Let’s delve into the MBTI model and its application to stock market investing.

MBTI, or the Myers-Briggs Type Indicator, is a personality typing system based on the theories of Carl Gustav Jung. It categorizes people into 16 distinct types based on four pairs of opposing preferences:

- Extraversion (E) vs Introversion (I)

- Sensing (S) vs Intuition (N)

- Thinking (T) vs Feeling (F)

- Judging (J) vs Perceiving (P)

Combining these preferences results in unique personality types such as ISTJ, ENFP, or INFJ. Each type is associated with specific traits, behaviors, and ways of interacting with the world. This knowledge is incredibly valuable for stock market investors as decision-making and behavior are influenced not only by information processing but also by psychological factors. Thus, different personality types will have distinct interaction patterns and behavioral tendencies, making certain investment strategies more suitable than others.

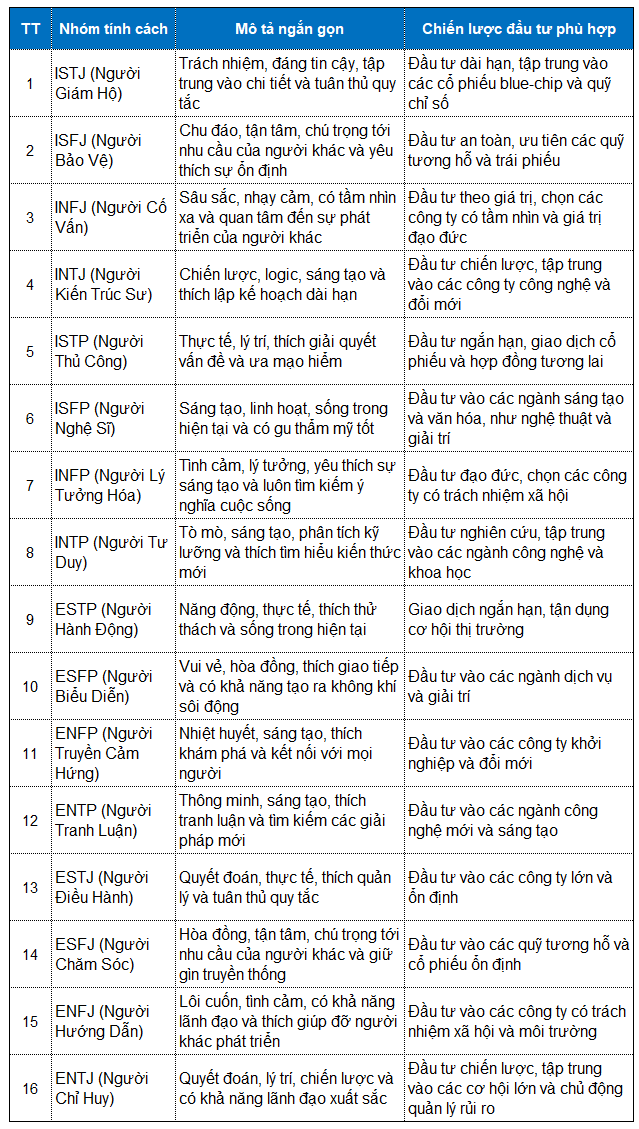

Below is an infographic illustrating the 16 MBTI types and their corresponding investment strategies:

These strategies are tailored to individual personality traits, helping investors optimize profits and manage risks effectively while considering their personal styles. However, it’s important to remember that the model has limitations and should only be used as a reference when crafting an investment strategy. One of its main shortcomings is its focus on personality traits rather than market conditions or business opportunities. Thus, the primary goal of this model is to help investors find a comfortable and psychologically harmonious investment approach that aligns with their personalities.

Analysis of Investment Strategies of Funds in 2023

With a dynamic strategy, major investment funds in the past year have achieved outstanding profitability compared to the VN-Index. Analyzing the investment strategies and portfolio allocation of these funds provides us with additional insights to make investment decisions in 2024.