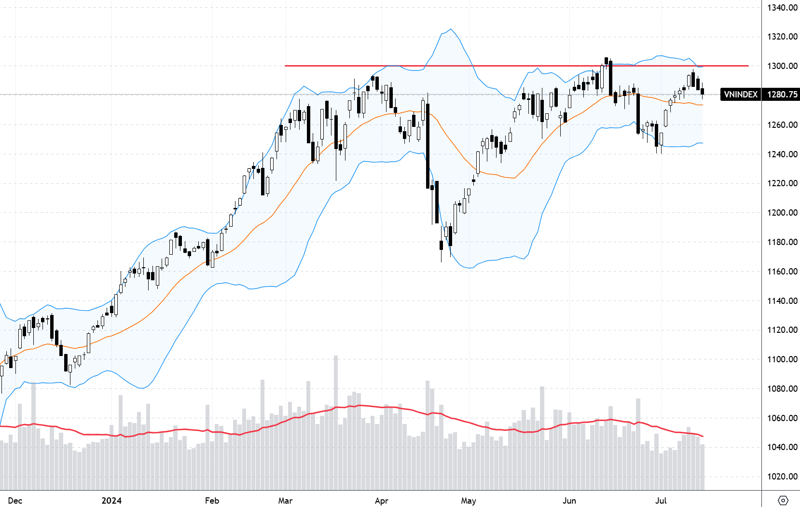

The market turned sour as strong fluctuations appeared consecutively in the last three sessions of the week, with the VN-Index closing below the 20-session moving average (MA20) and posting two consecutive weekly losses. Technically, experts believe the index is likely to retest the June low or even go lower.

Three corrective waves in June brought the VN-Index down to 1,240 points, and it closed last week at 1,264.78. While most experts highly value the 1,240 support level, some believe there is a significant chance of breaking below the June low.

Although scenarios are always anticipated at every risk level, experts also believe that the market needs to send clear signals to assess which scenario is more feasible. Currently, the market is still fluctuating towards the June low, and bottom-fishing force still appears at the sharpest declines. If this bottom holds, the market is still just fluctuating within a wide accumulation range.

In the accumulation scenario, experts believe that the current short-term fluctuations are not too negative. Investors can still choose fundamentally solid stocks with positive second-quarter profits, observe support levels, and look for buying opportunities. However, it is recommended to hold a reasonable proportion and not use margin.

Nguyen Hoang – VnEconomy

The market suddenly experienced strong fluctuations in the last three trading sessions of the week and ended quite unfavorably, with the VN-Index losing the MA20 support. Why did the market suddenly turn sour? What is your assessment of the selling pressure and bottom-fishing cash flow in these sessions?

In this phase, selecting trading stocks for T+ and short-term performance is relatively challenging, given the market is revolving around many unfavorable pieces of information.

Nghiem Sy Tien

Nguyen Thi My Lien – Head of Analysis, Phu Hung Securities Company

The market was unexpectedly sold off strongly again last week, even though it had adjusted quite well before. The lack of demand around the 1,270 support level caused the sellers to continue to dominate and push the index down to the lower support zone of 1,240-1,260. The reason may be that investors are concerned about the recent adjustments in the global stock market and domestic rumors, making the demand not strong enough. However, when the index returned to the 1,240-1,260 zone, I noticed that the demand participated better, helping to form hammer candles in this area despite the significant selling pressure.

Nguyen Viet Quang – Director of Business Center 3, Yuanta Hanoi

I don’t think the market has changed suddenly because, technically, many signals have warned of market risk: the VN-Index approached the resistance zone, the market completed five waves up, and in the corrective wave, it could be abc. I was just surprised by the strong fluctuations in the last three sessions. This week, there were three sessions with strong selling pressure, and there were two sessions when the demand pulled the market back up quickly as it approached the 1,257 area, but Friday’s session created a high probability that the market would break this level next week.

Nghiem Sy Tien – Investment Strategy Analyst, KBSV Securities

In my opinion, short-term trading psychology is dominating the market’s current state. Therefore, differentiation will be seen in different stock and sector groups. With such fluctuations, selling pressure will peak when stocks reach a short-term gain margin, and demand will reappear significantly after a deep correction. Typically, in the last three sessions, when pillar stocks faced profit-taking selling pressure, creating significant pressure on the index, bottom-fishing cash flow still pushed prices back up when the decline was deep enough. It can be said that in this phase, no side shows a clear dominance and significantly affects the trend.

