Market liquidity decreased compared to the previous trading session, with the matched trading volume of the VN-Index reaching over 474 million shares, equivalent to a value of more than VND 11.3 trillion; The HNX-Index reached over 50 million shares, equivalent to a value of over VND 1 trillion.

The VN-Index opened the afternoon session on a negative note as selling pressure continued to increase, causing the index to plunge despite the return of buying interest. The index remained in the red until the end of the session.

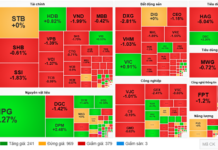

In terms of impact, VHM, HVN, FPT, and VPB were the stocks with the most negative influence, taking away more than 1.7 points from the index. On the other hand, GVR, BCM, PLX, and VJC were the stocks with the most positive influence on the VN-Index, contributing over 2 points.

| Top 10 stocks with the strongest impact on the VN-Index on July 15 |

The HNX-Index followed a similar trajectory, with negative influences from stocks such as IDC (-1.96%), PVI (-1.76%), VCS (-0.93%), and CEO (-1.14%) …

|

Source: VietstockFinance

|

The consulting and support services sector recorded the largest decline in the market, falling by -1.64%, mainly due to TV2 (-2.38%), VNC (-0.26%), and TV3 (-0.76%). This was followed by the information and technology sector and the agriculture, forestry, and fisheries sector, which decreased by 0.96% and 0.8%, respectively. On the other hand, the healthcare sector witnessed the strongest recovery, rising by 2.72%, driven by stocks such as DHG (+1.08%), IMP (+6.99%), DHT (+9.92%), and DBD (+0.48%)

In terms of foreign investors’ activities, they continued to be net sellers on the HOSE exchange, focusing on stocks such as HDB (VND 408.5 billion), STB (VND 333.71 billion), SAB (VND 178.77 billion), and SCS (VND 118.74 billion). On the HNX exchange, foreign investors net sold over VND 43 billion, mainly in IDC (VND 32.28 billion), PVS (VND 5.76 billion), TNG (VND 4.58 billion), and DTD (VND 3.77 billion)

| Foreign Investors’ Buying and Selling Activities |

Morning Session: Foreign Investors Continue to be Net Sellers, VN-Index Narrows Gains

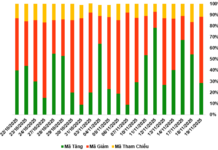

At the end of the morning session, the gains were narrowed, along with continuous net selling activities by foreign investors in recent times. Additionally, weak liquidity indicated that investors remained cautious. The VN-Index rose 3.53 points, temporarily standing at 1,284.28 points; The HNX-Index increased by 0.35 points, reaching 245.37 points. The number of advancing stocks temporarily outnumbered declining stocks, with 346 gainers and 267 losers.

The trading volume of the VN-Index recorded in the morning session reached over 204 million units, with a value of nearly VND 4.7 trillion. The HNX-Index recorded a trading volume of nearly 26 million units, with a trading value of over VND 515 billion.

Most of the industry groups that showed positive growth earlier narrowed their gains by the end of the morning session. Notably, the mining group, despite its strong performance at the beginning, failed to maintain its upward momentum and lost its green status. Instead, the healthcare and wholesale sectors took turns contributing positively to the index’s gains.

Specifically, the stocks that contributed to the positive growth of the healthcare sector included DHG, which rose by almost 1%, while IMP, VDP, and DHT witnessed strong gains of 3.68%, 6.58%, and 9.92%, respectively. Additionally, other stocks such as DBD, TNH, and DP3 also recorded notable increases.

Moreover, the wholesale sector was among the top performers in the morning session. Notable stocks within this sector included PLX (+2.05%), HHS (+1.75%), VPG (+1.03%), PET (+2.12%), SHN (+1.54%), and PSH (+3.81%) …, all of which achieved significant gains.

On the contrary, the consulting and support services sector did not perform positively from the start of the session. In fact, by the end of the morning session, this sector recorded the most negative growth compared to the overall market. Most of the stocks in this sector were in the red, including TV2, VNC, TV4, TV3, and PPE.

10:45 am: Green Dominates Amid Low Liquidity

Investors’ cautious sentiment led to a further decline in trading volume, and the main indices fluctuated around the reference level. As of 10:40 am, the VN-Index decreased by 1.48 points, hovering around 1,282 points. Meanwhile, the HNX-Index increased by 0.34 points, trading around 245 points.

