“Opening the new year – opening up thousands of new things”, that’s why the beginning of the year is also the time when businesses actively promote their production and business activities.

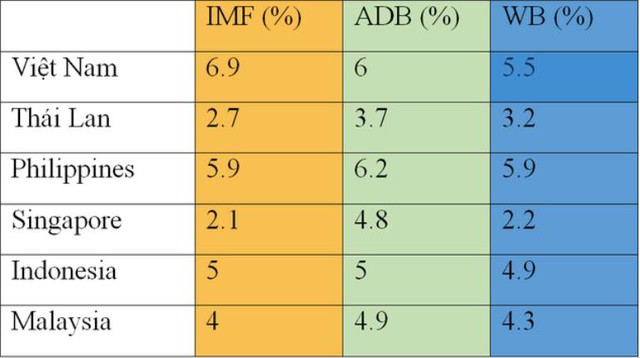

2024 is predicted to be a year with many growth motivations, with good signals from both domestic and foreign factors. Vietnam has set a target of economic growth of 6-6.5% in 2024 – the Year of the Dragon. The target set by Vietnam is also similar to the expectations of world organizations such as the IMF, ADB, and WB estimates.

Forecast of Vietnam’s GDP and strong economies in Southeast Asia in 2024 (Source: IMF, WB, Worldbox Intelligence)

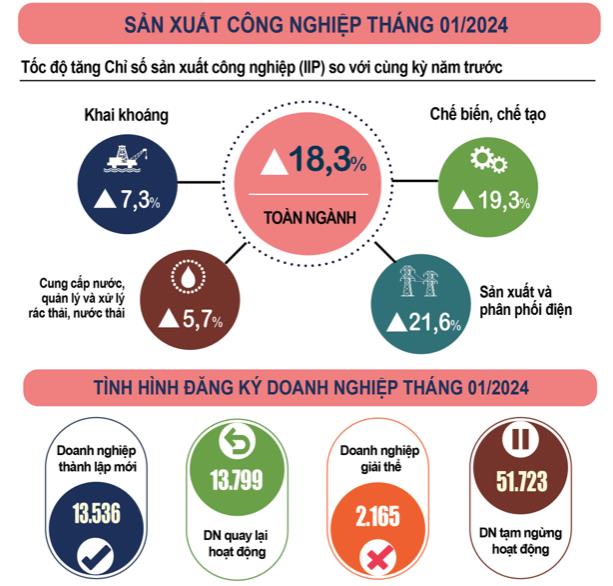

The report on the socio-economic situation in January 2024 of Vietnam also shows a bright economic picture. The bright spot from January must mention industrial production, in which the processing and manufacturing sector increased by 19.3% compared to the same period in 2023.

Supporting the economy is the stability of businesses. After a difficult period from the Covid-19 pandemic, businesses have resumed their activities. In January alone, the whole country had 13,500 newly established businesses, an increase of 2.2% compared to the previous month and an increase of 24.8% compared to the same period in 2023. Nearly 13,800 businesses resumed their operations, more than twice as many as in December 2023 and a decrease of 8.4% compared to the same period in 2023, bringing the total number of newly established and resumed businesses in January 2024 to over 27,300 businesses, up 5.5% compared to the same period in 2023.

Situation of industrial production in January 2024 (Source: General Statistics Office)

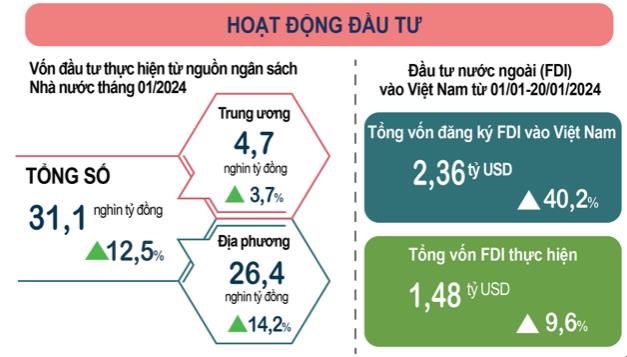

The number of newly established businesses and businesses resuming operations also shows an increasing demand for capital mobilization. The total actual investment capital from the state budget in April reached 31.1 trillion VND, an increase of 12.5% compared to the same period. FDI capital into Vietnam also increased sharply by 40.2% to 2.36 billion USD. These figures demonstrate the positive movement of the economy.