Le Duc Khanh – Analysis Director, VPS Securities

The July market performance reflected an accumulation state, with the first week of the month seeing a good performance while the second and third weeks were sideways. Besides the macroeconomic information, the optimistic signals of the economy may make investors unwilling or, at least, hesitant to invest more if the market moves sideways within a range. The VN-Index fell below the MA20 support but is still between MA50 & EMA55 – selling pressure increased, but the market is unlikely to fall deeply in this special support zone. The index is still closely following the technical lines, so I think there is a chance of accumulation and slight recovery next week. Bottom-fishing cash flow is not large, but the buying force of low-priced stocks is still quite good.

Nguyen Hoang – VnEconomy

Last week, most of your opinions tended to be positive or, at least, believed that the market would maintain an accumulation state. Do the strong fluctuations this week change your views?

Nghiem Sy Tien – Investment Strategy Analyst, KBSV Securities

My view remains unchanged about the current trend, which is challenging to break out but also difficult to fall deeply. Supply-demand testing moves will continue to occur alternately amid the lack of supportive information and leading sectors. Sharp declines with wide ranges can trigger temporary panic, but bottom-fishing cash flow still appears at support levels, reflecting the demand’s proactiveness.

Nguyen Viet Quang – Director of Business Center 3, Yuanta Hanoi

For the past two weeks, I have maintained that the market has ended wave B and entered corrective wave C, and the scenario is still developing as expected. I still hold this view and wait for the C wave’s targets: around 1,232 points, around 1,191 points, or around 1,125 points.

When the VN-Index returned to the 1,240-1,260 zone, I noticed that the demand participated better, helping to form hammer candles in this area despite the significant selling pressure. If the index holds this zone, there is still a chance to form a bottom and rebound.

Nguyen Thi My Lien

Le Duc Khanh – Analysis Director, VPS Securities

The market last week could still be called a sideways adjustment within a range and is still above the strong support zone of 1,250 – 1,260 points. The probability of falling below this level is very low. I assess that the market will continue to accumulate – the opportunity to return to the 1,270 – 1,280 point mark is not impossible.

Nguyen Thi My Lien – Head of Analysis, Phu Hung Securities Company

The current signal is not as positive as initially expected, as it has broken below the first support level of 1,270 points. However, it is still within my alternative scenario of returning to the next support zone of 1,240-1,260 points. If the index holds this zone, there is still a chance to form a bottom and rebound. Therefore, overall, I have not changed my view much, and the index may maintain a sideways state within the 1,240-1,300 point range.

Nguyen Hoang – VnEconomy

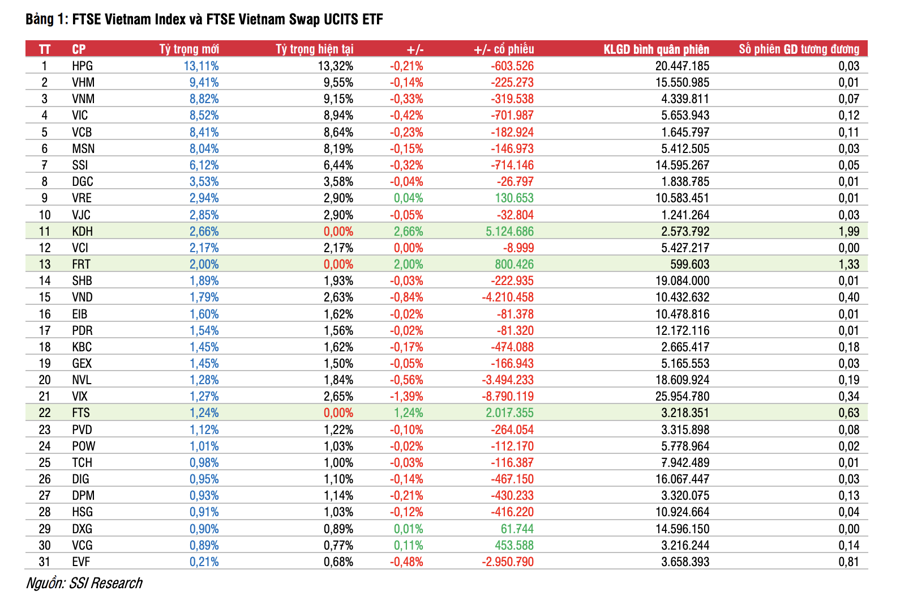

The opposite effect on the business results of many stocks has started to appear, as you predicted last week. By now, not many enterprises have released second-quarter profit reports. The banking group maintained the best price strength last week, while securities companies disappointed. Short-term stock selection is becoming more challenging. Do you have any advice for investors?

