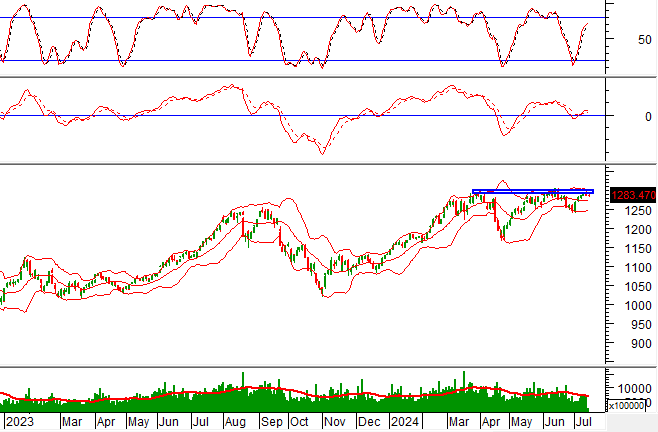

Technical Signals for VN-Index

During the trading session on the morning of July 12, 2024, the VN-Index witnessed a slight dip, along with a significant decline in trading volume. This cautious sentiment among investors was reflected in the market dynamics.

Additionally, the VN-Index continued to retest the old peak from March 2024 (equivalent to the 1,290-1,300 point range) while the MACD indicator trended upward, providing an earlier buy signal. Should this buy signal be sustained and the index successfully breaks through this resistance level, the short-term upward trend is likely to resume in upcoming sessions.

Technical Signals for HNX-Index

On July 12, 2024, the HNX-Index experienced a decline, coupled with a notable drop in liquidity during the morning session, indicating a cautious approach adopted by investors.

Furthermore, the HNX-Index has been exhibiting a tug-of-war pattern, with alternating rising and falling sessions, after crossing above the Middle curve of the Bollinger Bands. This movement occurs as the Bollinger Bands gradually narrow (a Bollinger Squeeze), suggesting that the sideways trend may persist in the near term.

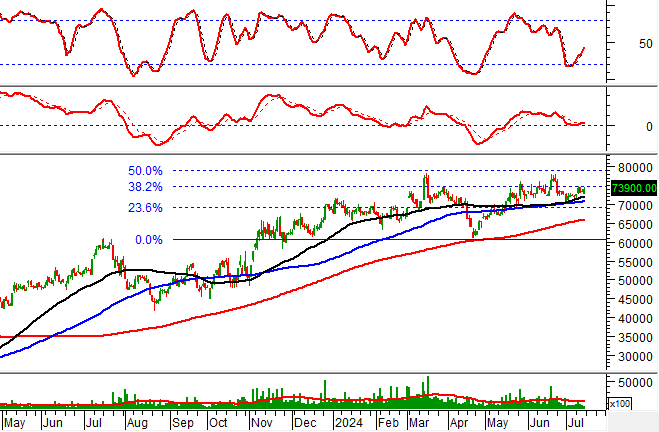

CTD – Coteccons Construction Joint Stock Company

On the morning of July 12, 2024, CTD witnessed an increase in its stock price, along with a slight uptick in trading volume, reflecting the optimism among investors.

Additionally, the stock price is retesting the Fibonacci Projection 38.2% level (equivalent to the 73,000-75,000 range) while the MACD indicator has provided a buy signal once again. Should this buy signal be sustained and the stock price successfully breaks through this resistance zone, a short-term bullish scenario is likely to unfold in the upcoming sessions.

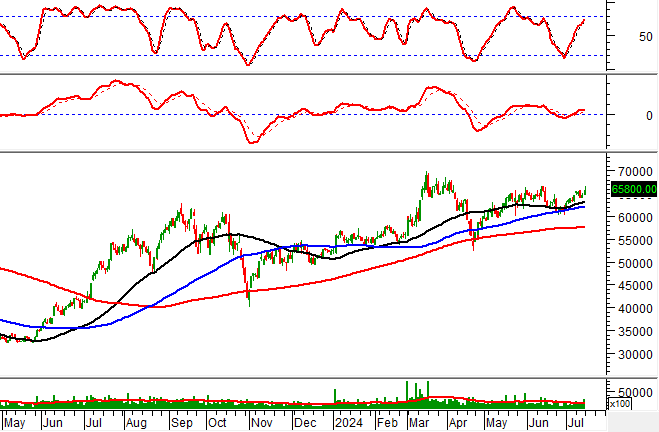

DGW – Digital World Joint Stock Company

During the morning session on July 12, 2024, DGW witnessed a surge in its stock price, accompanied by a significant spike in trading volume, surpassing the 20-session average. This indicates heightened trading activity and enthusiasm among investors.

Furthermore, the stock price is finding solid support at the 50-day SMA, and the Stochastic Oscillator continues to trend upward after providing an earlier buy signal, suggesting that the positive mid-term outlook remains intact.

Technical Analysis Department, Vietstock Consulting