A severe sell-off was triggered towards the end of the afternoon session, causing the index to turn from a slight gain to a near 10-point loss, settling around 1,264 points. Breadth was poor, with 324 declining stocks outweighing 126 advancing ones. Except for retail and seafood, most sectors closed lower.

Among large-cap sectors, Banking and Real Estate decreased by 0.34% and 0.58%, respectively. Securities also fell by 0.52%; Oil & Gas dropped by 1.08%; Information Technology contracted by 1.36%; Chemicals declined by 2.91%; Transportation decreased by 2.45%; and Construction & Materials lost over 1%.

The top stocks dragging down the market included GVR, erasing 1.51 points; BID, shaving off 1.11 points; HVN, taking away 1.05 points; and VCB, reducing 0.68 points. POW, VPB, and LPB also contributed to the decline. On the flip side, MBB, VHM, ACB, SAB, and OCB helped curb the index’s losses.

Total matched transactions across the three exchanges slightly decreased compared to the previous session, reaching VND 20,000 billion. Foreign investors were net sellers, offloading VND 316.1 billion, with matched transactions alone accounting for net sales of VND 602.1 billion.

Foreign investors’ main net buying on the matched transactions side was focused on the Retail and Financial Services sectors. Their top net buys on a matched basis included MWG, HPG, VND, FUEVFVND, SAB, KDH, PC1, BCM, E1VFVN30, and FRT.

On the net-selling side, Information Technology was the main sector sold by foreign investors on a matched basis. Their top net sells on a matched basis included FPT, TCB, MSN, HSG, DXG, VNM, VIC, VHM, and VIX.

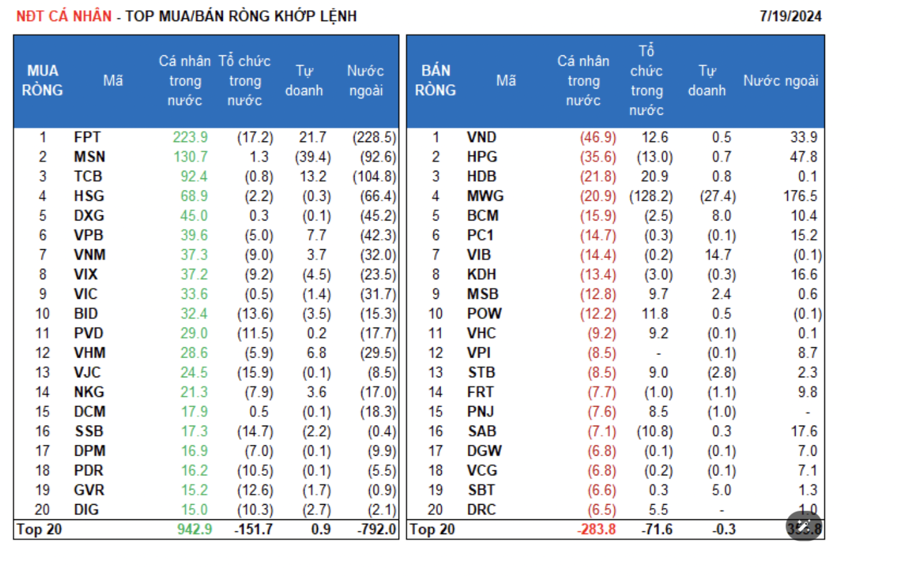

Individual investors were net buyers to the tune of VND 687 billion, with net purchases of VND 824.3 billion on a matched basis. Focusing on matched transactions, they net bought 12 out of 18 sectors, mainly in the Information Technology sector. Their top net buys included FPT, MSN, TCB, HSG, DXG, VPB, VNM, VIX, VIC, and BID.

On the net-selling side for matched transactions, they sold 6 out of 18 sectors, primarily in the Retail, Electricity, Water & Oil & Gas sector. Their top net sells included VND, HPG, HDB, MWG, BCM, PC1, KDH, MSB, and POW.

Proprietary trading accounts were net sellers, offloading VND 1.0 billion, while they net bought VND 3.2 billion on a matched basis.

Drilling down into matched transactions, proprietary trading accounts net bought 7 out of 18 sectors. Their most substantial net purchases were in the Information Technology and Real Estate sectors. Their top net buys on a matched basis included FPT, VIB, TCB, BCM, TPB, VPB, VHM, VCB, E1VFVN30, and CTG. On the net-selling side, the Retail sector led. Their top net sells included MSN, MBB, MWG, FUEVFVND, VIX, SSI, BID, SHB, STB, and DIG.

Domestic institutional investors were net sellers, offloading VND 322.4 billion, with net sales of VND 225.3 billion on a matched basis.

Zooming in on matched transactions, domestic institutions net sold 10 out of 18 sectors, with the most significant net sales in the Retail sector. Their top net sells included MWG, FUEVFVND, FPT, VJC, E1VFVN30, SSB, BID, HPG, GVR, and PVD. On the net-buying side, the Banking sector saw the most substantial net purchases. Their top net buys included MBB, HDB, PLX, VND, POW, MSB, VCI, GMD, VHC, and STB.

Today’s negotiated transactions reached VND 1,475.4 billion, a decrease of 53.3% compared to the previous session, contributing 7.2% to the total trading value.

Notable transactions today involved SBT, with a domestic individual investor selling over 32.4 million units (equivalent to VND 405.6 billion) to a foreign institution. Additionally, a foreign institution sold over 3.4 million units of VHM (valued at VND 130 billion) to a domestic individual investor.

Domestic proprietary trading accounts also participated in negotiated transactions, buying HPG from a foreign institution and selling SHB to a domestic individual investor. Domestic individual investors continued to trade in small-cap (TCM, NHH) and large-cap (KOS, KDC) stocks.

The money flow allocation ratio decreased in Real Estate, Software, Food, Steel, Construction, Chemicals, Agriculture & Seafood, Warehousing, Logistics & Maintenance, Oil & Gas, and Aviation. Meanwhile, it increased in Banking, Securities, and Retail.

Focusing on matched transactions, the money flow allocation ratio increased in the large-cap VN30 and mid-cap VNMID groups, while it decreased in the small-cap VNSML group.