Nguyen Viet Quang – Director of Business Center 3, Yuanta Hanoi

The market is in a short-term corrective phase, but in the medium and long term, I still “view” the market will increase well and head towards new peaks. Currently, we need to focus on businesses with good performance and growth potential, then find strong support zones to gradually disburse in this corrective wave.

To avoid psychological pressure, investors should use real money and limit margin. Margin will be used when the market turns back, and the purchased stocks have made good profits.

Nguyen Thi My Lien – Head of Analysis, Phu Hung Securities Company

In my opinion, investors should maintain their portfolio ratio at a moderate level and limit new stock purchases in the current phase. The story of business results will be an important factor that investors will care about in the coming period. According to the data we have collected, the whole market’s profits of some enterprises that have published financial statements are currently growing negatively compared to the same period last year. This may be one of the reasons for the market’s gloom last week. Investors should wait for the market to stabilize before reinvesting. They can focus on groups benefiting from the economy’s recovery and have relatively strong price movements compared to the general level, such as banks and retail. Besides, some groups with good performance, such as securities, steel, and fertilizer, will also be considered if they fall to a low valuation zone.

Le Duc Khanh – Analysis Director, VPS Securities

In my opinion, once large cash flow has not appeared, stocks will fluctuate, and differentiation will be evident, so stock selection will not be easy. Portfolio control should be prioritized to maintain a suitable stock ratio but limit short-term trading. An inappropriate stock ratio or buying the wrong stocks in large quantities will make portfolio restructuring more difficult in the next phase, not to mention if the market performs beyond expectations, and risk management will not go as planned. I think that after the corrective accumulation phase, the market will soon return to recovery and growth.

Currently, we need to focus on businesses with good performance and growth potential, then find strong support zones to gradually disburse in this corrective wave.

Nguyen Viet Quang

Nghiem Sy Tien – Investment Strategy Analyst, KBSV Securities

Technical factors can reflect the market’s current state, but fundamental factors are still the main drivers of the medium and long-term trends. In this phase, selecting trading stocks for T+ and short-term performance is relatively challenging, given the market is revolving around many unfavorable pieces of information. However, the publication of the first-half business results will help investors assess whether enterprises are on the right track.

Therefore, my view is to observe and select leading stocks or those still maintaining a positive fundamental situation. The stocks may be in a corrective wave, but when the short-term risks pass, the fundamental prospects will be reflected in the stock prices again.

Nguyen Hoang – VnEconomy

With three obvious weakening sessions at the end of the week, the VN-Index tends to find the late June-early July bottom again. Technically, do you think this support zone is “hard” enough to consolidate the current sideways accumulation state?

Nguyen Viet Quang – Director of Business Center 3, Yuanta Hanoi

Technically, I am aiming for three support levels and observing the market’s reaction in that zone: around 1,232, around 1,191, and around 1,125. This means the late June bottom can be broken – it can be broken in the form of SFP, Trap, or a complete break to the lower support zone.

Nghiem Sy Tien – Investment Strategy Analyst, KBSV Securities

I assess that the VN-Index scenario will hardly penetrate the support zone around the late June low, specifically the range from 1,235 – 1,255 points. This is the area with the highest trading volume, and bottom-fishing demand often appears here to push prices back up. In addition, the MA lines on the daily frame are tending to move sideways and cluster, indicating that the sideways, fluctuating accumulation trend will dominate in the future for the index.

In my opinion, the VN-Index will hardly fall below the monthly support of 1,250 – 1,260 points.

Le Duc Khanh

Nguyen Thi My Lien – Head of Analysis, Phu Hung Securities Company

I assess that the 1,240-1,260 support zone is relatively strong, even harder than the 1,270 area, as this zone was previously broken below the 1,250 threshold before forming a bottom and rebounding. This signal indicates the possibility of shaking off to accumulate goods in this zone before pushing prices up. Therefore, when the price returns to this zone, I expect the demand to continue to do well to stop the decline and push prices up again.

Le Duc Khanh – Analysis Director, VPS Securities

In my opinion, the VN-Index will hardly fall below the monthly support of 1,250 – 1,260 points, and by the end of July, the market may stand around the 1,265 – 1,270 – 1,275 point mark. These are strong support zones, and the market will continue to fluctuate and accumulate around this price range. The breakthrough can occur in August and September.

Investing in a volatile market: Should beginners consider putting money into high-yield bonds for 10-30% yearly profit?

Short-term stock market trading has proven to be a risky venture for many investors, leading to substantial losses. However, there are a few select open funds that have managed to achieve impressive returns, reaching up to 30%.