|

Super preferential interest rates from just 5.5%/year for import-export businesses

|

Accordingly, new and existing SME customers of OCB who are engaged in import and export activities will enjoy super preferential interest rates of just 5.5%/year for loans with terms of up to 3 months, and 6%/year for loans with terms between 3 and 6 months. These rates will be fixed for the duration of the loan.

Limited Company SNC Garment International, a company specializing in the import and export of garments to the Korean and American markets, is one of the businesses that has recently received a large credit line from OCB with super preferential interest rates. This source of funding will help the business have additional finances to supplement their working capital for importing raw materials to fulfill orders until the end of 2024. Ms. Ngoc, the company’s CFO, shared: “During the loan process at OCB, we have always received quick support, from preparation to appraisal, along with competitive interest rates. Thanks to this, our company has had timely access to capital to serve our business needs. By the end of this year, our company plans to continue drawing down a new loan from OCB to expand our export market and relocate our factory to increase productivity.”

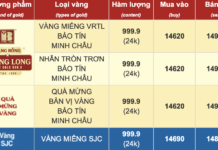

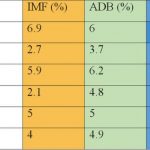

In the current context, to empower SMEs to develop and expand their production and business activities, OCB has continuously launched various programs and products suitable for different customer segments and industries. In line with the general direction of the Government and the State Bank of Vietnam, we have also adjusted deposit interest rates to a reasonable level so that we can support businesses with the best loan interest rates. As can be seen, the average interest rate in the market is currently quite low, averaging about 6-8%/year. For the group of import and export enterprises, we apply an even better interest rate, from only 5.5%/year, thereby helping customers solve the capital problem for their activities, shared the representative of OCB‘s leaders.

OCB is rated as one of the banks that always takes the initiative in supporting businesses, especially SMEs, in the direction and guidance of the Government and the State Bank of Vietnam. In addition to interest rate and price support, the bank is also focusing on digital transformation of financial products and services to enhance convenience and reduce transaction time for customers. For example, import and export businesses can easily make payments to foreign partners for orders through the digital banking channel for businesses (OCB OMNI Corp), creating orders anytime, anywhere, and OCB commits to processing transactions within 2 working hours from the time the business successfully approves the order. Inquiry and printing are also easy and fully online without having to go to the transaction counter as before.

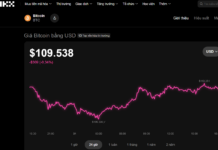

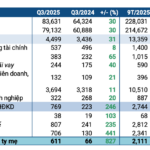

According to data from the General Statistics Office, Vietnam’s total import and export turnover of goods in the first 6 months of 2024 reached US$368.5 billion, up 15.7% over the same period last year, of which export turnover reached US$190 billion, up 14.5%; trade balance of goods surplus of US$11.6 billion. With the positive results of import and export activities in particular and the economy in general in the first 6 months of 2024, capital demand will continue to increase in the last 6 months of the year, and the banking industry is also expecting this to be an opportunity for banks to promote credit growth.

Bank Prepares for Deposit Interest Rate Hike

Some banks have unexpectedly adjusted their deposit interest rates for certain terms against the backdrop of bottoming out interest rates.