VPI Vice Chairman Sells 3.3 Million Shares Ahead of 2024 Dividend

Mr. To Nhu Thang, Vice Chairman of the Board of Directors of VPI Joint Stock Company (HOSE: VPI), sold 3.3 million VPI shares as registered from June 27 to July 4, 2024.

Following the transaction, Mr. Thang’s ownership in the Company decreased from 4.38% to 3.013%, equivalent to nearly 7.3 million shares.

Based on the average closing price of VPI shares from June 27 to July 4, it is estimated that Mr. Thang earned more than VND 196 billion from this transaction.

CKG Vice Chairman Completes Purchase of 5 Million Shares

Mr. Dinh Thanh Tam, Vice Chairman of the Board of Directors of CKG Joint Stock Company (HOSE: CKG), reported that he had completed the purchase of 5 million CKG shares, equivalent to 5.25% of the capital, from June 11 to July 10, and became a major shareholder. Prior to this, he did not own any CKG shares.

Calculated based on the average closing price of CKG from June 11 to July 10 at VND 25,600/share, Mr. Dinh Thanh Tam’s order to purchase CKG shares cost approximately VND 128 billion.

Two LSG Leaders Buy 9% of the Company’s Capital

Two leaders of LSG Joint Stock Company (UPCoM: LSG), Mr. Tran Thanh Nhon and Mr. Bui Huu Tai, purchased a total of 8.1 million LSG shares from June 5 to July 4, 2024.

Specifically, Mr. Nhon, the Chief Financial Officer and Accountant, bought 4.2 million LSG shares, thereby increasing his ownership in the Company from 0.01% to 4.67%. Meanwhile, Mr. Tai, the Secretary and Person in Charge of Corporate Governance, also bought 3.9 million LSG shares, increasing his ownership from 0.05% to 4.39%.

Based on the average closing price during the trading period, the value of Mr. Nhon and Mr. Tai’s transactions is estimated to be nearly VND 50 billion and over VND 46 billion, respectively.

NHA Board Member Seeks to Sell 1 Million Shares Amid Rising Share Price

Due to personal financial needs, Mr. Nguyen Van Hung, a member of the Board of Directors of NHA Joint Stock Company (HOSE: NHA), registered to sell 1 million shares from July 18 to August 15, 2024.

The transaction will be carried out by agreement or by matching orders on the exchange. If all the registered shares are successfully sold, Mr. Hung’s ownership will decrease from over 1.3 million shares, or 3.18%, to approximately 342,000 shares, or 0.81%.

Mr. Hung’s move to sell shares comes as the NHA share price has been on a strong upward trend since the beginning of the year. At the close of the July 12 trading session, the NHA share price stood at VND 30,350/share, up 78% from the beginning of the year, with an average trading volume of over 725,000 shares per session. At this price, Mr. Hung is expected to earn more than VND 30 billion from the transaction.

TCM Share Price Hits 2-Year High, “Shark” Nguyen Van Nghia Plans to Divest Nearly 7% of Capital

Mr. Nguyen Van Nghia, a “shark” investor holding thousands of billions of dong in stocks on the stock market, has just registered to divest nearly 7% of the charter capital of TCM Joint Stock Company (HOSE: TCM).

Specifically, Mr. Nghia registered to sell 7 million TCM shares from July 16 to August 14, aiming to reduce his ownership from 17.19 million shares (16.8772%) to 10.19 million shares (10.0047%).

Based on the TCM share price at the close of the July 11 trading session, which was VND 53,700/share, it is estimated that Mr. Nghia could earn approximately VND 376 billion if the transaction is completed.

DTH CEO and His Wife Register to Divest Their Entire 51% Stake

Mr. Tran Thanh Minh, a member of the Board of Directors and CEO of DTH Joint Stock Company (UPCoM: DTH), and his wife, Mrs. Tran Thi Huyen Trang, a member of the DTH Board of Directors, have both registered to sell all the shares they hold, equivalent to 51.39% of DTH’s capital. The transaction is expected to take place from July 16 to August 12, 2024.

Specifically, Mr. Minh and Mrs. Trang registered to sell their entire holdings of over 1.7 million and over 2.1 million DTH shares, respectively, representing 22.91% and 28.48% of the Company’s capital. If successful, the CEO and his wife will no longer be shareholders of DTH. Both cited personal reasons for the transaction.