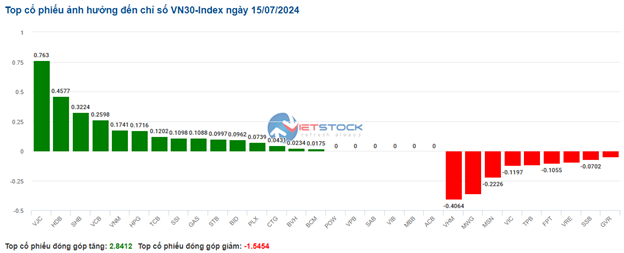

The breadth of the VN30 constituents was somewhat mixed, with a slight bias towards the green side. Notably, VJC, HDB, SHB, and VCB were among the stocks that provided support to the index, contributing more than 1.8 points. Conversely, VHM, MWG, MSN, and VIC were among the decliners, deducting 0.41 points, 0.36 points, 0.22 points, and 0.12 points from the VN30-Index, respectively.

Source: VietstockFinance

|

Notably, the healthcare sector was the leading industry group driving the market’s recovery, with a gain of 2.14%. Prominent stocks within this sector included DHT, which hit the daily limit-up, IMP with a 5.02% increase, DHG with a 0.09% rise, and DBD with a 0.24% gain…

Additionally, from a technical perspective, the stock price of TNH has been forming higher highs and higher lows after successfully breaking out of the medium-term downward trendline resistance, accompanied by a significant increase in trading volume over the past month. Moreover, the price has maintained its upward trajectory after the occurrence of a golden cross between the SMA 50 and SMA 100 moving averages, while the MACD indicator continues to trend upward, generating a buy signal that further reinforces the current uptrend.

However, the stock price is currently retesting the previous high of July 2022 (around the 28,400-29,000 level) as the Stochastic Oscillator has provided a sell signal within the overbought region. This dynamic suggests the potential for short-term corrective pressure if the indicator falls out of the overbought territory.

Source: https://stockchart.vietstock.vn/

|

Following the healthcare sector, the wholesale sector recorded a gain of 0.81%. Some notable contributors to the current upward momentum within this sector included PLX with a 1.3% increase, HHS with a 0.44% rise, and VPG with a 0.68% gain… Nevertheless, due to the mixed performance within the sector, stocks such as DGW, VFG, and TLH experienced selling pressure, resulting in minor declines of 0.46%, 0.12%, and 0.24%, respectively.

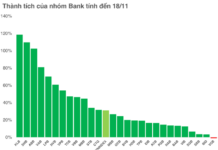

Similarly, the banking and securities sectors exhibited some mixed performance, with a slight bias towards the green side. Currently, the upward momentum is evident in stocks such as VCB (+0.46%), BID (+0.86%), CTG (+0.31%), SSI (+0.29%), VCI (+0.52%), and HCM (+0.19%)…

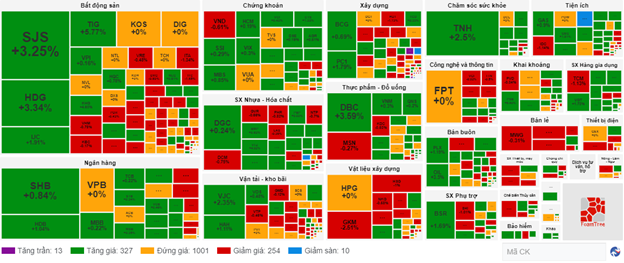

Compared to the beginning of the session, the number of stocks trading around the reference price remained high, exceeding 1,000 stocks. The buying side continued to hold a slight advantage, with 327 stocks advancing and 254 stocks declining.

Source: VietstockFinance

|

Opening: Green Prevails Across Most Industry Groups

At the start of the July 15 session, as of 9:40 am, the VN-Index surged more than 4 points, reaching 1,284.34 points. Meanwhile, the HNX-Index also edged slightly above the reference level, standing at 245.74 points.

The green side temporarily held the upper hand within the VN30 basket, with 2 declining stocks, 21 advancing stocks, and 7 stocks trading around the reference price. Among them, BVH, PLX, and GAS were the top gainers. Conversely, stocks such as SSB and VHM experienced minor declines of 0.48% and 0.26%, respectively.

As of 9:40 am, the insurance sector recorded impressive growth, with most stocks in the group trading in positive territory from the beginning of the session. Notable performers included BVH (+1.1%), BMI (+1.13%), MIG (+2.25%), BIC (+1.37%), and PVI (+0.53%)