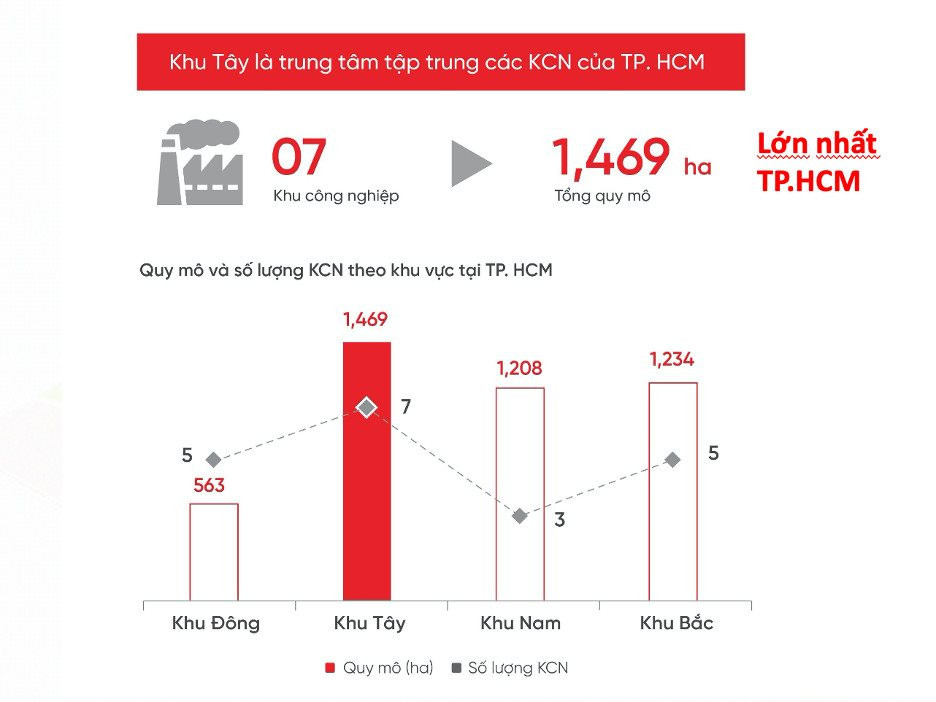

Multiple factors supporting the growth of real estate in the West of Ho Chi Minh City

The West leads in terms of industrial zones: Compared to other areas of Ho Chi Minh City, the West boasts the largest number and scale of industrial zones. Currently, there are seven major industrial zones spanning 1,469 hectares in this area. Notable zones include Tan Tao (443 hectares), Vinh Loc (200 hectares), Le Minh Xuan (100 hectares), Phong Phu (140 hectares), and An Ha (120 hectares), among others.

The development of these industrial zones has led to a surge in housing demand, transforming the real estate landscape in the region.

Source: Consolidated

Vast land area and high demand for owner-occupied housing: Mr. Tran Khang Quang, an experienced real estate investor, shared that 80% of homebuyers in the West of Ho Chi Minh City are looking for owner-occupied residences. The area caters to a diverse range of buyers with its reasonably priced offerings.

In contrast to projects in the South and East, which initially attract 60-80% investors, the West sees a majority of end-users, with investors comprising only 10-30%. This high proportion of owner-occupiers results in stable rental income growth for investors.

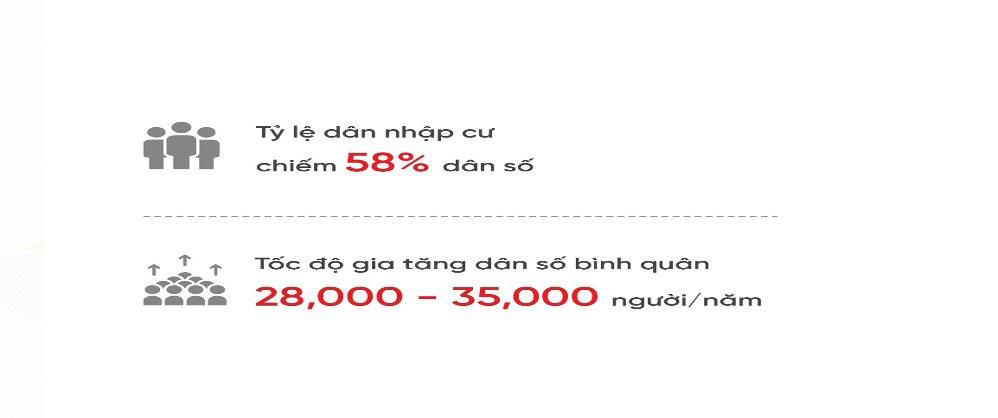

The fastest-growing population in the southern region: According to surveys, the population in a district in the West of Ho Chi Minh City increases by an average of 28,000 to 35,000 people annually. This population growth has silently supported the real estate market in the West.