Investment activities in January 2024 (Source: General Statistics Office)

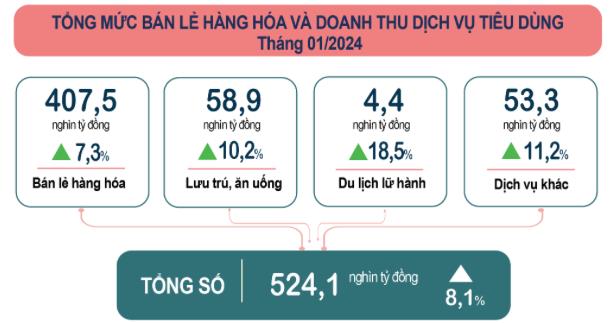

Catching up with the rhythm of the economy, domestic businesses have also made efforts to break through. The total retail sales of goods and consumer services in January reached over 524 trillion VND, up 8.1% compared to the same period.

Total retail sales of goods and consumer services in January 2024 (Source: General Statistics Office)

The strong breakthrough of businesses, services, and strong consumer demand in the early months of the year is partly due to the accompanying support of financial institutions to businesses and consumers.

Supporting businesses, apart from the government’s policies, is also the economic support of banks. At the beginning of 2024, the State Bank of Vietnam is oriented towards credit growth of about 15%, with appropriate adjustments to developments and the actual situation. In addition, the SBV also “opens up” the possibility of providing additional capital to the economy and continues to allocate additional credit limits if appropriate.

In response to this situation, commercial banks have also quickly joined forces with practical actions. By realizing the proposals of business representatives when they propose that banks “sacrifice part of their profits to reduce interest rates,” many banks have taken positive steps.

Favorable loans, super profitable business

BVBank (BVBank – stock code BVB) is one of the first banks to launch the most attractive interest rate packages to support businesses from the first days of the year.

A super attractive interest rate loan package of 5% per year to accompany individual customers and business owners at the beginning of the new year. BVBank’s loan program applies not only to purchasing/repairing residential real estate but also supports personal consumer loans or supplementary capital for production and business.

This continues to be one of BVBank’s efforts to strongly affirm its strong commitment “We start with YOU” after switching to a new brand image.

To provide cheap capital, share difficulties with customers, and contribute to economic recovery, aiming for sustainable growth, SHB also implements the program “Preferred Loan – Dragon Prosperity”, with VND 18,000 billion of preferential loans for individual customers to meet the needs of production, business, and living such as buying houses, buying cars… with interest rates from 6.79% per year.

LPBank launched the preferential loan program “Spring comes with a thousand auspicious things – Receive interest right away” unlimited with an interest loan package from 6% per year.

BIDV implemented 2 short-term and medium-long-term credit packages with a total scale of VND 200,000 billion for individual customers serving production, business, and consumer loans, preferential interest rates from 4.5%-7% per year. In which BIDV emphasizes priorities for the green sector towards sustainable development goals.

Nam A Bank (NAB) has just launched the program “Ready limit – Business breakthrough” with a limit of billions of VND for individual customers to supplement short-term business capital, preferential interest rates.

To make “cheap loans” no longer just a “TV story”

When banks reduce deposit interest rates and loan interest rates, it’s not new anymore, however, many businesses’ current concern is access to capital is still difficult. Therefore, banks with simple procedures are the “potential destination” for businesses.

Understanding this, BVBank is one of the few banks committed to supporting customers to the fullest with simple loan procedures, quick approval time within 24 hours. The interest rate margin has adjusted down to only 2% per year.

“We hope that the interesting experiences in each transaction at BVBank will be the touchpoint for BVBank to get closer to customers” – shared by a representative from BVBank.

Meanwhile, SHB created convenient conditions for customers to quickly and conveniently access preferential loans, applying flexible and simplified policies, loan documents, and pushing disbursement progress.

Nam A Bank commits to 4 no for customers’ ease of using capital, such as not applying third-party collateral pricing fee, no commitment to withdraw interest fee, no commitment to manage account sales volume fee…

When banks lower lending rates, businesses enjoy certain benefits, the most important of which is reduced borrowing costs. Low-interest rates help businesses reduce financial costs and increase profits. At the same time, product prices decrease, helping to stimulate consumer demand.

Low-interest rates also help reduce financial pressure on businesses, making it easier for them to invest in expansion projects, upgrade infrastructure, purchase new equipment, or expand business scale – this is also one of the advantages of businesses when accessing cheap loans.