On the other hand, a company related to Mr. Minh, METZ USA Vietnam Joint Stock Company, has registered to purchase up to 6.32 million DTH shares, equivalent to 84.59% of the Company’s capital. If successful, this company will become the parent company of DTH, with its ownership increasing to 84.61%.

Based on the closing price of DTH shares on July 11, it is estimated that Mr. Minh and Mrs. Trang could earn more than VND 23 billion and nearly VND 29 billion, respectively, from the transaction, while METZ USA Vietnam will need to spend nearly VND 86 billion.

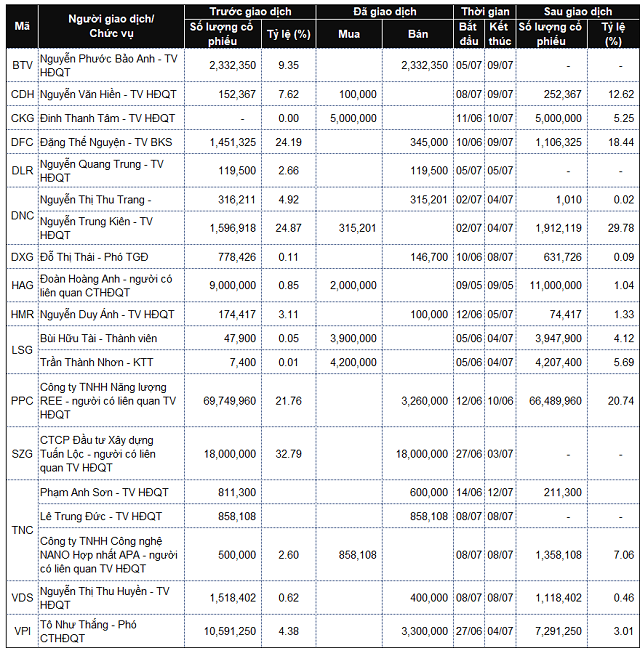

|

List of Company Leaders and Their Relatives Trading from July 8-12, 2024

Source: VietstockFinance

|

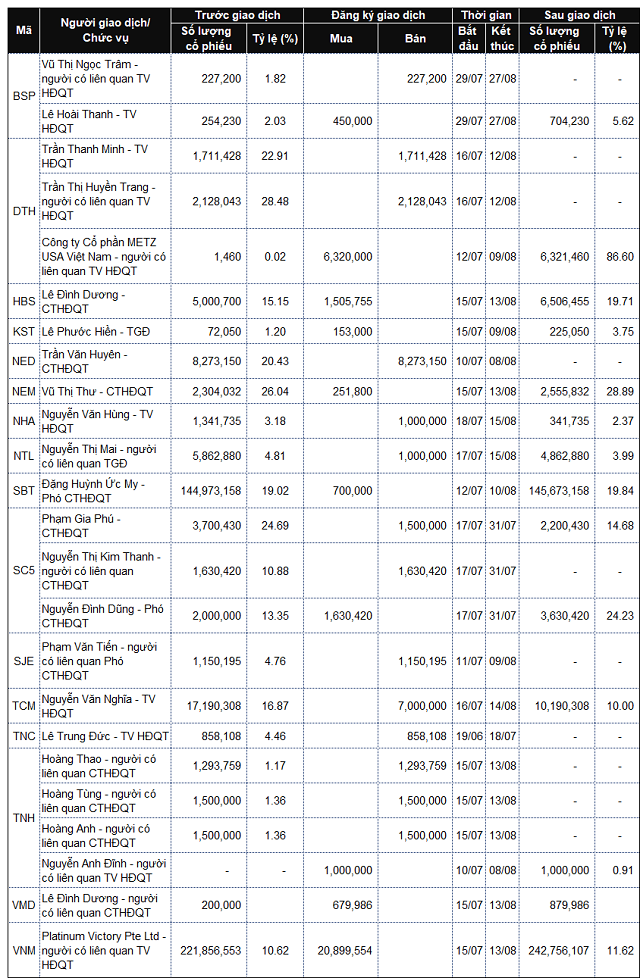

|

List of Company Leaders and Their Relatives Registered for Trading from July 8-12, 2024

Source: VietstockFinance

|

Thanh Tu