Well-established infrastructure: The formation of key roads has interconnected districts and boosted the development of real estate in the West for many years. For instance, the existing Vo Van Kiet Avenue connects most areas of Ho Chi Minh City.

Additionally, the Ho Chi Minh City-Trung Luong Highway, operational since 2010, spans 40 kilometers and links the city to the Mekong Delta provinces of Long An and Tien Giang.

Furthermore, other infrastructure projects currently under development or nearing completion this year, such as the extension of Vo Van Kiet Road to Long An, the expansion of National Highway 50, and the construction of the Ho Chi Minh City-Moc Bai Highway, will also have a significant impact on the real estate market in the West.

Affordable prices with potential for future growth: The West is known for its vast land area and more affordable real estate prices compared to other parts of Ho Chi Minh City. While the price gap has narrowed, it remains a hub for reasonably priced properties, catering to a wide range of buyers.

Most apartment projects in the West achieve high occupancy rates, largely driven by end-user demand. Illustration

While other areas have seen record-high prices, with some apartments reaching hundreds of millions of VND per square meter and focusing on luxury segments, the West has consistently offered apartments with prices ranging from VND 40-50 million per square meter. As a result, investors anticipate significant price growth potential in this area.

… But new supply is scarce

The contrasting nature of the real estate market in the West of Ho Chi Minh City is evident in the recorded numbers. Despite over 80% of buyers seeking owner-occupied properties, supply has continuously declined, even reaching record lows in the first half of 2024. Additionally, while the West boasts multiple supportive factors for real estate, the limited supply leaves residents with fewer options.

According to CBRE Vietnam, in the second quarter of 2024, nearly 1,200 new apartments were added to the Ho Chi Minh City market. However, most of these were located in the East and South of the city, with the West continuing to lack new supply.

With limited supply and a majority of end-user demand, existing projects experience strong demand, even during challenging market conditions. Recently, several projects in Binh Tan and District 8 sold out quickly. For instance, a project on An Duong Vuong Street in Binh Tan District sold nearly 1,000 apartments in just a few months in the second half of 2023, despite a sluggish real estate market.

Similarly, Akari City, a project by Nam Long with prices below VND 50 million per square meter on Vo Van Kiet Avenue, has consistently achieved positive sales performance. End-user demand accounts for a significant portion of the project’s transactions. Akari City is considered one of the best-located and most affordable projects in the West of Ho Chi Minh City at present. The developer and partnering bank offer attractive payment support, including a 30% down payment, a 70% loan with no interest for 18 months, a 24-month grace period for principal repayment, and additional early booking discounts. Alternatively, buyers can choose a 10% direct discount if they do not utilize the financial support.

A recent report by Nha Tot indicated that new apartment supply in Binh Tan District plummeted by a record 63% in the first half of 2024, making it the most scarce area in Ho Chi Minh City. When considering the entire West of Ho Chi Minh City, new supply decreased by nearly 50% compared to the same period last year. This prolonged scarcity of new supply is expected to significantly impact primary home prices in the region.

In reality, finding affordable housing in this area has become more challenging compared to three years ago. Apartments priced below VND 50 million per square meter are becoming a rare find in the West.

The West’s housing supply contrasts with its development potential. Illustration

CBRE Vietnam’s Q2 2024 apartment market report revealed that Ho Chi Minh City’s average primary home price reached VND 63 million per square meter, a 6% increase year-over-year. With projects in the VND 40-50 million per square meter range, future price increases are inevitable, especially considering the lack of new supply in the West.

Astonishingly high price for old and dilapidated apartment buildings reaching nearly 200 million VND/m2, rivaling the most luxurious condominiums in Hanoi

Old collective apartments with prices starting from 100 million VND/m2 are usually the first-floor units that can be used for commercial purposes, while the upper-floor units are priced at 60-80 million VND/m2 for residential purposes.

The Power of Lizen: Consistently Winning Massive Bids

Lizen has achieved a significant milestone by successfully deploying and implementing major high-speed construction projects in 2023. The company’s revenue has reached 2,030.5 billion VND, which is twice the amount compared to 2022. However, the post-tax profit has reached its lowest point in the past 6 years, dropping down to only 118.3 billion VND.