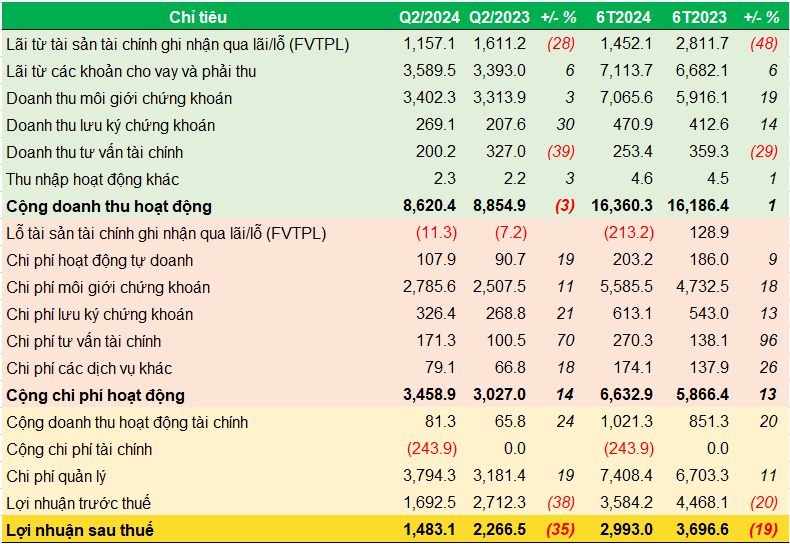

For Q2 2024, the company generated over VND 8.6 billion in operating revenue, a 3% decrease from the same period last year, mainly due to a 28% drop in income from financial assets measured at FVTPL, amounting to nearly VND 1.2 billion.

Notably, income from loans, receivables, and securities brokerage, which account for the highest proportion of DAS’s revenue, increased by 6% and 3%, respectively, but it wasn’t enough to offset the decline.

Total operating expenses for the quarter rose by 14% to nearly VND 3.5 billion, with most costs increasing. The most significant expense, securities brokerage, increased by 11% to nearly VND 2.8 billion.

Another notable increase was in management expenses, which rose by 19%, totaling nearly VND 3.8 billion.

Given these circumstances, DAS’s net profit was just under VND 1.5 billion, a 35% decrease from Q2 2023. However, it’s worth noting that the comparative period’s performance was relatively high in recent years.

For the first six months of 2024, DAS’s total operating revenue reached VND 16.4 billion, a slight 1% increase year-on-year, while operating expenses rose by 13% to over VND 6.6 billion, and management expenses increased by 11% to more than VND 7.4 billion.

Ultimately, DAS’s net profit for the period was nearly VND 3 billion, a 19% decrease.

|

DAS’s Q2 2024 Business Results

VND million

Source: DAS, Author’s Compilation

|

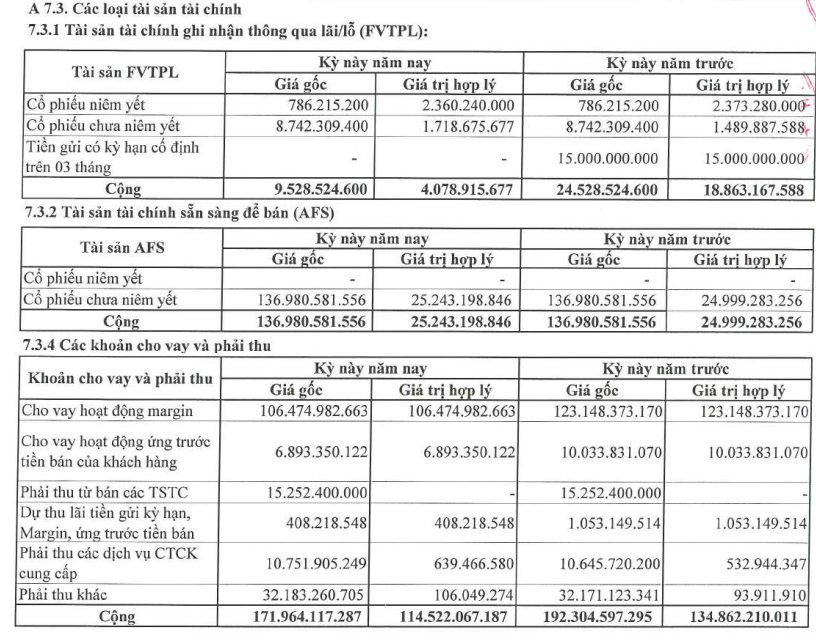

As of Q2 2024, the company’s asset size was approximately VND 234 billion, a 1% increase from the beginning of the year. The main assets were loans of over VND 113 billion and cash and cash equivalents of more than VND 66 billion.

The value of financial assets measured at FVTPL was over VND 9.5 billion, a 61% decrease from the beginning of the year, mainly due to the absence of a VND 15 billion fixed-term deposit with a maturity of more than three months.

The company invested over VND 8.7 billion in unlisted stocks, but their fair value was only about VND 1.7 billion, while it invested just over VND 786 million in listed stocks, with a fair value of nearly VND 2.4 billion.

Additionally, the company held nearly VND 137 billion in financial assets available for sale (AFS), consisting of unlisted stocks, unchanged from the beginning of the year, with a fair value of over VND 25 billion.

Margin lending outstanding at the end of Q2 was over VND 106 billion, a 14% decrease from the beginning of the year.

Source: DAS’s Q1 2024 Financial Statements

|

On the other side of the balance sheet, the company had payables of over VND 3.6 billion, a 24% decrease from the beginning of the year, due to the absence of long-term payables to sellers of VND 750 million, along with a 9% decrease in short-term debt.

Cen Land’s annual profits plummet to 2.5 billion VND, with nearly 60% of assets being accounts receivables.

Although the fourth quarter saw a reversal in profits, declining revenue resulted in Cen Land’s net profit for the entire year of 2023 only reaching 2.5 billion VND. It is worth mentioning that nearly 60% of the company’s assets consist of receivables from partners, with a total value of approximately 4,100 billion VND.