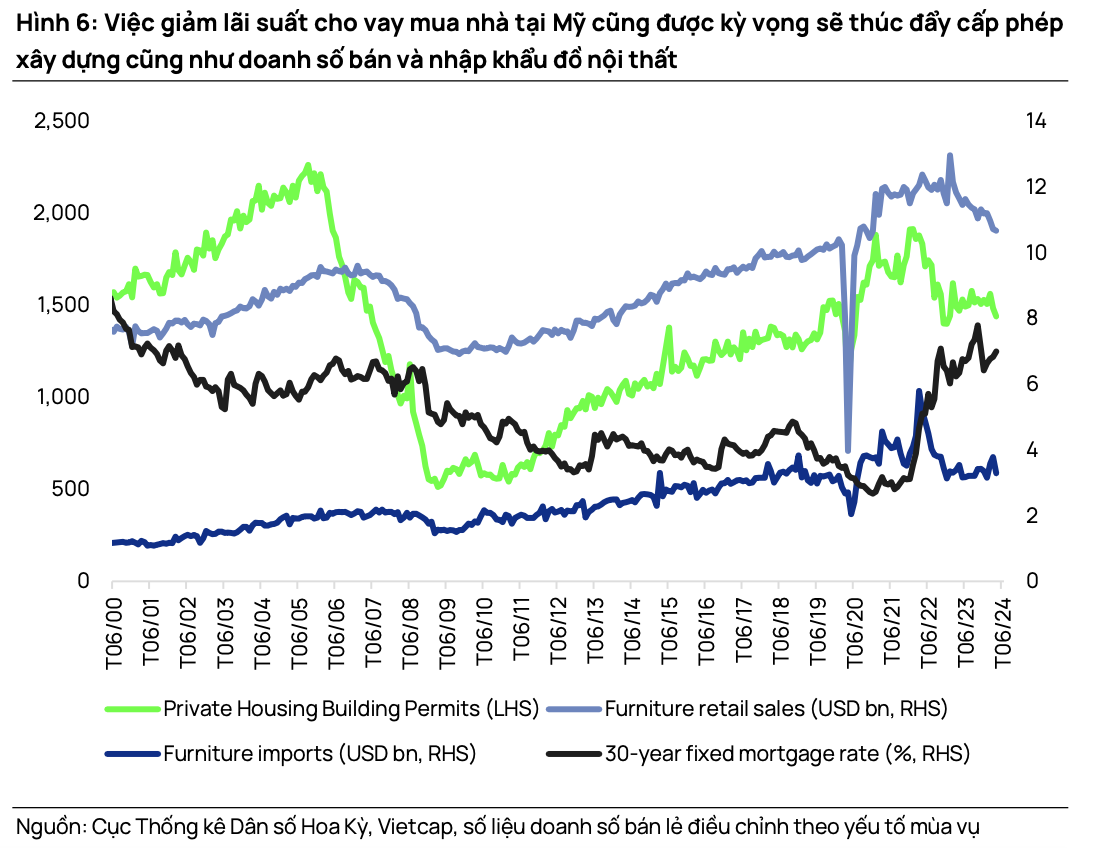

Vietcap expects mortgage rates for home purchases in the US to ease slightly after the Fed’s expected rate cut in September, thereby supporting Vietnam’s exports of wooden furniture. This forecast is reasonable, given that inflation- and employment-related data in the US in June support this crucial Fed decision.

Meanwhile, a recent report by Yuanta Vietnam argued that Phu Tai’s wood exports are recovering, independent of the construction situation in the US, thanks to (1) the results of its strategy to seek new customers and develop new product designs; and (2) Phu Tai’s FSC certification, which proves the origin of its wood, thereby exempting its exports to the US from anti-dumping taxes and helping to increase its market share.

Overall, regardless of the driving factors, it is undeniable that Phu Tai currently has many supportive elements to maintain growth in its main field of wood exports. At the same time, the company’s other segments are also showing positive signals.

Benefiting from the Long Thanh Super Project

According to Vietcap, Phu Tai is finalizing contracts for stone cladding for airport construction projects. As one of the few suppliers with facilities that meet the required standards, Phu Tai’s management is confident in winning the bid to supply stone cladding for the Long Thanh International Airport, Terminal 3 of Tan Son Nhat Airport, and Terminal 2 of Noi Bai Airport.

This confidence is bolstered by the fact that Phu Tai owns (1) two granite mines and (2) machinery capable of producing materials that meet the technical requirements of airports. According to Vietcap, the company is ready to commit to additional investment if necessary.

Similarly, Yuanta Vietnam also assessed that Phu Tai’s stone segment has maintained its recovery momentum thanks to public investment, despite the stagnant export channel. At present, the company has orders to supply stone cladding for the expansion projects of Noi Bai Airport and the Long Thanh Super Project.

The first phase of the Long Thanh Airport project has a total investment of VND 109,112 billion and is expected to require approximately 18 million tons of construction stone, consuming about 1 million tons of cement, less than 100,000 tons of steel, 50,000 square meters of wood, and about 500,000 square meters of stone cladding… To meet the project’s demands, stone cladding factories are currently operating at about 70% capacity. According to Phu Tai’s estimates, the demand for stone cladding for the Long Thanh Airport project is about VND 300 billion.

In addition, Phu Tai has expanded its real estate investment portfolio with three ongoing projects. The first phase of the Phu Tai Central Life project was sold out in the first quarter of 2024. This is Phu Tai’s second apartment project, with a smaller scale than the “debut” Phu Tai Residence project.

According to Vietcap, citing the company’s management, the Phu Tai Central Life project has been constructed up to the fifth floor and is expected to start recognizing revenue in October 2025. Meanwhile, the Phu Tai Dieu Tri project is in the process of site clearance and compensation, and revenue recognition is expected to begin in 2025. As for the Phu Tai Van Ha project, phases 1 and 2 are expected to commence construction in the 2025-2026 period, with an investment cost of VND 1,500 billion. However, Phu Tai has not set a profit plan for these projects.