Behind the Sudden Surge in Credit Growth

According to data from the State Bank of Vietnam (SBV), as of the end of June, total credit outstanding in the economy reached nearly VND 144 trillion, up 6% from the end of last year. This figure came as a surprise as credit growth spiked in June.

Specifically, with credit outstanding at the end of 2023 at VND 135.69 million billion, more than VND 810 trillion in credit has been injected into the economy in the first half of the year. Previously, credit growth had only reached 2.41% as of the end of May 2024 and 3.79% as of June 14.

This means that in June alone, nearly VND 500 trillion was injected into the economy by the banking system, even higher than the increase in the previous five months. In the last two weeks of June, credit outstanding increased by nearly VND 300 trillion.

Dr. Chau Dinh Linh from the University of Banking in Ho Chi Minh City shared with us that many people would question if there is something abnormal behind this credit growth figure. “It is possible that there are some abnormal factors, such as unjustified capital demands. However, the growth story is real and has a basis,” he said.

The expert analyzed that the government’s policies on promoting public investment and reducing taxes and fees have started to permeate, stimulating the production and business activities of enterprises. Moreover, credit growth in the securities sector has been very high. The real estate market has seen a recovery in some segments, with vibrant transactions and high personal demand for home loans due to low-interest rates. Many sectors, such as agriculture, auxiliary industries, and industrial real estate, have also witnessed positive developments, boosting credit demand. Therefore, the rapid credit growth in June is justified and mostly real growth.

However, credit growth in the first six months has mainly focused on corporate customers, while retail lending remains low. “Hopefully, in the coming time, personal and consumer lending will recover stronger, especially as banks are actively applying technology, optimizing processes, and offering flexible products that cater to the diverse capital demands of the people. For example, banks can now approve overdraft and consumer loans automatically, with loan amounts as high as hundreds of millions of VND. Moreover, the low lending rates will encourage people to spend more. The government’s and SBV’s policy is to maintain low-interest rates to boost growth,” said Dr. Chau Dinh Linh.

Dr. Chau Dinh Linh

He also stated that the reason for the weak personal credit growth in the past was not entirely negative. The lack of dynamism in personal lending was partly due to the decline in speculative investments, as making money through speculation was no longer as quick and easy as before. This shift encouraged more genuine personal lending demands. Therefore, in the long run, this is a positive development.

For the second half of the year, he expected credit growth to improve. In recent months, deposit rates have also been on an upward trend as many banks needed to prepare capital for their business plans for the last six months. This trend occurred not only in small banks but also in large banks, although the increase in deposit rates varied among different groups of banks, with smaller banks tending to raise rates more significantly.

Policy Change Cannot Be Ruled Out

Commenting on the SBV’s monetary policy management, the expert said that the authority had done a great job and acted flexibly in line with market developments. However, the pressure in the second half of the year is enormous, and there is a possibility of a change in monetary policy.

“The SBV’s objective is to maintain price stability and control inflation. Although inflation is still under control, it is showing an upward trend, along with the story of exchange rates. Therefore, from now until the end of the year, the SBV will face many challenges,” the expert said. After the tools in the open market operation (OMO) and the interbank market, the next step may involve adjusting the operating interest rates. The extent of the increase will depend on the macroeconomic context.

“It is hard to avoid having a different monetary policy compared to the first six months of this year,” he added.

Analyzing the exchange rate situation in more detail, Dr. Chau Dinh Linh said that the challenges remain significant, and many factors need to be monitored. However, the SBV is currently managing the situation effectively and has many resources to respond, and it could even be advantageous if the Fed cuts interest rates soon.

Additionally, remittances have been very positive, especially in the last six months of the year. Having additional foreign currency sources will help coordinate the foreign exchange market more smoothly.

He also drew attention to the disbursement situation of foreign-invested enterprises. Economic diplomacy is crucial at this point to attract these foreign currency sources and balance the outflow of foreign currency from Vietnam. Currently, the interest rate differential between VND and USD is causing a large amount of money to flow to other countries. “Looking at the stock market, we can see significant net selling activities.”

At present, the SBV is coordinating flexibly, such as through the central exchange rate corridor, promoting exports for various sectors, including agriculture, which is a bright spot in bringing foreign currency to Vietnam. The SBV has also used foreign exchange reserves to sell USD in the market to meet the legitimate foreign currency demands of individuals and enterprises.

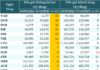

Which bank offers the highest interest rate for online savings in early February 2024?

Beginning February 1st, 2024, several banks have been adjusting their interest rates downwards for savings accounts ranging from 1 to 24 months. Based on a survey conducted across 16 banks, the highest annual interest rate for online savings deposits at a 6-month term is 5%, while for a 12-month term, it is 5.35%.