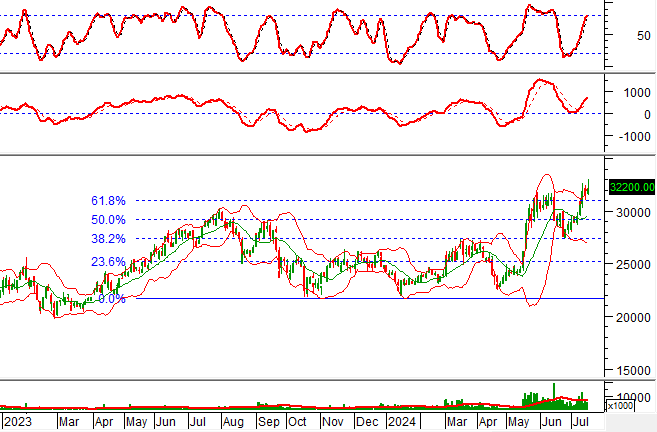

Technical Signals for the VN-Index

During the morning trading session on July 15, 2024, the VN-Index witnessed a rise in points, while trading volume saw a significant drop. This indicates a cautious sentiment among investors.

At present, the VN-Index is fluctuating, with alternating rises and falls. This comes after it cut above the Middle line of the Bollinger Bands, while the bands themselves are narrowing (Bollinger Squeeze). This suggests that the sideways trend may continue in upcoming sessions.

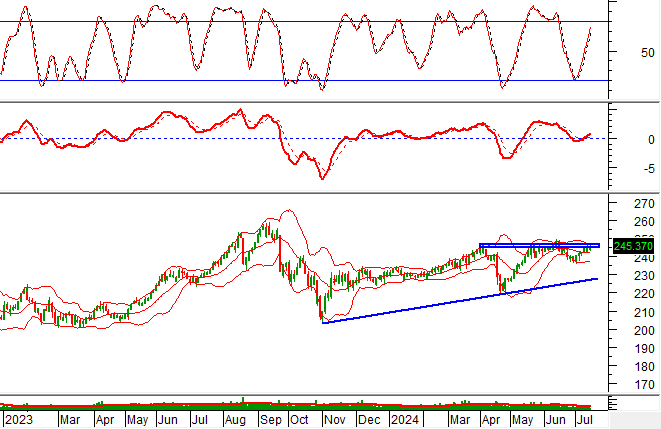

Technical Signals for the HNX-Index

On July 15, 2024, the HNX-Index rose, and trading volume slightly increased during the morning session, indicating investors’ optimistic sentiment.

Additionally, the HNX-Index continues to retest the old peak from May 2024 (equivalent to the 245-247-point region) while the MACD indicator consistently expands its gap with the Signal line after previously giving a buy signal. If this buy signal is maintained and successfully breaks through this resistance level, a short-term rise may occur in the coming sessions.

HDG – Hanoi Construction Corporation

On the morning of July 15, 2024, HDG’s price rose, and trading volume significantly increased during the morning session. It is expected to surpass the 20-day average by the session’s end, reflecting investors’ optimistic sentiment.

Moreover, the stock price remains close to the upper band of the Bollinger Bands, while the MACD indicator consistently expands its gap with the Signal line after previously giving a buy signal. This reinforces the upward momentum in the short term.

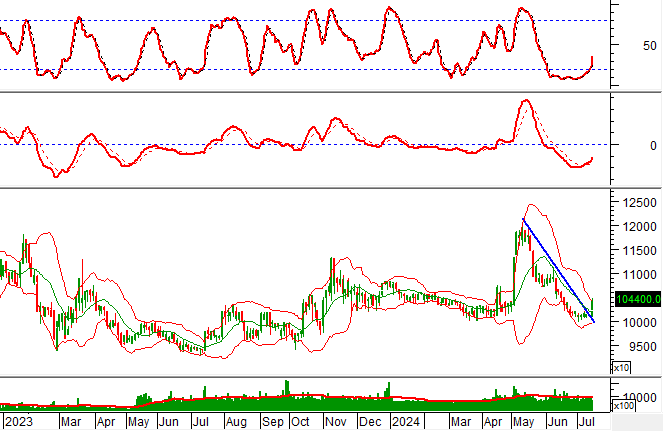

VJC – Vietjet Aviation Joint Stock Company

On the morning of July 15, 2024, VJC’s price rose, and a Rising Window candlestick pattern emerged, accompanied by a substantial improvement in trading volume during the morning session. It is anticipated to surpass the 20-day average by the session’s end, indicating investors’ optimism.

Furthermore, the stock price continues to climb after breaking out of the short-term downward trendline, while the Stochastic Oscillator is trending upward after providing a buy signal in the oversold region previously. This suggests that the recovery scenario may extend into the upcoming sessions.

Technical Analysis Department, Vietstock Consulting