The Vietnamese economy grew by 6.4% in the first half of 2024, following a positive 5.1% in 2023. The global economic recovery and effective solutions for the domestic real estate market will boost Vietnam’s economic growth, which Fitch predicts will hover around 7% in the medium term. These are favorable conditions for the operations of the banking sector in general and Sacombank in particular.

According to Fitch, Sacombank’s asset quality has been rated ‘b+’/stable. The bank’s funding and liquidity position is rated ‘bb-‘/stable. The loan portfolio structure has been diversified to support production and business and stimulate consumption, resulting in a ‘b+’/stable risk score. Sacombank’s capital adequacy and profitability are expected to improve significantly in the coming years as the bank completes its restructuring and enhances its core business operations.

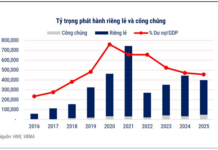

After more than 7 years of implementing the restructuring plan, Sacombank has resolved most of its existing issues and basically achieved its key objectives. The bank has recovered and handled over 80% of non-performing loans and stagnant assets, and made full provisions as required, including 100% provision for VAMC-sold debts that have not been handled yet. Asset quality has been continuously improved, with the proportion of profitable assets in total assets reaching over 91%. Business scale has been consistently expanded, with an average growth rate of 10-13% per year. Digital transformation has been accelerated to enhance governance capabilities and develop multi-utility products and services, meeting the digital banking needs of customers. Profits increased 62-fold from VND 156 billion in 2016 to VND 9,595 billion in 2023.

Dragon Capital Chairman: “Long-term vision is needed, accepting necessary adjustments for a safer, more efficient, and higher quality market”

According to Mr. Dominic Scriven, Chairman of Dragon Capital, the role of the finance industry in the stock market will be significant in 2023 and possibly in 2024. The roles of other industries, such as real estate or consumer goods, will depend on their respective challenges.

Sacombank maintains steady growth, ready to utilize internal resources to complete restructuring plan.

Sacombank has recently announced its financial results for Q4/2023. The bank has successfully achieved key business targets set by the Shareholders’ Meeting, with a pre-tax profit growth of 9,595 billion VND, a 51% increase compared to 2022, surpassing the year’s initial plans. What’s remarkable is that Sacombank has fully provisioned for the unrecovered VAMC debt, demonstrating its commitment to completing the restructuring plan in a timely manner.