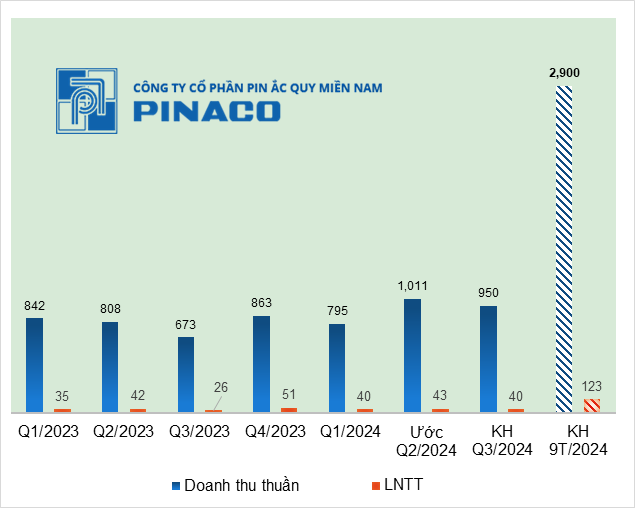

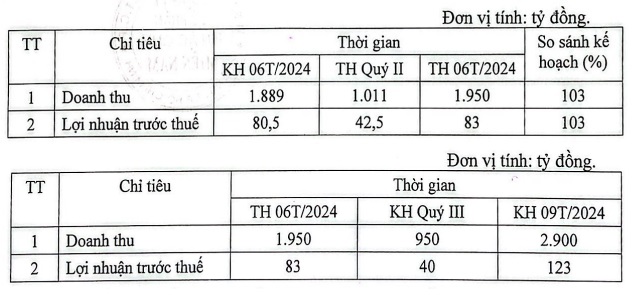

According to the resolution, the company under the Vietnam Chemical Group (Vinachem) is estimated to have achieved revenue of over VND 1,000 billion in Q2, a 25% growth compared to the same period last year, and 3% higher than the six-month plan. The profit before tax target increased slightly, estimated at VND 42.5 billion, also 3% higher than the six-month plan.

Source: PAC

|

Regarding the progress of investment projects, Pinaco announced that the total investment value in construction in the first six months reached over VND 9.6 billion, equivalent to more than 58% of the yearly plan. Most of this was spent on equipment, accounting for nearly VND 9.4 billion.

At the same time, the Board of Directors approved the Q3 business plan. Accordingly, revenue is expected to reach VND 950 billion, up 41% over the same period last year; profit before tax increased by 54%, to VND 40 billion. For the nine-month plan, revenue is projected at VND 2,900 billion, with a profit before tax of VND 123 billion.

At the 2024 Annual General Meeting of Shareholders, the Company set a target of VND 3,800 billion in revenue and VND 160 billion in profit before tax, up 19% and 4% respectively compared to the previous year.

|

PAC’s quarterly results and plans

Source: VietstockFinance

|

Sharing at the Annual General Meeting of Shareholders at the end of April this year, the PAC’s management board stated that they are considering the plan to implement the lithium battery project. However, the company needs to carefully study and prepare for production, including assembly for product lines (electric bicycles, motorcycles, forklifts, golf carts, etc.).

Currently, PAC is capable of producing lead-acid batteries for electric bicycles and motorcycles, which have already been introduced to the market. The company also noted that each electric car is equipped with a lead-acid battery, and PAC is currently supplying 100% of VinFast’s electric car lead-acid battery needs.

PAC is planning to invest in a new factory with a budget of VND 1,000 billion (capital structure of 30% self-owned and 70% borrowed) in An Phuoc Industrial Park. The company stated that the self-owned capital will come from the development investment fund at the end of 2023, amounting to VND 355 billion.

PAC’s stock price has been on an upward trend since mid-May 2024 and is currently trading near its highest peak this year. At the closing price on July 12, PAC’s market price was VND 52,100/share.

| PAC’s Stock Price Movement since the Beginning of 2024 |