For the week of July 8-12, there was a significant rebound in trading activity in the stock market. On the HOSE exchange, liquidity increased by over 30% compared to the previous week. Trading volume rose by 32% to 728 million units per session, while trading value climbed by 34% to more than VND 19.4 trillion per session.

On the HNX exchange, trading volume increased by almost 20% to 63.2 million units per session, and trading value surged by 32%, reaching VND 1.4 trillion per session.

The indices on the two exchanges moved in opposite directions. The VN-Index dipped slightly by 0.2%, closing at 1,280 points, while the HNX-Index climbed by over 1.1% to 245 points.

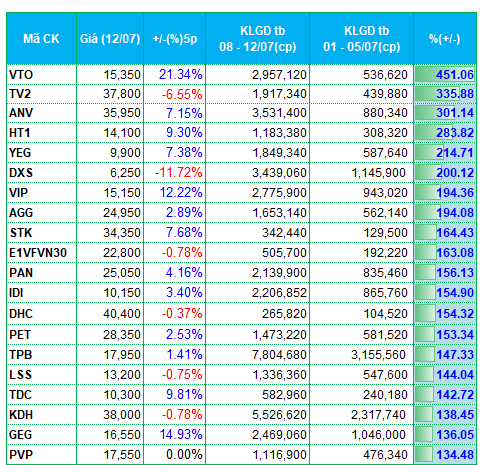

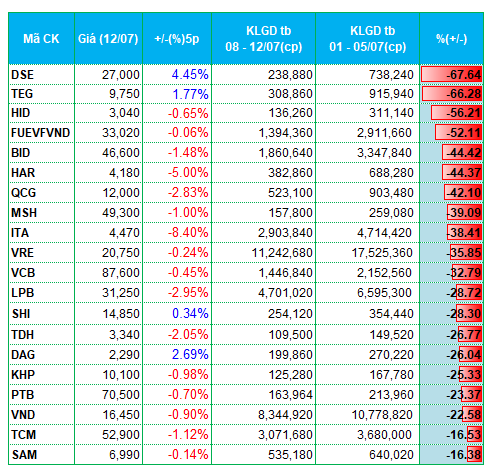

The strong return of capital resulted in a significant boost in liquidity for many stocks. On the HOSE exchange, the top 20 stocks with the highest increase in liquidity all witnessed a more than 100% surge in trading volume compared to the previous week.

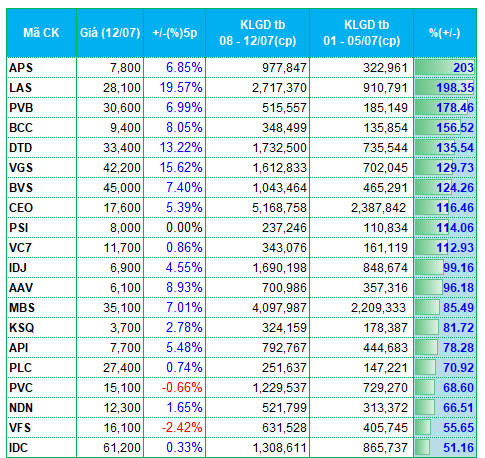

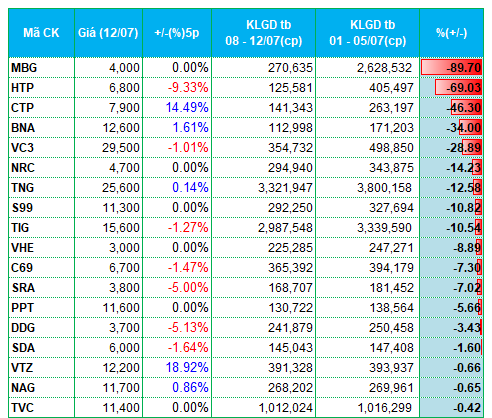

On the HNX exchange, half of the stocks in the top gainers in liquidity saw a 100% increase in trading volume.

The real estate sector demonstrated its appeal, with several stocks entering the top gainers in liquidity. Names such as DXS, AGG, TDC, KDH, DTD, CEO, VC7, IDJ, AAV, API, and NDN experienced a notable rise in liquidity compared to the previous week.

Additionally, capital on the HNX exchange also showed a concentration in the securities sector. Stocks like APS, BVS, PSI, MBS, and VFS recorded significant increases in liquidity.

Apart from these two prominent groups, capital tended to spread across individual stocks in other sectors. VTO, a marine transportation stock, witnessed a remarkable breakout with a 450% surge in trading volume, and its share price also climbed by over 21%. Stocks in the seafood sector, such as ANV and IDI, also attracted strong capital inflows.

On the downside, a few sectors experienced mild capital outflows. These included the banking sector (BID, VCB, LPB) and the textile sector (MSH, TCM, TNG).

|

Top 20 stocks with the highest increase/decrease in liquidity on the HOSE exchange

|

|

Top stocks with the highest increase/decrease in liquidity on the HNX exchange

|

The list of stocks with the highest and lowest liquidity changes is based on a minimum average trading volume of 100,000 units per session.

Dragon Capital Chairman: “Long-term vision is needed, accepting necessary adjustments for a safer, more efficient, and higher quality market”

According to Mr. Dominic Scriven, Chairman of Dragon Capital, the role of the finance industry in the stock market will be significant in 2023 and possibly in 2024. The roles of other industries, such as real estate or consumer goods, will depend on their respective challenges.